H.R. 6125: Housing Financial Literacy Act of 2025

This bill, titled the Housing Financial Literacy Act of 2025, proposes changes to the existing policies surrounding Federal Housing Administration (FHA) mortgage insurance premiums specifically for first-time homebuyers who participate in financial literacy housing counseling programs.

Key Provisions of the Bill

- Discount on Mortgage Insurance Premiums: The bill aims to provide a reduction in the mortgage insurance premiums that first-time homebuyers would typically need to pay if they complete a financial literacy housing counseling program.

- Eligibility Requirement: The proposed discount would only be available to homebuyers who complete the counseling program prior to signing a mortgage application or a sales agreement for a home.

- Financial Literacy Focus: The counseling program is intended to ensure that homebuyers are educated about mortgage terms and homeownership responsibilities, which may help them make informed financial decisions.

- Premium Rate Adjustment: Instead of the standard premium limit of 2.75% of the loan amount, the bill suggests that the mortgage insurance premium for eligible first-time homebuyers would be set at 25 basis points lower than the standard rate established by the Secretary of Housing and Urban Development.

Impact of the Bill

The changes proposed in the bill are aimed at making homeownership more affordable for first-time buyers by reducing the up-front costs associated with mortgage insurance. The expectation is that this will encourage more individuals to pursue homeownership after receiving the necessary financial education, potentially leading to better financial outcomes for those individuals in the long term.

Implementation Oversight

The implementation of these provisions would fall under the jurisdiction of the Secretary of Housing and Urban Development, who would be responsible for establishing and enforcing the guidelines surrounding the financial literacy housing counseling programs as well as adjusting the mortgage insurance premiums accordingly.

Relevant Companies

- PHM - PulteGroup, Inc.: This homebuilder may be positively impacted due to an increase in first-time homebuyer purchases resulting from the affordability measures the bill proposes.

- DHI - D.R. Horton, Inc.: Another major homebuilder that could benefit from a boost in demand from first-time homebuyers who are now able to afford homes due to lower insurance premiums.

- TOL - Toll Brothers, Inc.: This luxury homebuilder might see an indirect benefit as lower entry costs for first-time buyers can stimulate demand in the broader housing market.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

34 bill sponsors

-

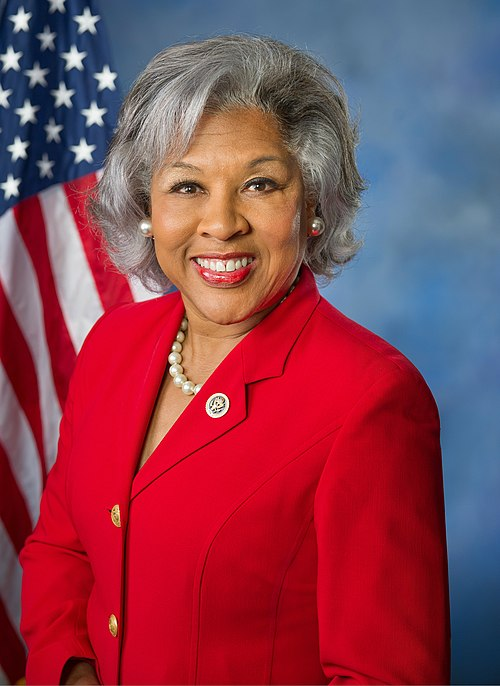

TrackJoyce Beatty

Sponsor

-

TrackAlma S. Adams

Co-Sponsor

-

TrackSanford D. Bishop, Jr.

Co-Sponsor

-

TrackMike Carey

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

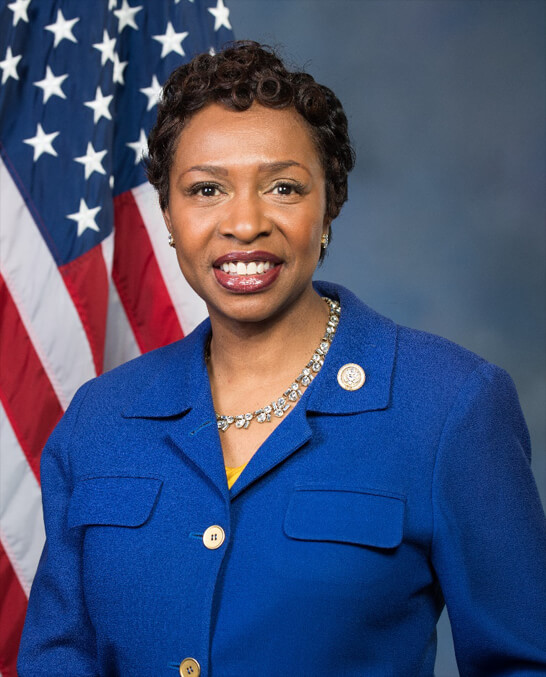

TrackYvette D. Clarke

Co-Sponsor

-

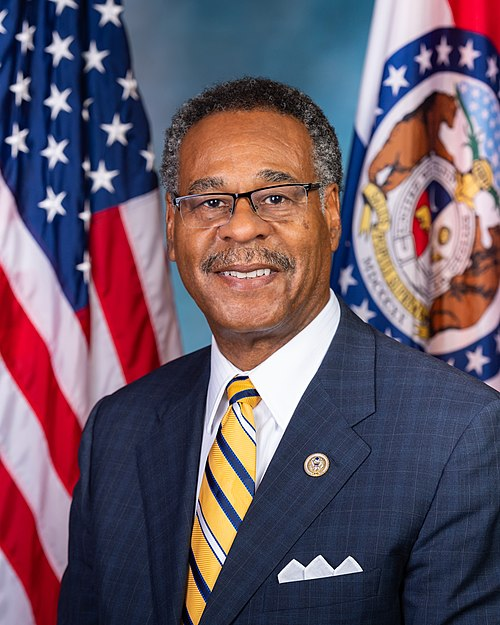

TrackEmanuel Cleaver

Co-Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackJ. Luis Correa

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackJahana Hayes

Co-Sponsor

-

TrackChrissy Houlahan

Co-Sponsor

-

TrackJulie Johnson

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

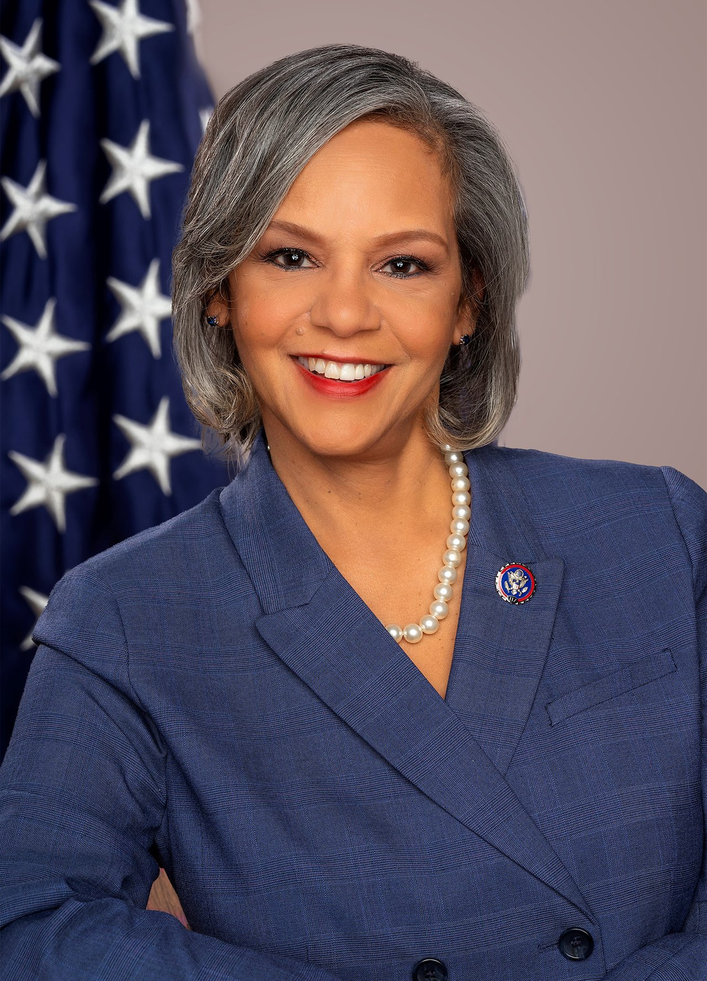

TrackRobin L. Kelly

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackJohn Mannion

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

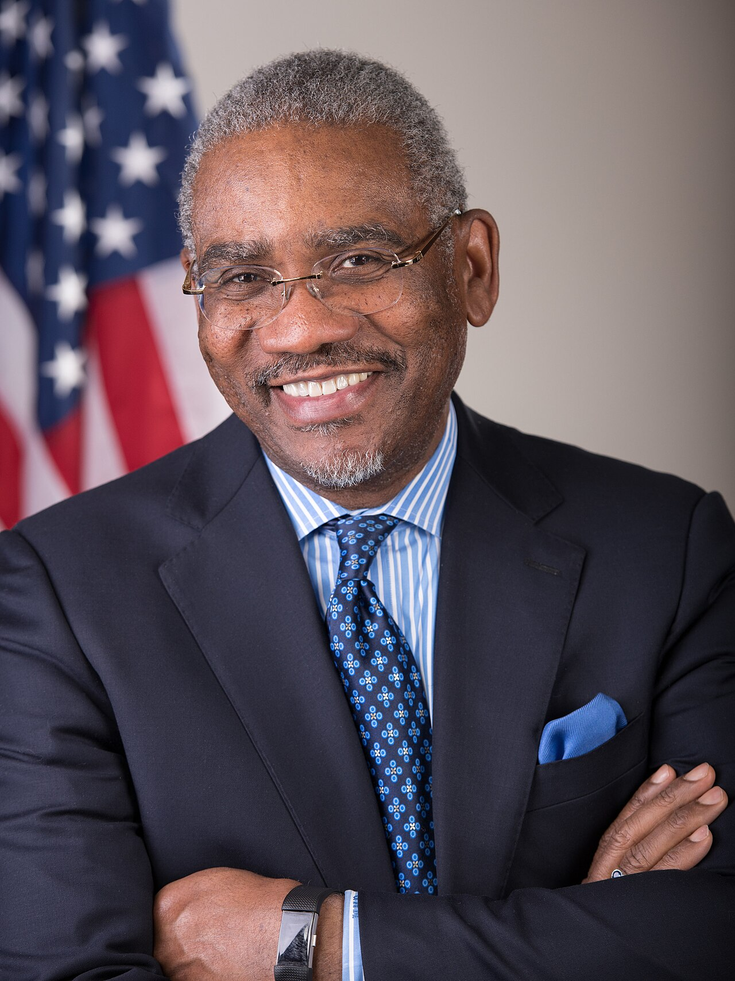

TrackGregory W. Meeks

Co-Sponsor

-

TrackGwen Moore

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackDavid Scott

Co-Sponsor

-

TrackAdam Smith

Co-Sponsor

-

TrackHaley M. Stevens

Co-Sponsor

-

TrackSuhas Subramanyam

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackBennie G. Thompson

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 19, 2025 | Introduced in House |

| Nov. 19, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.