H.R. 5840: Feed the Community Act

The bill, titled the Feed the Community Act, proposes amendments to the Internal Revenue Code to enhance the tax treatment of certain charitable donations. Specifically, it aims to allow nonprofit organizations that provide food to communities in need to benefit from similar tax reductions for donations of food transportation vehicles and food storage equipment as they currently receive for donations of food inventory.

Key Provisions of the Bill

- Tax Treatment for Charitable Donations: The bill amends Section 170(e)(3) of the Internal Revenue Code to include food storage and transportation equipment under the same tax deductions available for food inventory donations.

- Definition of Qualified Property: “Qualified property” is defined to include:

- Food storage equipment, such as industrial refrigerators, freezers, and shelving

- Food transportation vehicles, like delivery trucks and vans

- Meal transport equipment, which includes insulated bags and warming boxes

- Meal preparation and packing equipment, such as industrial ovens and packing machinery

- Tax Reduction Limitations: The maximum tax deduction for donations of meal transport equipment is capped at $500, and for meal preparation and packing equipment at $15,000.

- Effective Date: The changes proposed in the bill would apply to tax years starting after December 31, 2025.

Goals of the Bill

The primary aim of this legislation is to incentivize donations of equipment that is essential for food storage and transportation by offering nonprofits similar tax benefits as those already provided for food. The intention is to improve the capacity of these organizations to serve individuals and communities in need by enhancing their resources for food distribution.

Conclusion

This bill seeks to facilitate and encourage charitable contributions towards improving food security by adjusting the tax framework surrounding the donation of necessary equipment.

Relevant Companies

- US Foods Holding Corp (USFD) - This company might be impacted as it provides foodservice distribution and may face changes in charitable giving patterns related to equipment and transportation.

- Synnex Corporation (SNX) - As a distributor of various products, including food service equipment, they could see changes in demand based on the incentives provided by this bill.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

21 bill sponsors

-

TrackNanette Diaz Barragán

Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackJasmine Crockett

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackShomari Figures

Co-Sponsor

-

TrackRobert Garcia

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackSara Jacobs

Co-Sponsor

-

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

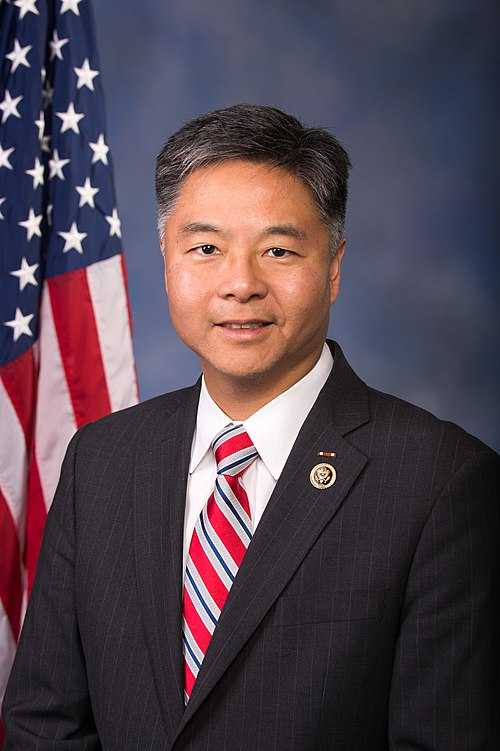

TrackTed Lieu

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackLuz Rivas

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackJuan Vargas

Co-Sponsor

-

TrackFrederica S. Wilson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 28, 2025 | Introduced in House |

| Oct. 28, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.