H.R. 5728: Rural Homeownership Continuity Act of 2025

This legislation, known as the Rural Homeownership Continuity Act of 2025, proposes changes to the Housing Act of 1949, specifically concerning the Doug Bereuter Section 502 Single Family Housing Loan Guarantee Program. The main aspects of the bill include the following:

Loan Assumption Provision

The bill allows individuals qualified for a guaranteed loan under the Section 502 program to assume existing loans when they acquire the property for which those loans were made. This means that if a property owner decides to sell their home, the buyer could take over the existing mortgage instead of needing to get a new loan.

Release from Liability

When a borrower transfers their property and the new buyer assumes the loan, the original borrower (transferor) and any co-borrowers or guarantors will be released from further liability for the loan. This change aims to provide an easier transition for homeowners looking to sell while ensuring that those selling the property are not held responsible for the loan once it is transferred.

Terms of Assumption

The bill stipulates that when a loan is assumed, the Secretary of Agriculture will ensure that the obligations, rights, and interests tied to the loan are also assumed by the new borrower. This could allow for different terms to be negotiated if necessary, as determined by the Secretary.

Applicability

The changes described in this act will apply to loans that are guaranteed under Section 502 of the Housing Act of 1949 from the date this bill is enacted onward. This means that the new provisions would not apply retroactively to loans made before the enactment date.

Rulemaking Authority

The Secretary of Agriculture will have the authority to create rules that permit loan servicers to charge fees to borrowers for transaction costs related to these loans. This could involve various costs associated with processing the loan assumption or any other related transactions.

Implementation Orientation

The overall objective of the bill is to facilitate homeownership in rural areas by making it more feasible for current homeowners to pass on their loans to buyers, thereby lowering barriers to purchasing homes in these regions.

Relevant Companies

None found:

This is an AI-generated summary of the bill text. There may be mistakes.

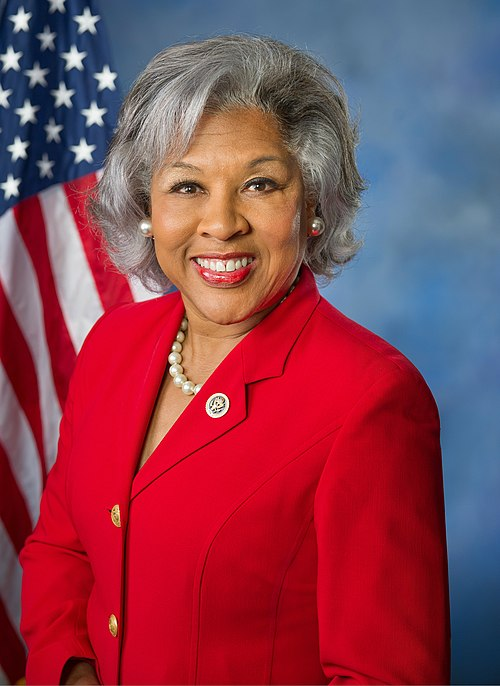

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 10, 2025 | Introduced in House |

| Oct. 10, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.