H.R. 5612: Cost-of-Living Fairness Act

This bill, titled the Cost-of-Living Fairness Act

, aims to change how certain insurance payments are accounted for when determining a person's eligibility for federal benefits and assistance programs. Here are the main aspects of the bill:

Overview of the Bill

The bill proposes that payments made by individuals for specific types of insurance policies should be deducted from their income and resources when assessing their eligibility for assistance under federal programs or any state or local programs that use federal funds.

Types of Covered Insurance Policies

The bill defines covered insurance policies

as follows:

- Motor Vehicle Insurance: This includes insurance policies for passenger motor vehicles registered under state law, either for the individual who pays for the policy or a household member.

- Property Insurance: This encompasses any insurance or products that protect against liability, loss of life, health issues, or property damage available to individual homeowners or renters based on their status.

- Flood Insurance: This applies to flood insurance policies for an individual's principal residence, including those issued under federal law, private flood insurance, or policies supplementing existing flood coverage.

Eligibility Determination Changes

Under this bill, when determining an individual's eligibility for federal assistance, the costs associated with these insurance policies will not count against their declared income. This could allow more individuals and families to qualify for federal support or receive a greater amount of assistance than they would have otherwise, as their reported income may appear lower with these deductions taken into account.

Implications

The bill aims to alleviate financial burdens for those paying for essential insurance policies, thereby potentially enhancing their eligibility for government benefits at a time when living costs may be rising. This could be particularly beneficial to low- and middle-income families who are balancing multiple expenses.

Administrative Aspects

The bill requires federal programs, as well as state and local programs that receive federal funding, to adopt this new method of calculating an individual’s income for the purpose of determining assistance eligibility.

Relevant Companies

- ALL (Allstate Corporation): As an insurance provider, changes in policy premiums could affect their customers' financial eligibility for government assistance, potentially influencing their policy sales.

- PHM (PulteGroup, Inc.): As a homebuilder, changes in flood insurance affordability could impact home sales, as potential buyers may be influenced by their possible insurance costs.

- PRU (Prudential Financial, Inc.): This company offers various insurance products that might see changes in demand as the bill could allow more households to qualify for financial assistance, impacting their insurance product sales.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

TrackRashida Tlaib

Sponsor

-

TrackNanette Diaz Barragán

Co-Sponsor

-

TrackSheila Cherfilus-McCormick

Co-Sponsor

-

TrackRosa L. DeLauro

Co-Sponsor

-

TrackVeronica Escobar

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackKristen McDonald Rivet

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

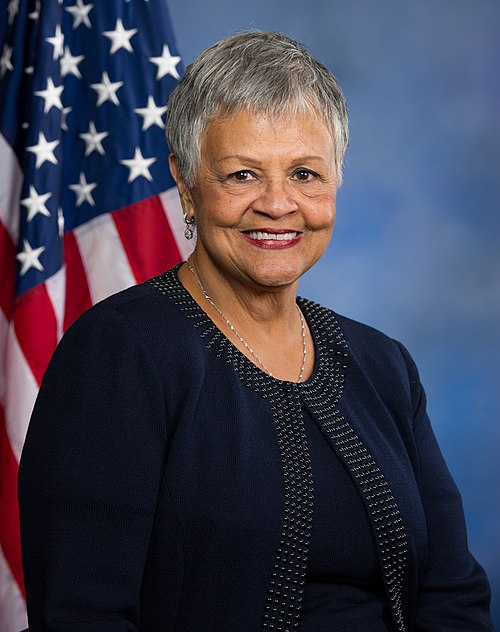

TrackBonnie Watson Coleman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 26, 2025 | Introduced in House |

| Sep. 26, 2025 | Referred to the House Committee on Oversight and Government Reform. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.