H.R. 5427: Billionaires Income Tax Act

The Billionaires Income Tax Act aims to require billionaires to pay taxes on their income annually by closing various tax avoidance strategies and loopholes that currently allow them to defer taxes. Here are the main components of the bill:

Tax Requirements for Billionaires

The bill mandates that billionaires no longer utilize strategies such as "buy, borrow, die," which previously allowed them to defer paying taxes on their wealth indefinitely. To enforce this, the legislation modifies over 30 existing tax provisions, ensuring that billionaires are taxed on their income on an annual basis.

Treatment of Grantor Trusts

This section details how grantor trusts will be treated under the new tax rules. It lays out specific conditions that determine when property is considered transferred and specifies the types of grantor trusts affected by this legislation. Additionally, it includes exceptions for:

- Spousal Transfers: Rules for transfers of assets between spouses are defined.

- Charitable Contributions: Contributions to charities are addressed, along with their implications on taxation.

- Transfers Upon Death: Guidelines are provided for how assets are treated when owned by deceased individuals.

Furthermore, the bill establishes rules for how the basis value of these properties is calculated and lays out exceptions for certain types of trusts.

Definitions and Special Rules

The bill defines key terms related to financial statements and introduces special rules for entities concerning asset basis adjustments and the valuation of partner ownership. This section also provides the Secretary of the Treasury with the authority to issue regulations to prevent tax avoidance and ensure effective coordination of the new tax provisions. The amendments introduced by this bill are set to take effect for any changes made after December 31, 2025.

Tax Treatment of Life Insurance and Annuity Contracts

Another provision of the bill addresses the tax implications for amounts received from certain life insurance and annuity contracts. It defines the applicable amounts and which taxpayers are impacted. New reporting requirements for life insurance companies are also established, with this provision effective for taxable years beginning after December 31, 2025.

Relevant Companies

- PRU (Prudential Financial) - As a life insurance provider, Prudential may be affected by new reporting requirements introduced in the bill, impacting its operations related to life insurance and annuity contracts.

- AXP (American Express) - American Express could be indirectly impacted as affluent clients may seek to navigate the new tax implications, potentially altering demand for certain financial products.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

33 bill sponsors

-

TrackSteve Cohen

Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackYvette D. Clarke

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackRosa L. DeLauro

Co-Sponsor

-

TrackMadeleine Dean

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackMaxwell Frost

Co-Sponsor

-

TrackJohn Garamendi

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackRobin L. Kelly

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackZoe Lofgren

Co-Sponsor

-

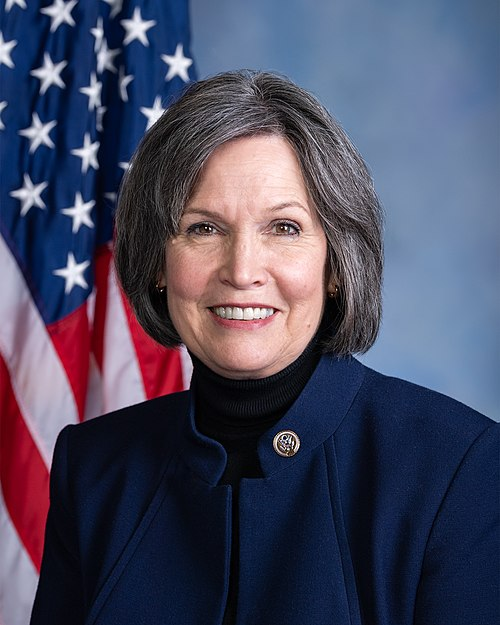

TrackBetty McCollum

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

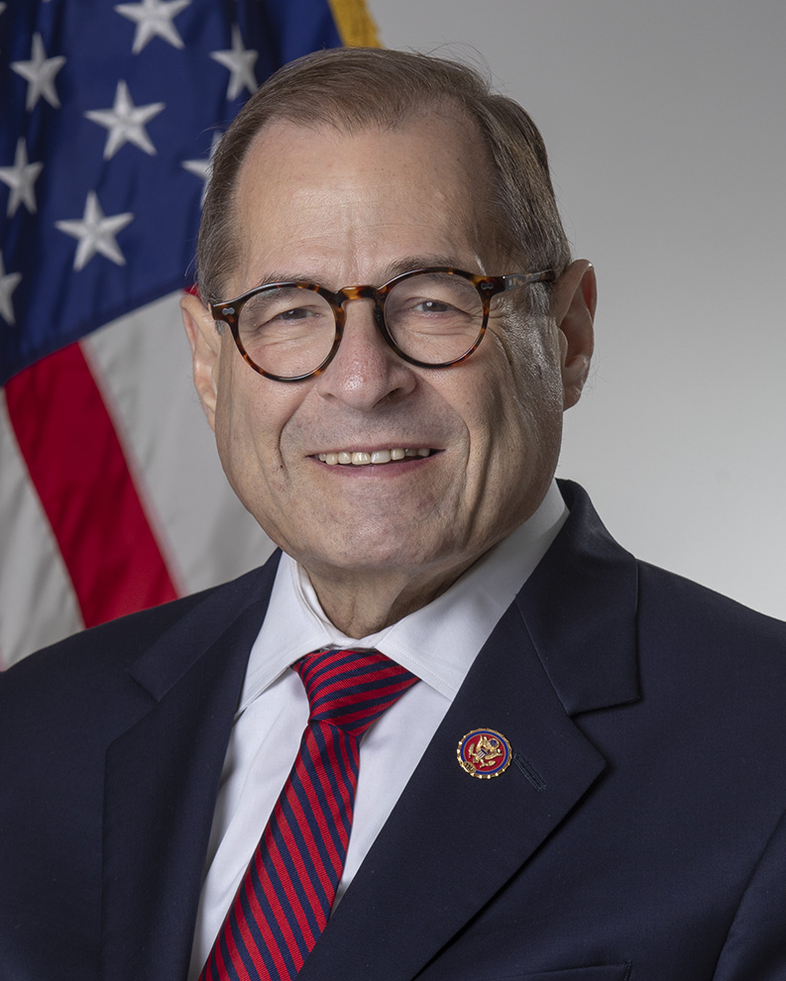

TrackJerrold Nadler

Co-Sponsor

-

TrackDonald Norcross

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

TrackLateefah Simon

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

Actions

4 actions

| Date | Action |

|---|---|

| Sep. 17, 2025 | Introduced in House |

| Sep. 17, 2025 | Referred to the House Committee on Ways and Means. |

| Sep. 17, 2025 | Sponsor introductory remarks on measure. (CR H4397) |

| Sep. 16, 2025 | Sponsor introductory remarks on measure. (CR E863) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.