H.R. 5366: Federal Disaster Tax Relief Act of 2025

This bill, titled the Federal Disaster Tax Relief Act of 2025

, proposes amendments to the Internal Revenue Code to extend and codify tax relief provisions related to personal casualty losses from major disasters, as well as to address compensation for wildfire damages. Below is a summary of its main provisions:

Casualty Loss Provisions

The bill introduces several changes to how personal casualty losses are treated under the tax code:

- Special Rule for Qualified Disaster Losses: Taxpayers who experience a qualified net disaster loss will be allowed to claim the total loss amount as well as a portion of any excess losses, specifically those that exceed 10% of their adjusted gross income (AGI).

- Definition of Qualified Disaster-Related Personal Casualty Losses: These are losses stemming from a declared disaster, occurring within specific regions designated as qualified disaster areas after major disasters from July 4, 2025, to January 1, 2027.

- Dollar Limitation Changes: The threshold for deducting casualty losses will be adjusted, lowering the minimum amount deductible from $500 to $100, while maintaining a higher limit for certain net disaster losses.

- Standard Deduction Inclusion: The bill incorporates disaster loss deductions into the standard deduction, allowing taxpayers to benefit from these losses even if they take the standard deduction.

- Impact on Alternative Minimum Tax (AMT): The disaster loss deduction will be treated separately under AMT calculations, presumably enabling individuals to claim it without diminishing their ability to utilize other deductions.

Wildfire Relief Provisions

The legislation also establishes guidelines for tax exclusions specifically related to compensation received for wildfire damages:

- Exclusion from Gross Income: Individuals will not need to include amounts received as qualified wildfire relief payments in their gross income, effectively reducing their taxable income.

- Definition of Qualified Wildfire Relief Payments: Compensation for losses, expenses, or damages due to a federally declared wildfire disaster can be excluded, provided these payments cover losses not already compensated by insurance.

- Conditions to Avoid Double Benefits: If an individual receives a qualified wildfire relief payment, they cannot also claim deductions or credits for the same expenses. This provision is meant to prevent tax advantages for payments already received.

- Limitation on Application: The exclusions for wildfire relief payments apply only to payments received during certain taxable years, specifically from after December 31, 2025, to before January 1, 2031.

Effective Dates

The changes proposed in this bill would take effect for losses incurred in taxable years starting after December 31, 2024, and for wildfire relief payments received from taxable years beginning after December 31, 2025.

Relevant Companies

- PLTR (Palantir Technologies Inc.) - As a company involved in data analytics, Palantir could be engaged for disaster response operational needs, potentially seeing an increase in demand for its services following disaster declarations.

- HD (The Home Depot, Inc.) - Home improvement stores like Home Depot might benefit from increased sales of repair and rebuilding materials as individuals assess and recover from disaster damages.

This is an AI-generated summary of the bill text. There may be mistakes.

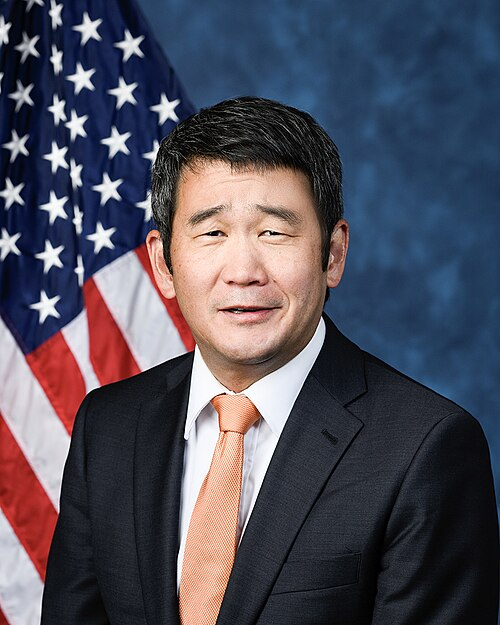

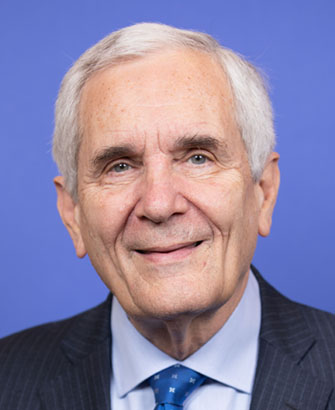

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 15, 2025 | Introduced in House |

| Sep. 15, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.