H.R. 6231: Improve and Enhance the Work Opportunity Tax Credit Act

This bill, titled the "Improve and Enhance the Work Opportunity Tax Credit Act," proposes several changes to the Work Opportunity Tax Credit (WOTC) program, which is designed to encourage employers to hire individuals from certain target groups who face barriers to employment. Here are the key provisions of the bill:

Extension of the Work Opportunity Tax Credit

The bill extends the expiration date of the WOTC from December 31, 2025, to December 31, 2030, allowing employers to continue to benefit from this tax credit for an additional five years.

Enhancements to the Tax Credit

- **Increased Credit Amounts**: The bill increases the amount of the WOTC from 40% to 50% of qualified first-year wages up to $6,000. If an employee works for at least 400 hours for the same employer, the credit will apply to additional wages—increasing the cap to $12,000 for those individuals.

- **Cost-of-Living Adjustments**: The bill includes provisions for annual inflation adjustments to the wage limits starting from 2026, ensuring the amounts remain relevant over time.

Changes to Specific Groups

- **Increased Limitation for Veterans**: It provides higher wage limits for certain qualified veterans, which vary based on their specific circumstances.

- **Removal of Age Limits**: The bill removes the age limit currently in place for individuals receiving supplemental nutrition assistance, allowing younger individuals to qualify.

Inclusion of Military Spouses

The bill expands the eligibility for the tax credit to include spouses of qualified military personnel, offering incentives to hire them as well.

Promotion of Targeted Group Member Hiring

The bill mandates the Secretaries of Treasury, Commerce, and Labor to promote the hiring of targeted group members across various industries, including manufacturing and healthcare, encouraging employers to create more job opportunities for these individuals.

Effective Dates

- Most provisions in the bill, including the changes to the tax credit calculations and eligibility, would apply to individuals starting work after December 31, 2025.

Conclusion

In summary, the bill aims to improve and modernize the Work Opportunity Tax Credit program, making it more beneficial for both employers and targeted employees, thereby promoting longer employment and increased hiring in specific sectors.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

17 bill sponsors

-

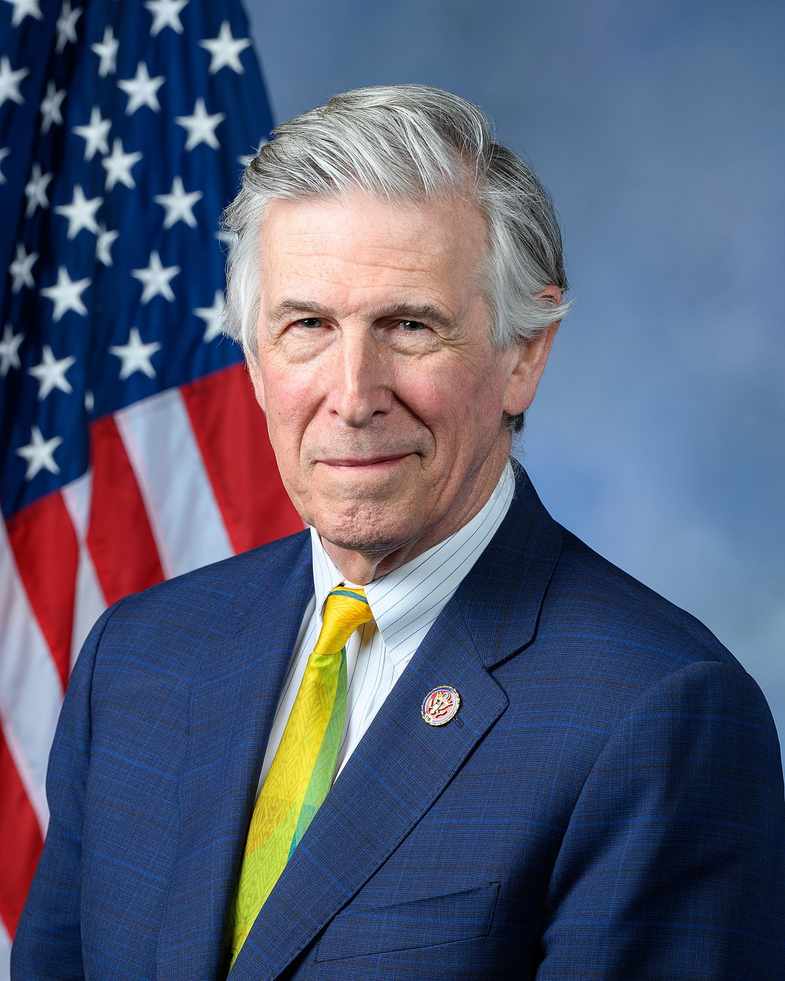

TrackLloyd Smucker

Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackMike Carey

Co-Sponsor

-

TrackSuzan K. DelBene

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackMike Kelly

Co-Sponsor

-

TrackDavid Kustoff

Co-Sponsor

-

TrackMax L. Miller

Co-Sponsor

-

TrackBlake D. Moore

Co-Sponsor

-

TrackJoseph D. Morelle

Co-Sponsor

-

TrackGregory F. Murphy

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackDaniel Webster

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 20, 2025 | Introduced in House |

| Nov. 20, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.