H.R. 5441: Fusion Advanced Manufacturing Parity Act

The Fusion Advanced Manufacturing Parity Act proposes changes to the Internal Revenue Code to offer tax incentives for the manufacturing of fusion energy components. Here’s a breakdown of the key points of the bill:

Tax Credit for Fusion Energy Components

The bill seeks to expand an existing tax credit known as the advanced manufacturing production credit. This credit previously applied to certain manufacturing activities, but the proposed changes would allow manufacturers to receive a credit for producing fusion energy components.

Specifically, manufacturers would receive a tax credit equal to **25 percent** of the sales price of eligible fusion energy components they produce. This credit aims to support the development and commercial viability of fusion energy technologies.

Eligible Fusion Energy Components

The legislation defines "fusion energy components" to include a variety of equipment and materials essential for the operation of fusion machines, such as:

- High-temperature superconducting magnets

- Fusion chambers or plasma vacuum vessels

- Blanket systems

- High-energy lasers

- Cooling system components

- Many others, including materials like quartz and ceramics used in fusion chambers

This wide range of eligible components indicates a focus on promoting various technologies involved in the fusion energy sector.

Phased Credit Reduction

The legislation includes a provision that phases out the tax credit over time. This phase-out would occur for components sold after December 31, 2031, reducing the percentage of the credit available in subsequent years:

- **75%** of the original credit for components sold in 2032

- **50%** for 2033

- **25%** for 2034

- No credit for components sold after December 31, 2034

This structure is designed to encourage the rapid development and adoption of fusion technology while gradually decreasing the reliance on tax incentives.

Effective Date

The amendments proposed in this bill would apply to components produced and sold after December 31, 2025. This timeframe allows manufacturers to prepare for the changes and potentially influence production strategies.

Potential Impact

This initiative is likely aimed at accelerating the development of fusion energy technology, potentially leading to increased investment in the sector. It recognizes fusion energy's potential as a clean energy source, seeking to make manufacturing in this area more economically viable through tax incentives.

Relevant Companies

- PLUG - Plug Power, which specializes in alternative energy technology, including hydrogen fuel cells, may benefit from advancements in fusion energy technology.

- BLDP - Ballard Power Systems, involved in fuel cell technology, might also look into fusion energy as a complementary technology.

- NIO - As an electric vehicle manufacturer, advancements in fusion energy could influence the overall energy landscape and potentially impact the electric vehicle market.

This is an AI-generated summary of the bill text. There may be mistakes.

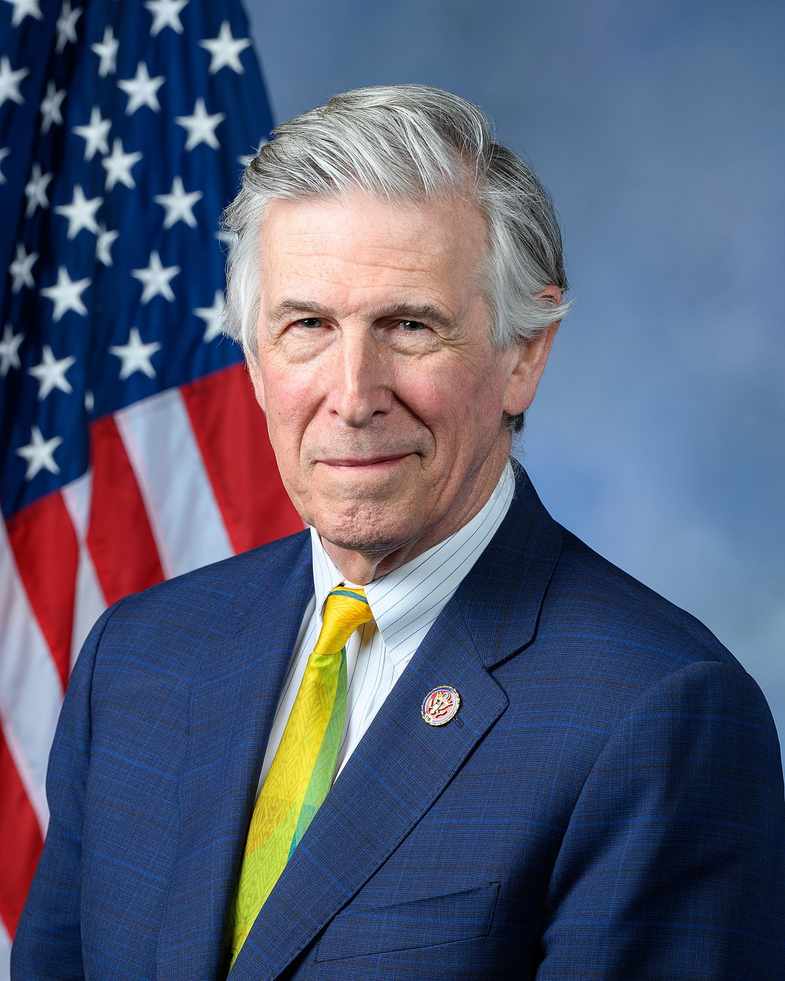

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 17, 2025 | Introduced in House |

| Sep. 17, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

1 company lobbying