H.R. 5508: Mortgage Insurance Freedom Act

This legislation, titled the Mortgage Insurance Freedom Act

, aims to adjust the rules governing annual mortgage insurance premiums related to certain types of mortgages insured under the National Housing Act.

Key Provisions of the Bill

The main focus of the bill is to limit the collection of annual mortgage insurance premiums when specific conditions regarding the loan-to-value ratio are met. Here are the primary aspects of the bill:

- Premium Collection Restriction: The bill proposes that the Secretary of Housing and Urban Development (HUD) cannot collect annual mortgage insurance premiums on loans where the remaining insured principal balance is 78 percent or less of either the original sales price of the home or its appraised value at the time the mortgage was originated.

- Exception Clause: There is an exception for cases where the capital ratio of the Mutual Mortgage Insurance Fund falls below 2 percent. In such instances, the restriction on collecting premiums would not apply to mortgages already being charged premiums prior to that drop in the capital ratio.

- Implementation Timeline: HUD is required to establish rules for this new process within 180 days of the bill becoming law. These rules will detail how mortgagors can prove that their mortgage balance qualifies for the exemption.

- Outreach Requirements: The bill mandates that HUD engage in outreach and educational efforts to inform borrowers about the new limitation on premium collection and how they can demonstrate they meet the criteria.

Applicability of the Bill

The provisions of this bill would apply only to mortgages that are endorsed for insurance by HUD after the bill becomes law. This means existing mortgages would not be affected, but new mortgages secured after the enactment would be subject to the new rules.

Relevant Companies

- AMGN: As a company involved in the housing and mortgage sector, changes in mortgage insurance policies could affect their business operations.

- MTG: As a mortgage insurance company, this bill directly impacts their revenue streams based on the collection of mortgage insurance premiums.

- RDN: Another player in the mortgage insurance industry which could be influenced by the changes in premium collection practices.

This is an AI-generated summary of the bill text. There may be mistakes.

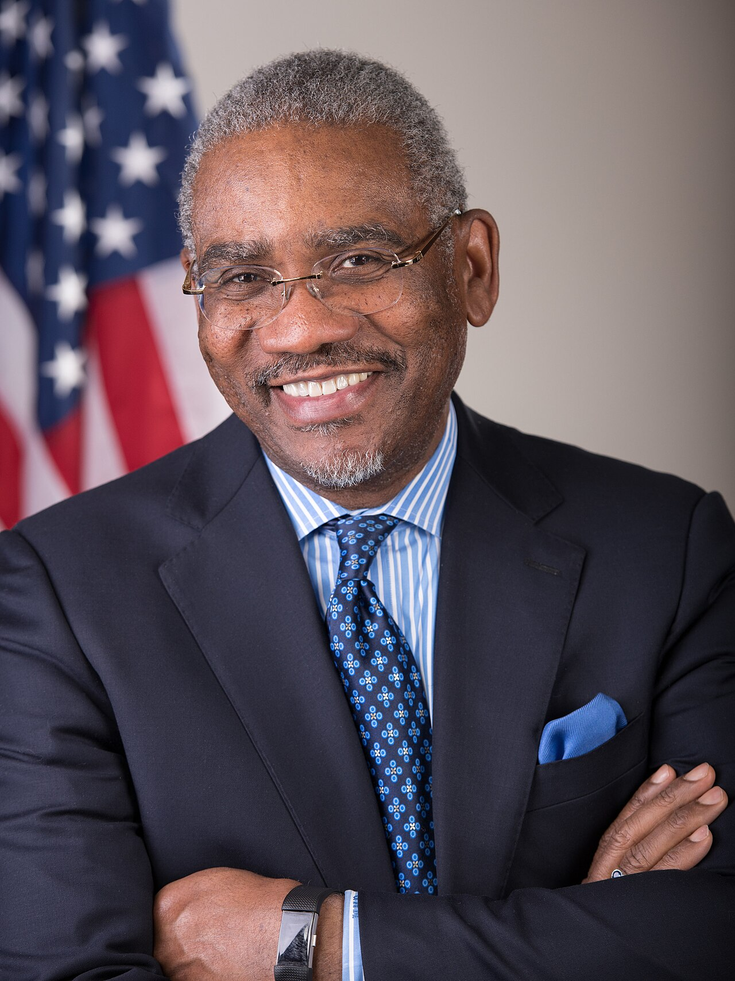

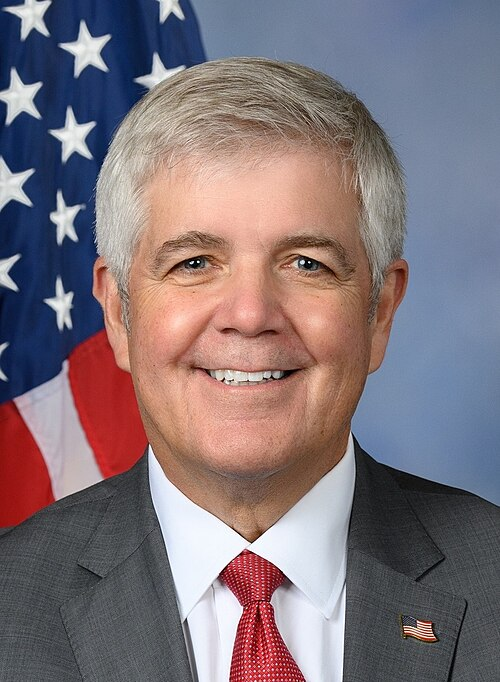

Sponsors

5 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 19, 2025 | Introduced in House |

| Sep. 19, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.