H.R. 5674: Emergency Relief for Federal Workers Act of 2025

This bill, titled the Emergency Relief for Federal Workers Act of 2025, aims to provide financial relief to federal employees who are directly affected by government shutdowns or lapses in appropriations. Here’s a breakdown of the main provisions of the bill:

Waiver of Tax Penalties

- The bill proposes an amendment to the Internal Revenue Code to waive the 10% additional tax penalty on early withdrawals from the Thrift Savings Plan for federal employees who are furloughed or working without pay during a qualified lapse in appropriations.

- Employees can withdraw up to $30,000 without incurring this penalty, and this limit will be adjusted for inflation in future years.

- A "qualified lapse in appropriations" is defined as a period of at least two continuous weeks where federal funding is not available.

Thrift Savings Plan Provisions

- The bill allows federal employees on furlough or working without pay to make in-service withdrawals based on financial hardship during the qualified lapse.

- There will be no limit on the number of hardship withdrawals employees can make during this time, but the total amount withdrawn cannot exceed $30,000.

- Employees who withdraw from their Thrift Savings Fund may also contribute back to it and will be treated as having made an eligible rollover if certain conditions are met.

Loan Assistance

- The bill enables employees affected by a lapse in appropriations to take loans from the Thrift Savings Plan without restrictions related to the duration of the lapse.

- If employees miss loan payments due to a shutdown, these missed payments will not be classified as taxable distributions if the missed payment occurs during the lapse.

- Furthermore, any outstanding missed payments will be deducted from the employee's pay once appropriations resume.

Effective Date

- The provisions regarding waiving penalties and the Thrift Savings Plan amendments will apply to transactions occurring after September 30, 2025.

Implementation and Oversight

- The bill requires federal agencies to maintain a list of employees who are affected by furloughs or unpaid work due to lapses in appropriations, ensuring that the relief can be administered effectively.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

39 bill sponsors

-

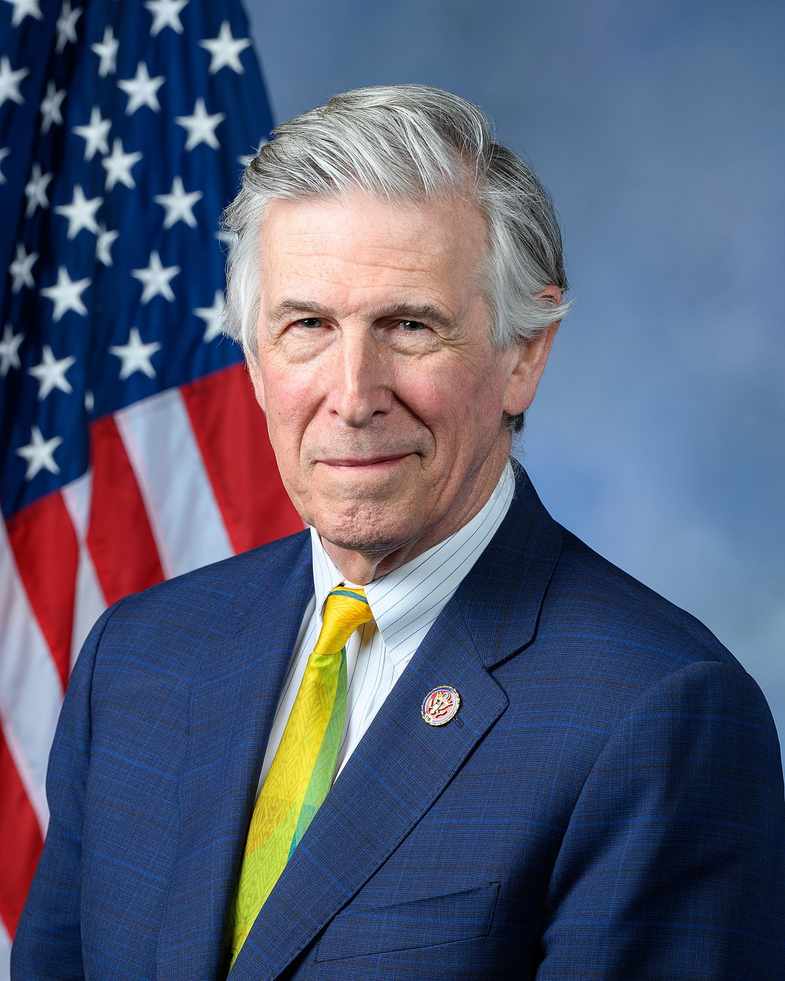

TrackDonald S. Beyer, Jr.

Sponsor

-

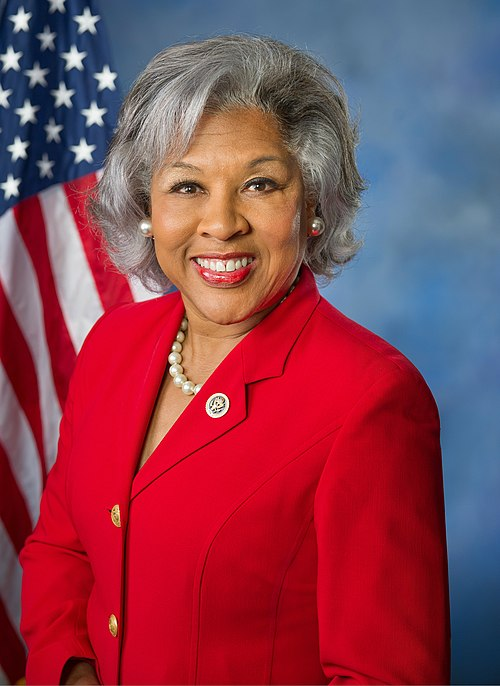

TrackJoyce Beatty

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackSharice Davids

Co-Sponsor

-

TrackDiana DeGette

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

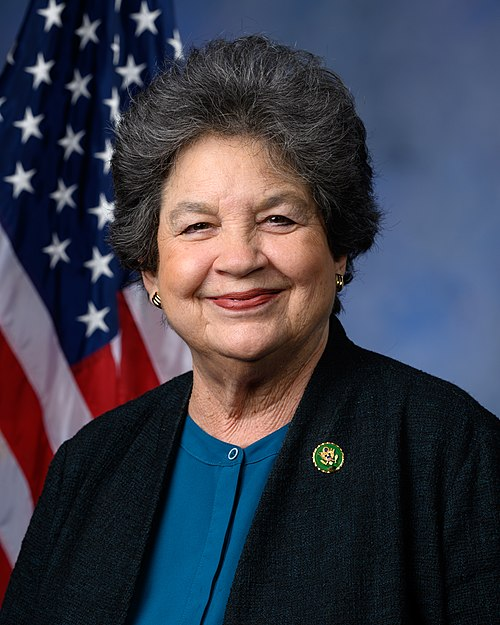

TrackLois Frankel

Co-Sponsor

-

TrackDaniel S. Goldman

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackRobin L. Kelly

Co-Sponsor

-

TrackTed Lieu

Co-Sponsor

-

TrackApril McClain Delaney

Co-Sponsor

-

TrackJennifer L. McClellan

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackGwen Moore

Co-Sponsor

-

TrackSeth Moulton

Co-Sponsor

-

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackNellie Pou

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackSuhas Subramanyam

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackNydia M. Velázquez

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

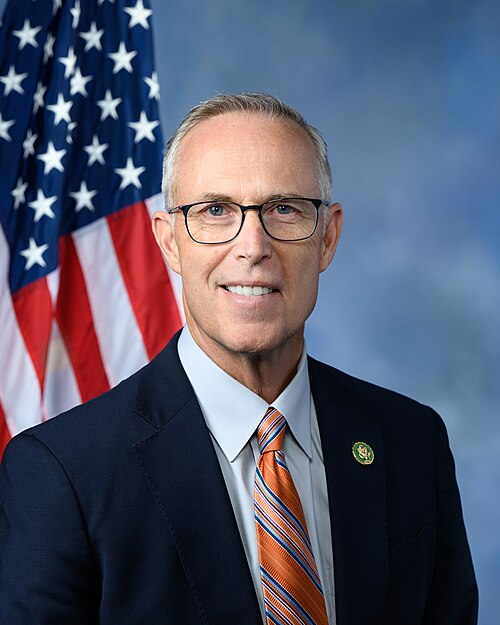

TrackJames R. Walkinshaw

Co-Sponsor

-

TrackBonnie Watson Coleman

Co-Sponsor

-

TrackGeorge Whitesides

Co-Sponsor

-

TrackNikema Williams

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 03, 2025 | Introduced in House |

| Oct. 03, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Oversight and Government Reform, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.