H.R. 6167: Helping Everyone Access Long Term Healthcare Act of 2025

The bill titled "Helping Everyone Access Long Term Healthcare Act of 2025" aims to amend existing healthcare and tax laws to enhance access to healthcare services for individuals in need, especially those requiring charity care. Below is a summary of the key provisions of the bill:

Tax Deductions for Charity Care

The bill introduces a new provision in the Internal Revenue Code that allows physicians to deduct the unreimbursed Medicare-based value of qualified charity care they provide during the tax year. This means:

- Physicians can claim a tax deduction for services they provide at no charge or without expectation of payment, specifically for patients enrolled under certain government healthcare plans.

- Qualified charity care is defined as services given without reimbursement to individuals who are either part of the Medicaid program (Title XIX) or the Children's Health Insurance Program (Title XXI).

- The unreimbursed Medicare-based value is calculated based on what would typically be paid for such services under the Medicare fee schedule.

Exclusions from Qualified Charity Care

Not all services are eligible for the tax deduction. The following are explicitly excluded:

- Services for which federal funding is prohibited under certain appropriations acts.

- Gender reassignment surgeries.

- Hormone treatments for gender alteration.

Deduction for Non-Itemizers

The bill expands the ability to receive this deduction not just to those who itemize their tax deductions, but also to non-itemizers, thereby broadening its potential impact on physicians providing charity care.

Limitation on Liability for Physicians

Another significant provision of the bill is the limitation of liability for physicians providing qualified charity care. Under this provision:

- Physicians and medical personnel will not be held liable in civil actions for any harm that occurs while delivering charity care, as long as their actions are not intentional, reckless, or grossly negligent.

- This limitation extends to both federal and state laws, preempting conflicting state laws unless they offer greater protections.

Effective Date

The changes outlined in the bill are set to apply to qualified charity care provided after December 31, 2025.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

10 bill sponsors

-

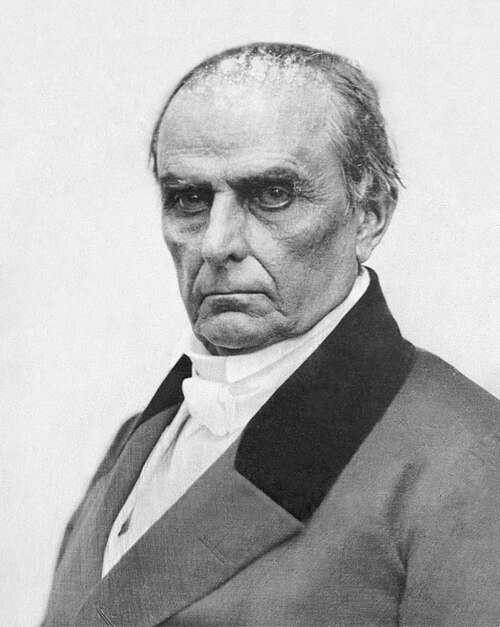

TrackDaniel Webster

Sponsor

-

TrackRick W. Allen

Co-Sponsor

-

TrackPaul A. Gosar

Co-Sponsor

-

TrackMichael Guest

Co-Sponsor

-

TrackMike Haridopolos

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackJohn H. Rutherford

Co-Sponsor

-

TrackW. Gregory Steube

Co-Sponsor

-

TrackBruce Westerman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 20, 2025 | Introduced in House |

| Nov. 20, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Energy and Commerce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.