H.R. 5830: Guaranteed Income Pilot Program Act of 2025

This bill, titled the Guaranteed Income Pilot Program Act of 2025, aims to establish a pilot program that provides a guaranteed monthly income to certain individuals for a period of three years. Here is a detailed summary of its content and provisions:

Purpose and Findings

The bill recognizes the financial instability faced by many Americans due to:

- Income fluctuations and volatility.

- Rising costs of living.

- Wage stagnation.

- Lack of affordable housing.

It finds that a significant portion of the population is struggling to cover essential expenses and that many cannot handle emergency costs. The bill cites the impact of the COVID-19 pandemic, noting that prior direct payments helped reduce financial hardship in households.

Pilot Program Details

- Establishment: The Secretary of Health and Human Services will create a three-year pilot program to provide financial support to eligible individuals.

- Eligibility: The program will target 20,000 eligible individuals, with a selection criteria developed in consultation with the Commissioner of Internal Revenue.

- Monthly Payments: 10,000 participants will receive monthly payments equivalent to the fair market rent for a two-bedroom home in their area or a similar amount, distributed on the 15th of each month.

- Data Collection: An external partner will be chosen to assist in the program’s design, implementation, and evaluation, ensuring the collection of relevant data to study its outcomes.

Responsibilities

- The Commissioner of Internal Revenue will assist in the administration of the program by providing access to tax records and updated income information for participants.

- The external partner will be responsible for evaluation and analysis, ensuring confidentiality and compliance with federal laws.

Impact on Federal Programs

Payments made through this program will not be considered income or resources for eligibility determinations for other federal or state programs for a duration of 12 months from the time of receipt.

Study and Reporting Requirements

- A comprehensive study will assess the effects of the guaranteed income on various factors, including economic outcomes, health, and social costs associated with income volatility.

- An interim report will be submitted to Congress within 24 months of program initiation, followed by a final report after the program’s conclusion, detailing findings and suggesting possibilities for expansion.

Definitions

Key definitions in the bill include:

- Commissioner: Refers to the Commissioner of the Internal Revenue Service.

- Eligible Individual: Defines individuals aged 18-65 who will be considered for the program.

- External Partner: Refers to a research or academic institution with expertise in social science experimentation.

Funding Authorization

The bill proposes an appropriation of $495,000,000 for each fiscal year from 2026 to 2030 to fund the pilot program.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

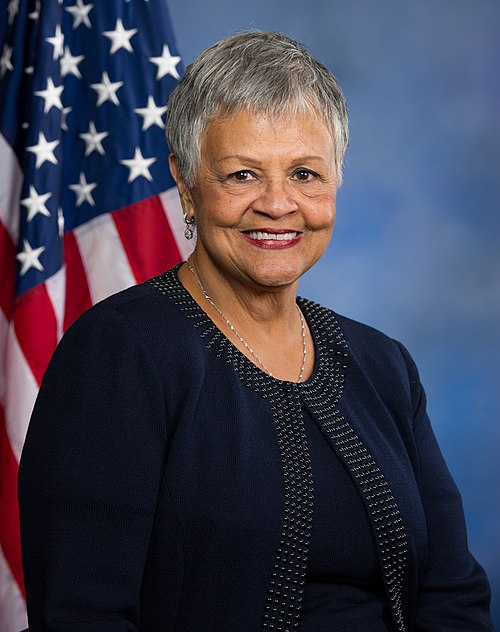

TrackBonnie Watson Coleman

Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackSara Jacobs

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

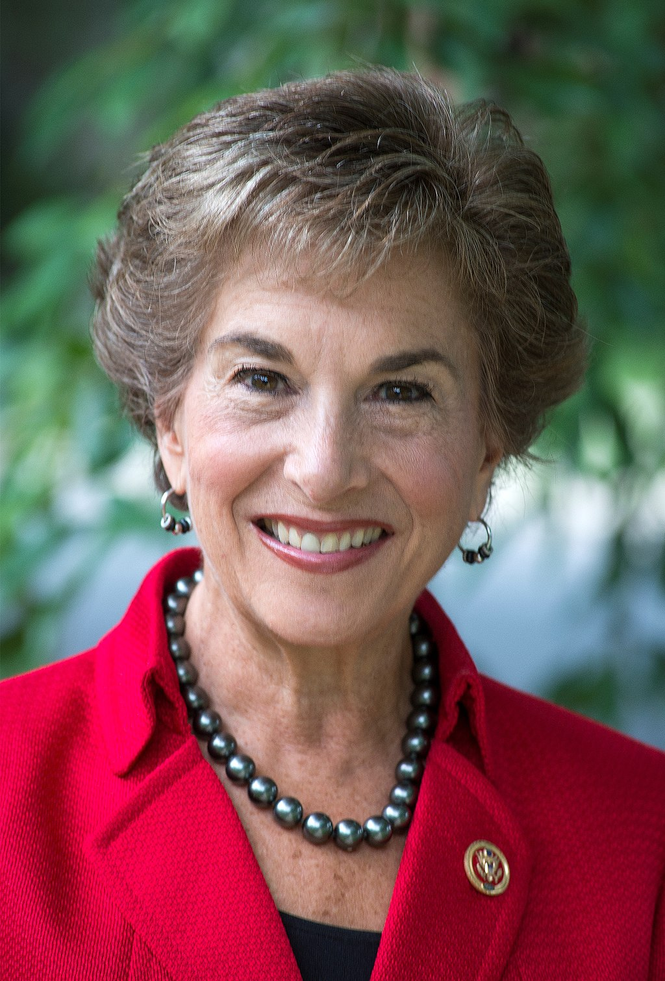

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 24, 2025 | Introduced in House |

| Oct. 24, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.