H.R. 6224: Servicemember Student Loan Affordability Act of 2025

This bill, known as the Servicemember Student Loan Affordability Act of 2025, aims to provide financial relief to servicemembers by allowing them to consolidate or refinance their student loans at a capped interest rate during their military service. Here are the key points of the proposed legislation:

Purpose

The primary purpose of this bill is to amend the Servicemembers Civil Relief Act (SCRA) to extend interest rate protections to those in military service who are consolidating or refinancing student loans that they originally incurred before serving.Interest Rate Limitation

- The bill introduces a cap on the interest rate for debts incurred by servicemembers during their military service when they consolidate or refinance student loans.- Specifically, any debt taken on by a servicemember, or jointly with their spouse, for the purpose of consolidating or refinancing student loans incurred before their military service will be capped at an interest rate of 6% per year.- This cap would apply only to those loans specifically mentioned and would not extend to other types of debts.Implementation of the Limit

- The legislation clarifies that the interest rate limitation for student loan consolidation or refinancing becomes effective as of the date the servicemember incurs this new obligation during their service.- It also makes adjustments to ensure that the relevant provisions for interest rate limitations provide clarity concerning the time frame in which the cap applies.Definition of Student Loan

- The bill defines a "student loan" to include: - Federal student loans made, insured, or guaranteed under the Higher Education Act of 1965. - Private education loans as defined under the Truth in Lending Act.Impact on Servicemembers

The bill's provisions are expected to benefit servicemembers by potentially lowering their financial burdens related to educational debts during the time they are serving in the military. It aims to provide a clearer and more accessible pathway for them to manage existing student loans more effectively while focusing on their military duties.Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

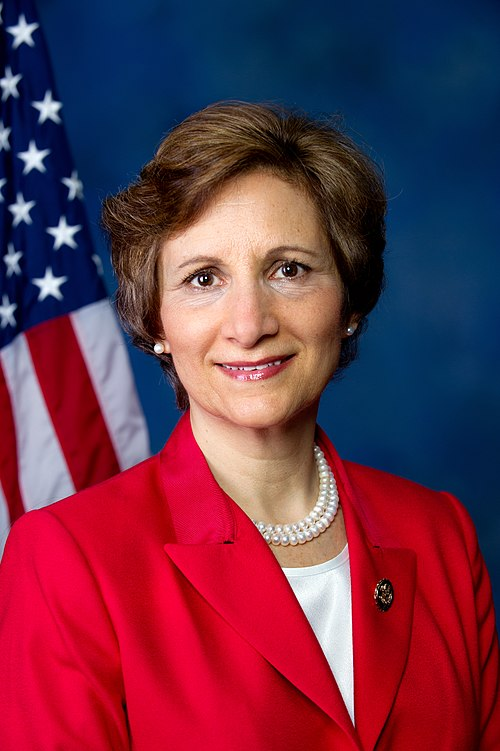

TrackDelia C. Ramirez

Sponsor

-

TrackSuzanne Bonamici

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

TrackJennifer L. McClellan

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

Actions

3 actions

| Date | Action |

|---|---|

| Dec. 18, 2025 | Referred to the Subcommittee on Economic Opportunity. |

| Nov. 20, 2025 | Introduced in House |

| Nov. 20, 2025 | Referred to the House Committee on Veterans' Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.