H.R. 5572: Help Federal Employees During Shutdowns Act

This bill, known as the Help Federal Employees During Shutdowns Act, proposes amendments to the Social Security Act regarding unemployment compensation for federal employees during government shutdowns. Here’s a summary of its main provisions:

Unemployment Compensation for Federal Employees

The bill mandates that states must provide unemployment benefits to certain federal employees during periods of government shutdowns. Specifically, it outlines the requirements that states must follow:

- States must allow excepted federal employees—those who are still required to work during a shutdown—to apply for and receive unemployment compensation.

- If an excepted employee receives a different pay during their unemployment period, they must repay the unemployment benefits to the state.

- Any benefits not repaid will be considered an overpayment, and states will have the authority to recover those amounts.

- Funds collected from repayments will go to the state's unemployment fund.

Federal Funding for State Compensation

The bill also stipulates a mechanism for federal support to states for these unemployment payments:

- The Secretary of the Treasury is required to pay each state an amount equal to 100% of the unemployment compensation granted to excepted federal employees and any extra administrative costs incurred by the states in handling these payments.

- Payments to states will be financed through the Unemployment Trust Fund established under federal law.

Definition of Excepted Federal Employee

According to the bill, an “excepted federal employee” refers to federal employees who are not receiving pay due to the government shutdown but are still performing essential work as categorized under the relevant federal provisions.

Implementation Timeline

This law is proposed to be applicable during fiscal years 2026 and 2027, focusing on situations where there is a lapse in appropriations.

Impact and Administration

The implementation of this bill will require states to adjust their unemployment compensation systems to comply with the new requirements regarding federal employees, and they will receive federal funds to support this adjustment.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

38 bill sponsors

-

TrackSarah Elfreth

Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

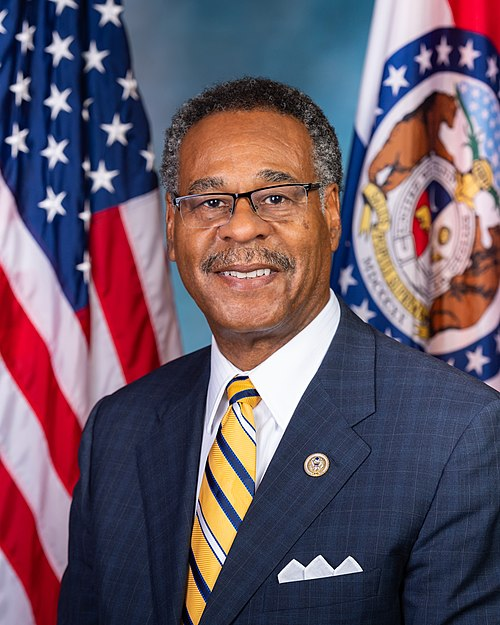

TrackEmanuel Cleaver

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackMaxine Dexter

Co-Sponsor

-

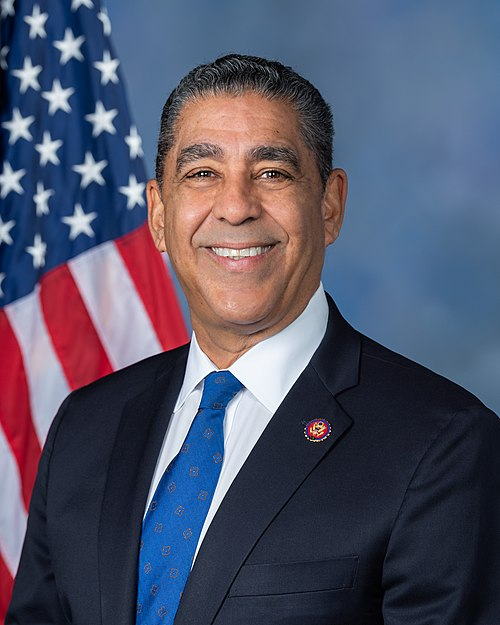

TrackAdriano Espaillat

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackSteny H. Hoyer

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackGlenn Ivey

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

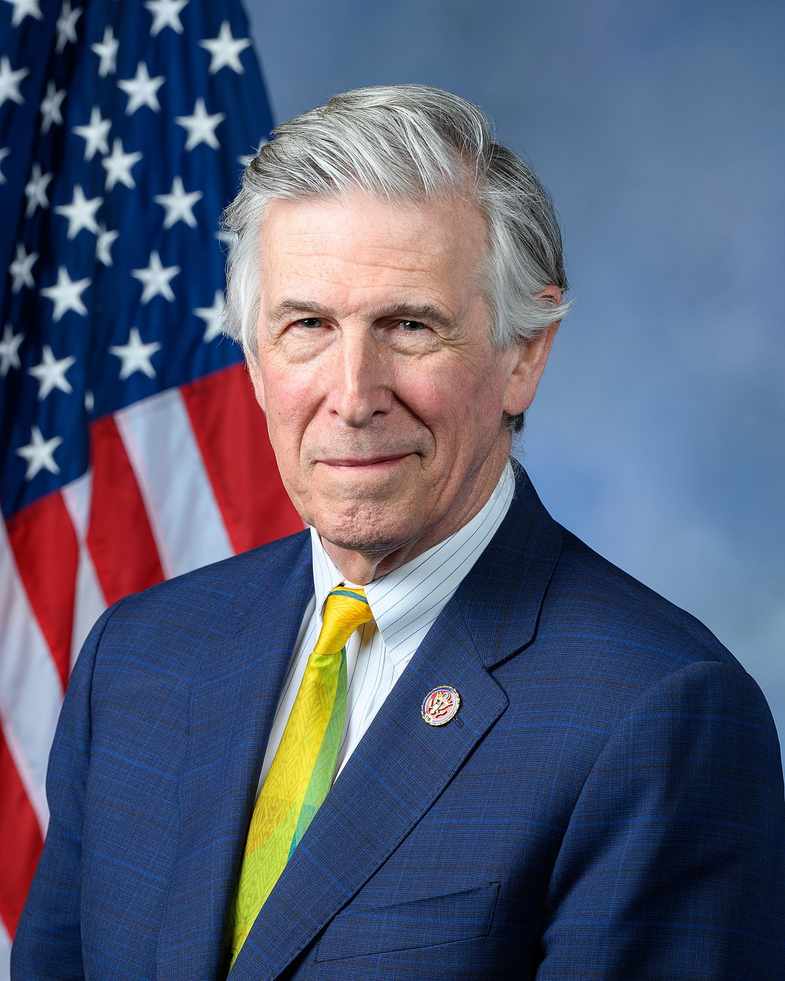

TrackWilliam R. Keating

Co-Sponsor

-

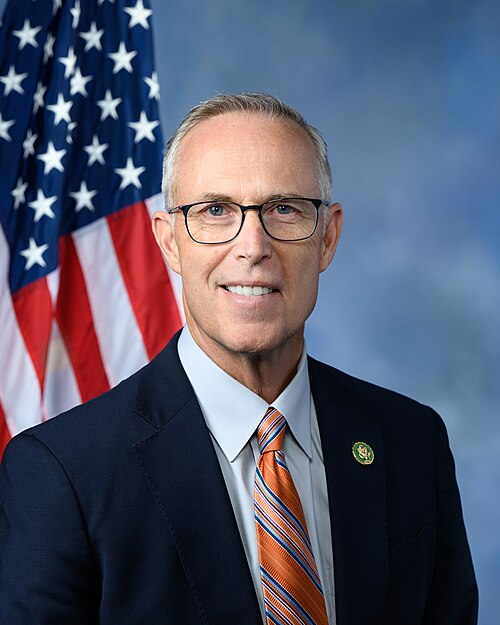

TrackGreg Landsman

Co-Sponsor

-

TrackZoe Lofgren

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackApril McClain Delaney

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackJohnny Olszewski

Co-Sponsor

-

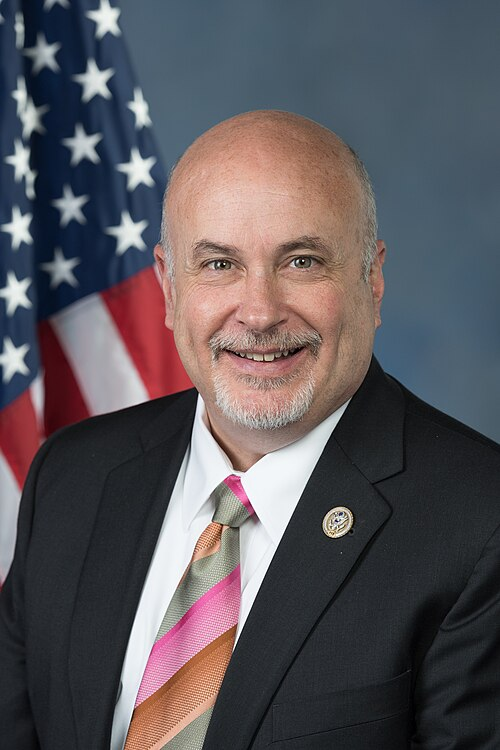

TrackMark Pocan

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackJamie Raskin

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackSuhas Subramanyam

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackJames R. Walkinshaw

Co-Sponsor

-

TrackGeorge Whitesides

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 26, 2025 | Introduced in House |

| Sep. 26, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.