H.R. 5325: Unclaimed Retirement Rescue Plan

This bill, known as the Unclaimed Retirement Rescue Plan, aims to help manage unclaimed retirement distributions. Here are the key components of the bill:

Purpose

The primary goal of the bill is to allow administrators of pension plans to voluntarily transfer unclaimed retirement funds to state unclaimed property programs. This is intended to ensure these funds can be returned to individuals who may not be aware of their benefits or have lost contact with their retirement accounts.

Regulation Development

The bill mandates that the Secretary of Labor must establish regulations within 180 days of the bill's enactment. These regulations will allow pension plan administrators to transfer unclaimed distributions to a national clearinghouse that coordinates with state programs.

Transfer Requirements

Before transferring unclaimed distributions, which are defined as amounts of $50 or more, the plan administrator must:

- Attempt to identify the current contact details of the participant or beneficiary using an informational database and other sources.

- Send a notice to the entitled participant or beneficiary informing them of the distribution and the potential transfer to the state program.

The notice should explain how to prevent the transfer and can be sent via a reasonable and secure means, including email or traditional mail.

Relief for Plan Administrators

Administrators who comply with the transfer requirements will be considered to have met their fiduciary responsibilities under existing retirement security laws. This means they will have legal protections when transferring funds to the state programs.

Information Sharing

The Department of Labor will ensure there is a way for pension plans to verify whether transferred distributions have been claimed by the rightful participants or beneficiaries, aiding in compliance with existing regulations.

Reporting Requirements

Pension plan fiduciaries must report every 90 days on transferred distributions, including details such as participant identities and the amounts transferred. This report will not be publicly disclosed, maintaining the confidentiality of participant information.

Retirement Savings Database

Information regarding the transfers will be included in the Retirement Savings Lost and Found Database, which aims to help individuals reclaim their retirement savings.

Regulatory Oversight

The Secretary of Labor is required to assess the effectiveness of the implemented regulations and provide a report to Congress within 24 months of their promulgation.

Definitions

The bill provides definitions for key terms, including what constitutes unclaimed retirement distributions and the parameters for unclaimed property programs at the state level. Unclaimed distributions generally refer to amounts that have not been claimed for certain periods, typically 90 days or one year, depending on the circumstances.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

14 bill sponsors

-

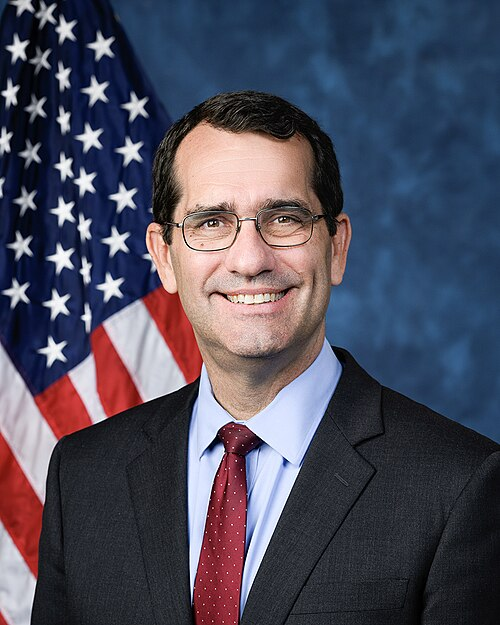

TrackSeth Magaziner

Sponsor

-

TrackBecca Balint

Co-Sponsor

-

TrackSean Casten

Co-Sponsor

-

TrackRon Estes

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackMike Flood

Co-Sponsor

-

TrackHarriet M. Hageman

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackJamie Raskin

Co-Sponsor

-

TrackMike Rogers

Co-Sponsor

-

TrackDerek Schmidt

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackKim Schrier

Co-Sponsor

-

TrackGlenn Thompson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 11, 2025 | Introduced in House |

| Sep. 11, 2025 | Referred to the Committee on Education and Workforce, and in addition to the Committee on Ways and Means, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.