H.R. 5356: National Infrastructure Bank Act of 2025

The National Infrastructure Bank Act of 2025 seeks to create a national bank dedicated to funding infrastructure projects throughout the United States. This initiative is designed to tackle notable gaps in infrastructure funding by employing innovative financial strategies and capital raising efforts, aiming to create jobs while enhancing the nation's infrastructure.

Key Provisions of the Bill

The bill proposes the following main components regarding the establishment and operations of the National Infrastructure Bank:

- Capital and Loans: The Bank will have the authority to issue loans totaling up to $5 trillion. The interest rates for these loans will be determined based on the risk associated with each project.

- Board of Directors: A Board of Directors will be established to oversee the Bank’s operations and ensure that the objectives of the Bank are being met. This Board will also develop regional planning groups to assess local infrastructure needs.

- Eligibility and Risk Management: The bill sets forth specific eligibility criteria for projects seeking funding and includes provisions for effective risk management practices to safeguard the interests of the Bank and its stakeholders.

- Community Benefits: A focus will be placed on projects that provide tangible benefits to communities and promote domestic production. This means that projects should aim to enhance local economies and support local businesses.

Operational Oversight

The bill delineates the functions of the Bank’s risk management and audit committees. These committees will be responsible for:

- Appointment and Compensation: The bill specifies how members of these committees will be appointed, their compensation structures, and the terms of their service.

- Duties: Committees are tasked with ensuring the Bank adheres to federal laws, including adherence to nondiscrimination clauses, and promoting transparency in all financial dealings.

- Partnerships: The Bank will be encouraged to partner with local financial institutions to enhance its outreach and effectiveness in funding community-based projects.

The overarching goal of this legislation is to develop a structured and responsible framework for funding vital infrastructure projects across the country while fostering economic growth and community well-being.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

54 bill sponsors

-

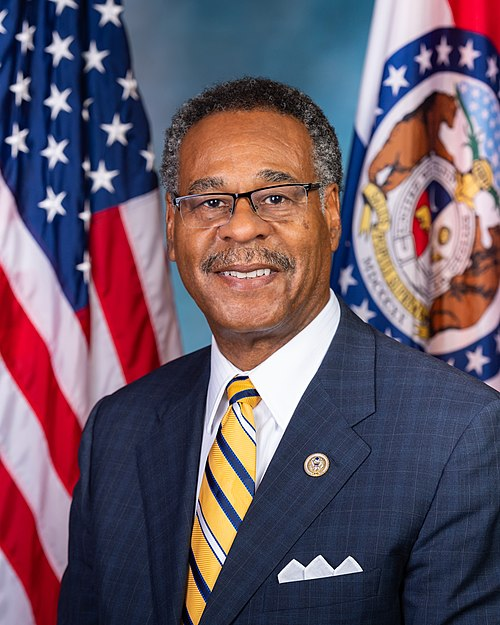

TrackDanny K. Davis

Sponsor

-

TrackAlma S. Adams

Co-Sponsor

-

TrackGabe Amo

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackSheila Cherfilus-McCormick

Co-Sponsor

-

TrackEmanuel Cleaver

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackDebbie Dingell

Co-Sponsor

-

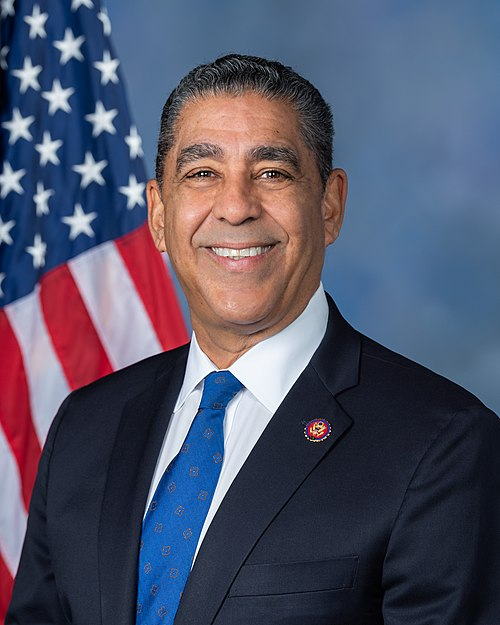

TrackAdriano Espaillat

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

TrackLaura Friedman

Co-Sponsor

-

TrackMaxwell Frost

Co-Sponsor

-

TrackJohn Garamendi

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackDaniel S. Goldman

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackSara Jacobs

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackMarcy Kaptur

Co-Sponsor

-

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackGeorge Latimer

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackTeresa Leger Fernandez

Co-Sponsor

-

TrackZoe Lofgren

Co-Sponsor

-

TrackStephen F. Lynch

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackJohn Mannion

Co-Sponsor

-

TrackJennifer L. McClellan

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

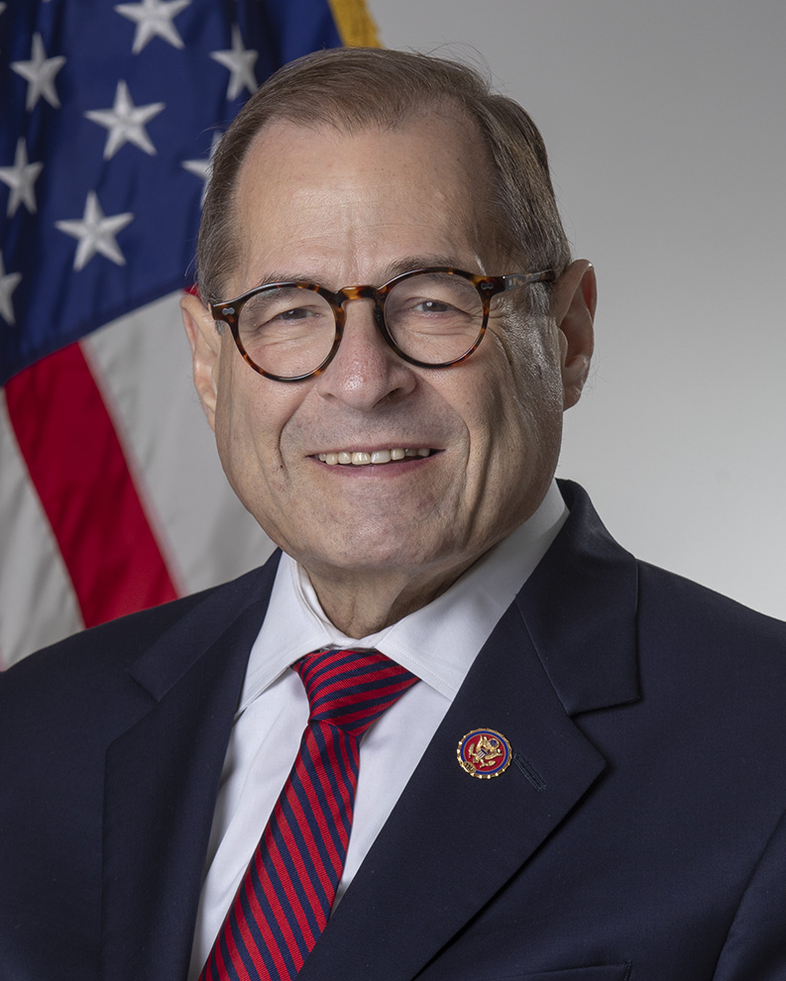

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackAlexandria Ocasio-Cortez

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackChellie Pingree

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackDeborah K. Ross

Co-Sponsor

-

TrackPatrick Ryan

Co-Sponsor

-

TrackAdam Smith

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

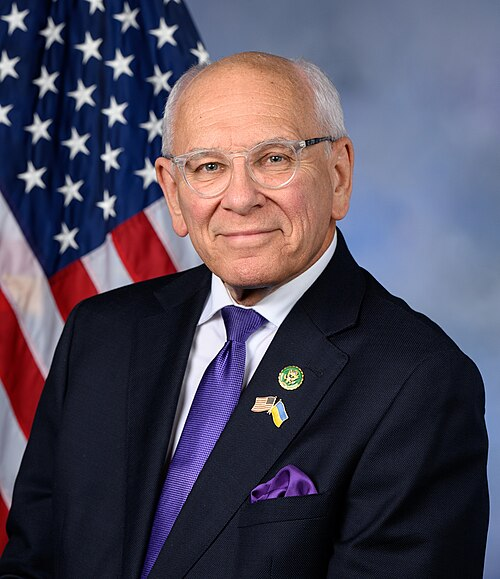

TrackPaul Tonko

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackGabe Vasquez

Co-Sponsor

-

TrackNydia M. Velázquez

Co-Sponsor

-

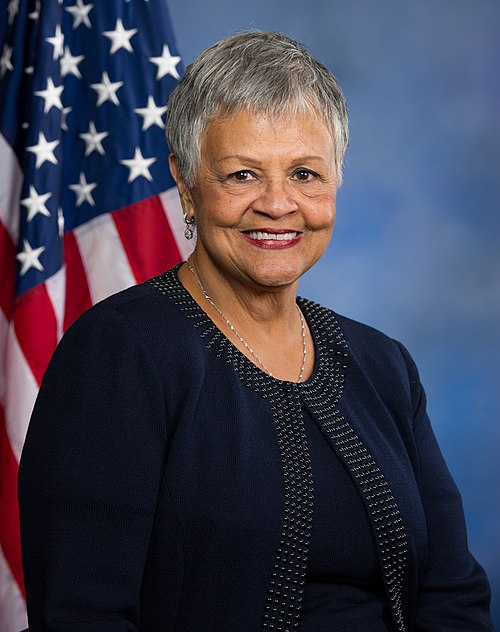

TrackBonnie Watson Coleman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 15, 2025 | Introduced in House |

| Sep. 15, 2025 | Referred to the Committee on Energy and Commerce, and in addition to the Committees on Ways and Means, Transportation and Infrastructure, Financial Services, Education and Workforce, Natural Resources, and the Budget, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.