H.R. 5843: Shutdown Student Loans for Feds Act

This bill, known as the Shutdown Student Loans for Feds Act, aims to provide relief to federal employees who are affected by lapses in government funding, commonly referred to as shutdowns. Here’s a breakdown of its key provisions:

1. Definitions

The bill specifically defines terms relevant to its provisions:

- Agency: Refers to any authority within the executive, legislative, or judicial branches of the U.S. Government.

- Covered Individual: Includes employees of federal agencies who may be (i) excepted employees or performing emergency work, or (ii) furloughed. This definition also extends to contractors who support these employees but do not provide services during a government shutdown.

2. Loan Payment Suspension

The bill mandates that during any fiscal year in which there is a lapse in appropriations lasting at least 14 days, the Secretary of Education must suspend all loan payments due from covered individuals for federal student loans under part D of title IV of the Higher Education Act of 1965. This means that if the government shuts down for a specified period, affected federal employees won’t have to make their student loan payments during that time.

3. Interest Accrual

During the suspension period, no interest will accrue on the loans for which payments have been suspended. This provision helps prevent the total amount owed on the loans from increasing while payments are paused.

4. Consideration for Loan Forgiveness

Any month in which a payment is suspended due to this act will be treated as if the borrower made a payment when it comes to qualifying for any loan forgiveness programs. This benefits borrowers who are working towards loan forgiveness by ensuring that their time spent in suspension still counts towards their repayment goals.

5. Reporting to Credit Agencies

During the payment suspension, the Secretary of Education is required to report to consumer reporting agencies that the suspended payments should be treated as though they were made regularly. This measure is meant to ensure that borrowers’ credit scores are not adversely affected due to the suspension of payments.

6. Retroactive Effectiveness

The act is proposed to take effect as if it were enacted on September 30, 2025. This retroactive application allows it to cover any shutdown periods that occur after that date. Additionally, it provides for refunds of any payments made by covered individuals during a suspension period, upon request.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

15 bill sponsors

-

TrackSarah Elfreth

Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackGilbert Ray Cisneros, Jr.

Co-Sponsor

-

TrackShomari Figures

Co-Sponsor

-

TrackLaura Friedman

Co-Sponsor

-

TrackGlenn Ivey

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

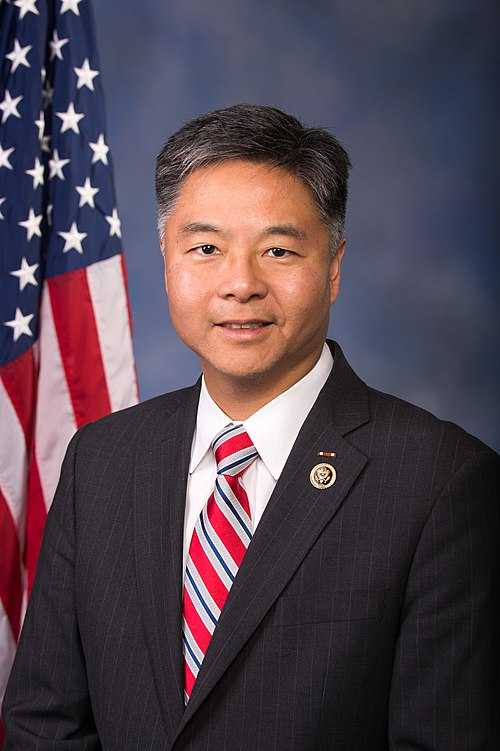

TrackTed Lieu

Co-Sponsor

-

TrackKweisi Mfume

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackJohnny Olszewski

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackJamie Raskin

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackJames R. Walkinshaw

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 28, 2025 | Introduced in House |

| Oct. 28, 2025 | Referred to the House Committee on Education and Workforce. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.