H.R. 5788: 504 Program Risk Oversight Act

This bill, known as the **504 Program Risk Oversight Act**, aims to enhance oversight of loan guarantees made under the 504 loan program of the Small Business Investment Act. Here’s a summary of its principal provisions:

Annual Risk Analysis

The bill mandates that the Administrator of the relevant administration conduct an annual risk analysis of all loans guaranteed under the 504 program. This analysis is intended to assess the overall risk associated with these loans and to identify any factors that could impact their repayment.

Reporting Requirements

By December 1, 2025, and every year thereafter, the Administrator must submit a comprehensive report to Congress. This report will contain the findings from the annual risk analysis and must include the following elements:

- Overall Program Risk: An assessment of the risk associated with all loans guaranteed under the program.

- Industry Concentration Risk: An analysis of program risk broken down by the concentration of loans in specific industries.

- Development Companies Analysis: A review of risks linked to development companies that account for at least 1% of gross loan approvals, focusing on:

- Dollar value and number of loans made.

- Risk analysis based on loan amounts divided into specific ranges (e.g., under $500,000, between $500,000 and $1,000,000, etc.).

- Loan Origination Timing: An evaluation of risks for loans originated within various timeframes (e.g., less than a year ago, 1-2 years ago, etc.).

- Borrower Types: Analysis of risks tied to loans for borrowers opening new businesses versus established businesses.

- Special Purpose Properties: Risk assessment for loans related to limited or special purpose properties, as defined in the bill.

- Mitigation Steps: A report on actions taken to address the highlighted risks.

- Volume of Loans: Data on the number of development companies, loans made, and total dollar amounts involved.

- Defaulted Loans: Information on the Administrator's purchases of defaulted loans, collections recovered, and charge-offs related to these loans.

- Enforcement Actions: Details on recommendations for enforcement actions related to loans and any civil monetary penalties assessed.

Public Access to Reports

The reports submitted to Congress are required to be made publicly available on the Administrator's website within seven days of their submission. This provision aims to enhance transparency regarding the oversight of the 504 loan program.

Definition of Limited or Special Purpose Property

The bill defines "limited or special purpose property" based on existing guidelines, ensuring that there is clarity in classifications relevant to loan guarantees.

Relevant Companies

None found:

This is an AI-generated summary of the bill text. There may be mistakes.

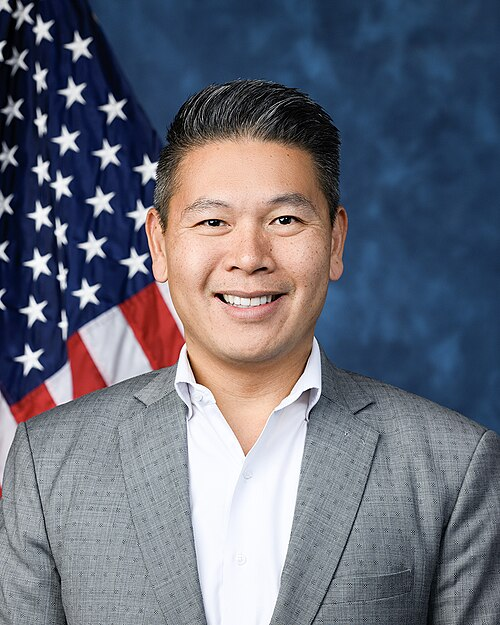

Sponsors

4 bill sponsors

Actions

13 actions

| Date | Action |

|---|---|

| Jan. 26, 2026 | Received in the Senate and Read twice and referred to the Committee on Small Business and Entrepreneurship. |

| Jan. 20, 2026 | Considered under suspension of the rules. (consideration: CR H932-934) |

| Jan. 20, 2026 | DEBATE - The House proceeded with forty minutes of debate on H.R. 5788. |

| Jan. 20, 2026 | Motion to reconsider laid on the table Agreed to without objection. |

| Jan. 20, 2026 | Mr. Williams (TX) moved to suspend the rules and pass the bill. |

| Jan. 20, 2026 | On motion to suspend the rules and pass the bill Agreed to by voice vote. (text: CR H933) |

| Jan. 20, 2026 | Passed/agreed to in House: On motion to suspend the rules and pass the bill Agreed to by voice vote. (text: CR H933) |

| Dec. 12, 2025 | Placed on the Union Calendar, Calendar No. 352. |

| Dec. 12, 2025 | Reported by the Committee on Small Business. H. Rept. 119-404. |

| Nov. 18, 2025 | Committee Consideration and Mark-up Session Held |

| Nov. 18, 2025 | Ordered to be Reported by the Yeas and Nays: 27 - 0. |

| Oct. 17, 2025 | Introduced in House |

| Oct. 17, 2025 | Referred to the House Committee on Small Business. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.