H.R. 5440: To amend the Internal Revenue Code of 1986 to establish a tax credit for small businesses to provide diaper changing stations in restrooms.

This bill proposes changes to the Internal Revenue Code to introduce a tax credit aimed at small businesses that install diaper changing stations in their restrooms. The key elements of the bill are summarized below:

Tax Credit Overview

The proposed Diaper Changing Station Restroom Credit would allow eligible small businesses to receive a tax credit amounting to 70% of expenses incurred for qualified diaper changing station restroom expenses. This credit would apply for each business location that meets specific requirements outlined in the bill.

Eligible Small Businesses

To qualify for the tax credit, a small business must meet defined eligibility criteria, which include:

- Gross Receipts: The business should not exceed $5 million in gross receipts for the taxable year.

- Employee Count: The business should have fewer than 100 full-time equivalent employees.

Qualified Expenses

Qualified diaper changing station restroom expenses include:

- Costs for any diaper changing station installed in the restroom (free access).

- Costs for any diaper dispenser in the restroom (which may charge customers) along with installation expenses.

- Expenses related to the installation of new restrooms or renovations to existing restrooms to meet the requirements.

Family Bathroom Requirement

The bill specifies that a business must provide access to at least one public restroom that meets the family bathroom requirement. This means that both men and women should have access to a restroom equipped with:

- A diaper changing station (free access).

- A diaper dispenser (which may charge for products).

Credit Limitations

There are limitations on the amount of credit any business can claim:

- The credit awarded cannot exceed $10,000 minus any credits claimed in the three preceding years for that location.

Denial of Double Benefit

To prevent businesses from claiming multiple benefits for the same expenses, the bill specifies that:

- No deduction or credit shall be allowed for any expense covered by the tax credit.

- The basis of any property shall be reduced accordingly if the expense was included in claiming the credit.

Effective Date

The provisions of this bill would take effect for taxable years beginning after December 31, 2025.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

-

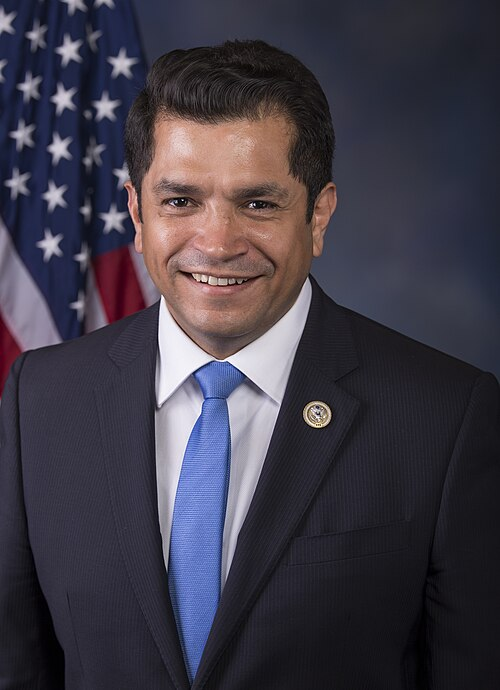

TrackRobert Menendez

Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

TrackDaniel S. Goldman

Co-Sponsor

-

TrackJimmy Gomez

Co-Sponsor

-

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackRyan Mackenzie

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackBrittany Pettersen

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 17, 2025 | Introduced in House |

| Sep. 17, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.