H.R. 5529: Fair Housing for Disabeled Veterans Act

This bill, titled the Fair Housing for Disabled Veterans Act, proposes changes to how income is calculated for certain housing tax credits and bonds specifically for veterans receiving disability compensation or pension payments.

Key Changes Proposed

- Disregarding Disability Payments: The bill amends the Internal Revenue Code to exclude veteran disability compensation and pension payments from being counted as income when determining eligibility for low-income housing tax credits and certain residential rental project bonds. This means that veterans who receive these payments would not have their financial assistance considered, potentially allowing them to qualify more easily for affordable housing options.

- Applicability: The changes would apply to determinations made after the enactment of this Act, meaning that once it becomes law, the new income calculation rules would start immediately for future evaluations.

Overall Impact

The intent behind this bill is to enhance affordable housing opportunities for disabled veterans by ensuring that their disability compensation or pension benefits do not adversely affect their eligibility for housing assistance programs. This could help disabled veterans to have better access to housing that meets their needs without being disqualified due to their benefits.Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

18 bill sponsors

-

TrackLinda T. Sánchez

Sponsor

-

TrackDon Bacon

Co-Sponsor

-

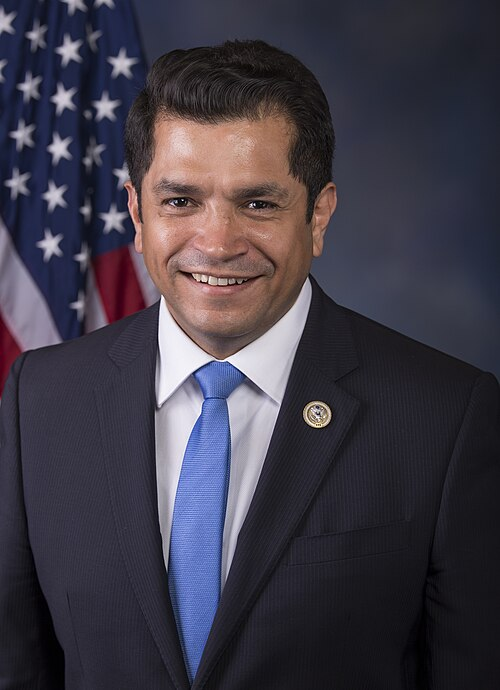

TrackSalud O. Carbajal

Co-Sponsor

-

TrackMike Carey

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackJimmy Gomez

Co-Sponsor

-

TrackMike Kelly

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

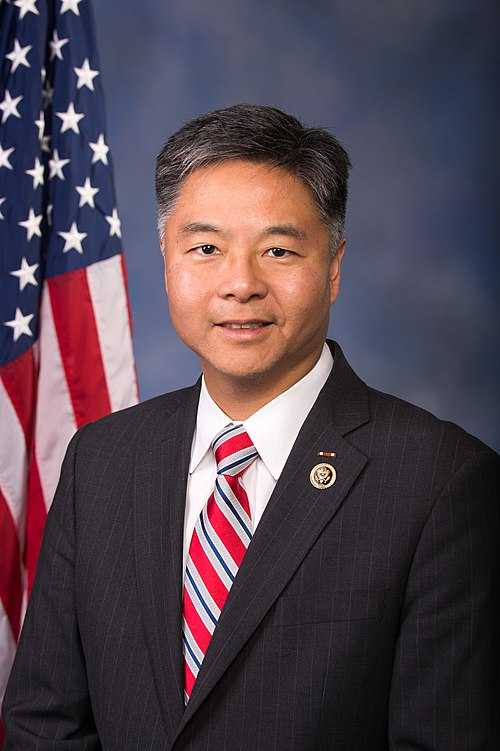

TrackTed Lieu

Co-Sponsor

-

TrackBlake D. Moore

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

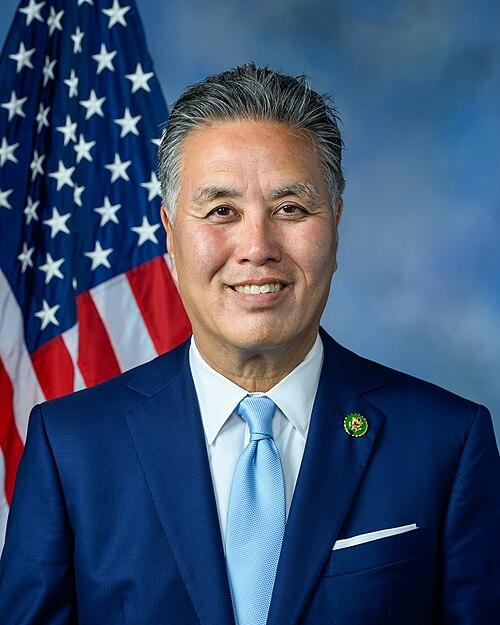

TrackMark Takano

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackRobert J. Wittman

Co-Sponsor

-

TrackRudy Yakym III

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 19, 2025 | Introduced in House |

| Sep. 19, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.