H.R. 5862: American Energy Independence and Affordability Act

The American Energy Independence and Affordability Act aims to make changes to tax credits and incentives related to energy production and efficiency. Here are the main points of the bill:

Title I – Lowering Energy Costs through All-of-the-Above Energy Production

- Clean Energy Production Credit: The bill would restore a clean energy production tax credit. This credit supports the production of electricity from renewable sources like wind and solar, allowing for greater flexibility in transitioning away from fossil fuels. Additionally, it would no longer be phased out based on greenhouse gas emission targets.

- Clean Electricity Investment Credit: This credit for investments in renewable energy infrastructure would also be reinstated, encouraging businesses to invest in clean energy technologies.

- Advanced Manufacturing Production Credit: The bill aims to repeal restrictions related to this credit, promoting domestic manufacturing of clean energy technologies.

- Extension of Advance Energy Project Credit: The legislation proposes lifting limits on this credit to support additional projects in renewable energy and efficiency.

- Clean Hydrogen Production Credit: The date for this credit’s construction commencement would revert to allow for continued investment in clean hydrogen technologies.

- Residential Clean Energy Credit: This credit for homeowners investing in clean energy technologies would also be continued beyond initial deadlines, making it easier for individuals to access clean energy solutions.

- Sustainable Aviation Fuel Rate: The bill would reinstate a special rate for sustainable aviation fuel, incentivizing the production of low-carbon aviation fuels.

Title II – Lowering Energy Costs Through Energy Efficiency

- Energy Efficient Home Improvement Credit: The bill would require improved identification for energy-efficient products and ensure that tax credits are only available for qualified items, encouraging better compliance and selection of energy-efficient improvements in homes.

- New Energy Efficient Home Credit: This provision extends the tax credit for new energy-efficient homes to 2032, promoting the construction of energy-efficient residential properties.

- Commercial Buildings Deduction: The termination of tax deductions for energy-efficient commercial buildings would be reversed, incentivizing businesses to invest in energy-efficient structures.

- Restoration of Cost Recovery for Energy Property: Businesses would be allowed to recover costs related to energy property more effectively, incentivizing investment in energy efficiency.

Title III – Ensuring America Leads the Way in Our Automotive Future

- Previously-Owned Vehicle Credit: The timeline for tax credits for previously-owned electric vehicles would be extended, encouraging the purchase of used electric vehicles.

- Clean Vehicle Credit: The provisions for tax credits related to clean vehicles would also be adjusted for a longer duration, promoting the transition to cleaner transportation options.

- Commercial Clean Vehicles Credit: The bill proposes to extend credits for qualified commercial clean vehicles to encourage businesses to invest in clean transportation.

- Alternative Fuel Vehicle Refueling Property Credit: This credit for alternative fueling stations would be extended, supporting infrastructure growth for alternative fuel vehicles.

Relevant Companies

- TSLA - Tesla, Inc.: As a major player in the electric vehicle market, changes to clean vehicle credits would likely impact Tesla's sales and market strategies.

- NIO - NIO Inc.: Similar to Tesla, NIO could benefit from extended clean vehicle credits and incentives for electric vehicle adoption.

- FSLR - First Solar, Inc.: As a solar energy provider, changes to investment credits for solar production would directly benefit First Solar's business model.

- PLUG - Plug Power Inc.: This hydrogen technology company may benefit from the restored clean hydrogen production credit, bolstering their market position.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

129 bill sponsors

-

TrackMike Thompson

Sponsor

-

TrackGabe Amo

Co-Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackBecca Balint

Co-Sponsor

-

TrackNanette Diaz Barragán

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackSuzanne Bonamici

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackJanelle Bynum

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

TrackSean Casten

Co-Sponsor

-

TrackKathy Castor

Co-Sponsor

-

TrackSheila Cherfilus-McCormick

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackEmanuel Cleaver

Co-Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackJ. Luis Correa

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackJoe Courtney

Co-Sponsor

-

TrackSharice Davids

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackDiana DeGette

Co-Sponsor

-

TrackMark DeSaulnier

Co-Sponsor

-

TrackMadeleine Dean

Co-Sponsor

-

TrackSuzan K. DelBene

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackMaxine Dexter

Co-Sponsor

-

TrackLloyd Doggett

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

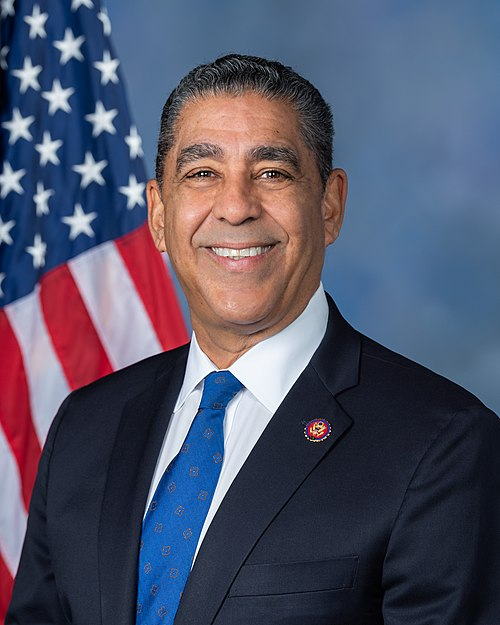

TrackAdriano Espaillat

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackLizzie Fletcher

Co-Sponsor

-

TrackBill Foster

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

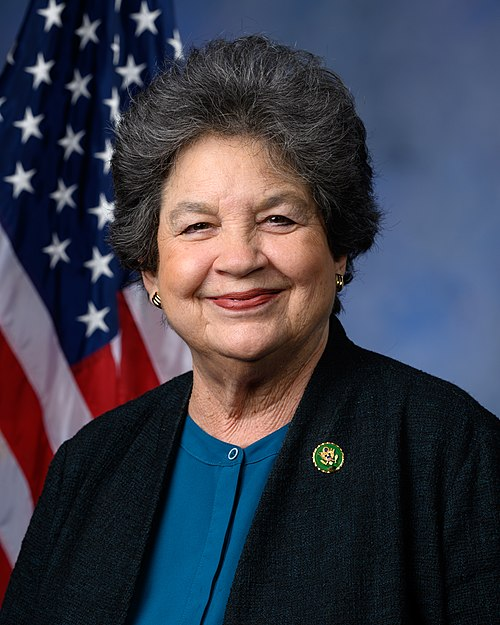

TrackLois Frankel

Co-Sponsor

-

TrackLaura Friedman

Co-Sponsor

-

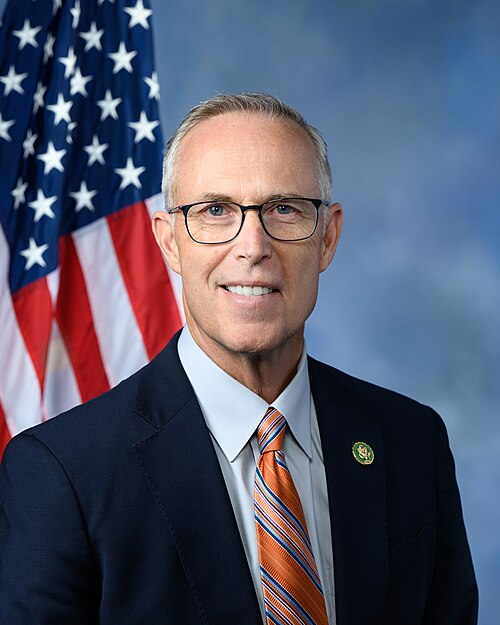

TrackJohn Garamendi

Co-Sponsor

-

TrackSylvia R. Garcia

Co-Sponsor

-

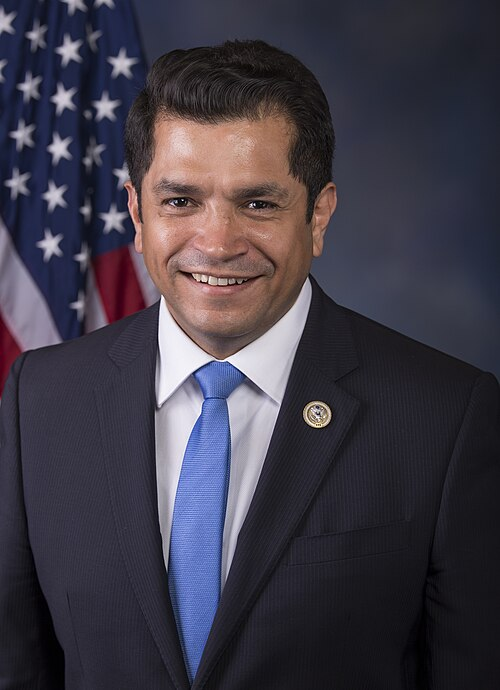

TrackRobert Garcia

Co-Sponsor

-

TrackDaniel S. Goldman

Co-Sponsor

-

TrackJimmy Gomez

Co-Sponsor

-

TrackVicente Gonzalez

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackJahana Hayes

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackSteny H. Hoyer

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackSara Jacobs

Co-Sponsor

-

TrackJulie Johnson

Co-Sponsor

-

TrackSydney Kamlager-Dove

Co-Sponsor

-

TrackRobin L. Kelly

Co-Sponsor

-

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackRick Larsen

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackGeorge Latimer

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

TrackTed Lieu

Co-Sponsor

-

TrackZoe Lofgren

Co-Sponsor

-

TrackStephen F. Lynch

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackDoris O. Matsui

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackApril McClain Delaney

Co-Sponsor

-

TrackJennifer L. McClellan

Co-Sponsor

-

TrackBetty McCollum

Co-Sponsor

-

TrackKristen McDonald Rivet

Co-Sponsor

-

TrackMorgan McGarvey

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackRobert Menendez

Co-Sponsor

-

TrackGrace Meng

Co-Sponsor

-

TrackKweisi Mfume

Co-Sponsor

-

TrackDave Min

Co-Sponsor

-

TrackGwen Moore

Co-Sponsor

-

TrackKelly Morrison

Co-Sponsor

-

TrackSeth Moulton

Co-Sponsor

-

TrackFrank J. Mrvan

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackJerrold Nadler

Co-Sponsor

-

TrackRichard E. Neal

Co-Sponsor

-

TrackDonald Norcross

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackChris Pappas

Co-Sponsor

-

TrackBrittany Pettersen

Co-Sponsor

-

TrackChellie Pingree

Co-Sponsor

-

TrackStacey E. Plaskett

Co-Sponsor

-

TrackMark Pocan

Co-Sponsor

-

TrackMike Quigley

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackJamie Raskin

Co-Sponsor

-

TrackDeborah K. Ross

Co-Sponsor

-

TrackRaul Ruiz

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackHillary J. Scholten

Co-Sponsor

-

TrackRobert C. "Bobby" Scott

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackLateefah Simon

Co-Sponsor

-

TrackEric Sorensen

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackGreg Stanton

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackMark Takano

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackBennie G. Thompson

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

TrackPaul Tonko

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackDerek Tran

Co-Sponsor

-

TrackJuan Vargas

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackDebbie Wasserman Schultz

Co-Sponsor

-

TrackMaxine Waters

Co-Sponsor

-

TrackNikema Williams

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 28, 2025 | Introduced in House |

| Oct. 28, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.