H.R. 523: Permanent Tax Cuts for American Families Act of 2025

This bill, titled the Permanent Tax Cuts for American Families Act of 2025

, aims to make significant changes to the standard deduction in the U.S. tax system, particularly focusing on increasing the amounts and ensuring they remain in effect indefinitely.

Key Changes Proposed by the Bill

- Increase in Standard Deduction:

- The standard deduction for married couples filing jointly would be increased from

$4,400

to$18,000

. - The standard deduction for single filers would be increased from

$3,000

to$12,000

.

- The standard deduction for married couples filing jointly would be increased from

- Inflation Adjustment:

- The bill includes a provision that will allow the standard deduction amounts to be adjusted annually for inflation. This means that each year, the standard deduction can be increased based on the cost-of-living adjustments, ensuring that the real value of the deduction does not diminish over time.

- Specifically, adjustments would relate to changes in the Consumer Price Index (CPI), ensuring that the deduction reflects the cost of living in the years following the enactment of the bill.

- Removal of Certain Provisions:

- The bill proposes to strike a specific paragraph (paragraph (7)) from the existing tax code related to the standard deduction, which may be intended to simplify the tax structure associated with it.

Effective Date

The changes proposed in this bill would take effect for taxable years beginning after the enactment of the legislation. This means that once the bill becomes law, the new standard deduction amounts and their indexation for inflation would apply starting with the next tax year.

Overall Impact

The bill aims to benefit taxpayers by allowing them to deduct a larger portion from their taxable income, thereby potentially reducing their overall tax liability. The inflation adjustment mechanism is designed to help maintain the purchasing power of the standard deduction over time, making tax burdens more manageable for families and individuals.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

15 bill sponsors

-

TrackMax L. Miller

Sponsor

-

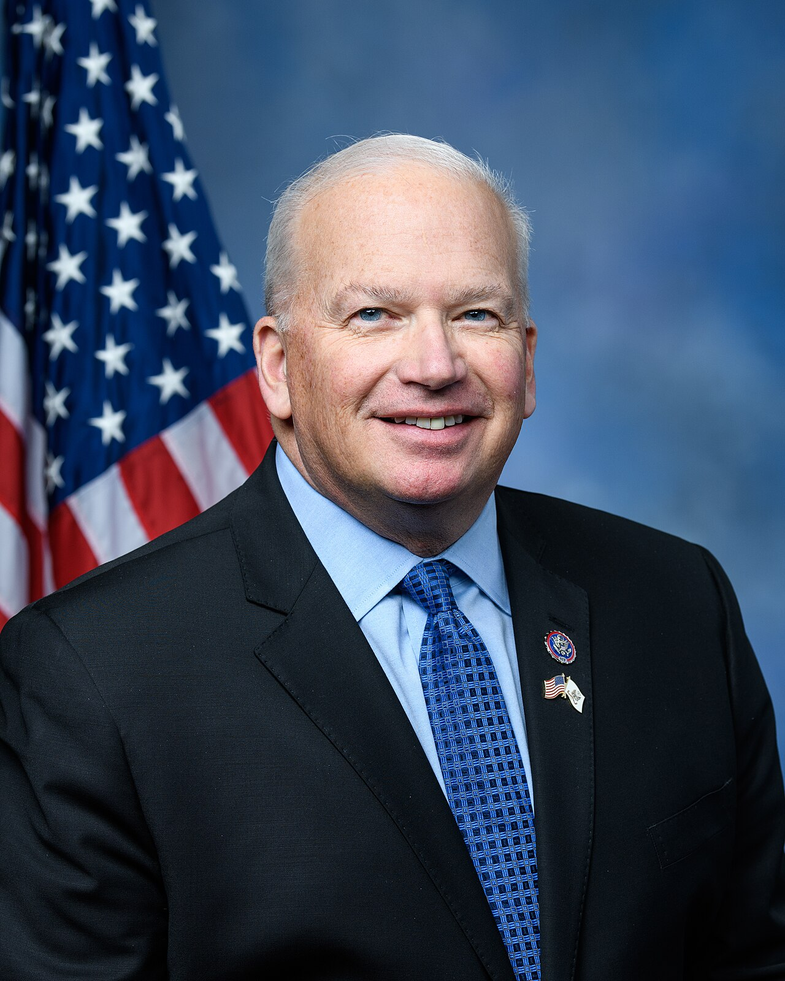

TrackVern Buchanan

Co-Sponsor

-

TrackKen Calvert

Co-Sponsor

-

TrackRon Estes

Co-Sponsor

-

TrackRandy Feenstra

Co-Sponsor

-

TrackBrad Finstad

Co-Sponsor

-

TrackMichelle Fischbach

Co-Sponsor

-

TrackScott Fitzgerald

Co-Sponsor

-

TrackDavid Kustoff

Co-Sponsor

-

TrackDarin LaHood

Co-Sponsor

-

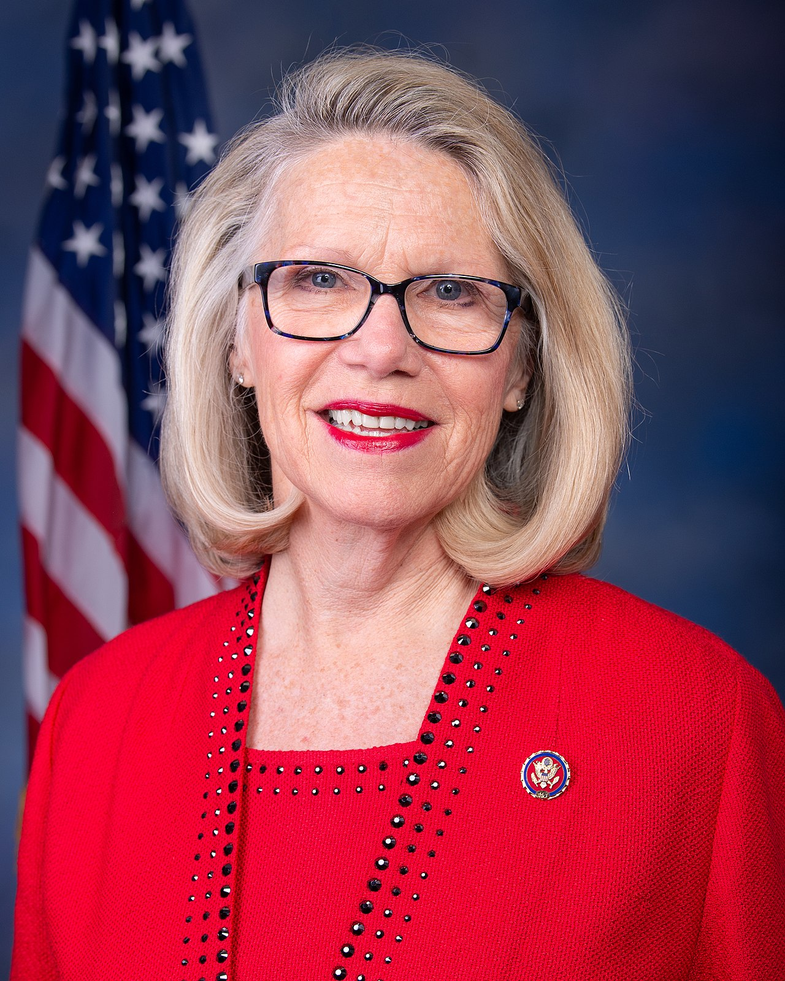

TrackCarol D. Miller

Co-Sponsor

-

TrackAdrian Smith

Co-Sponsor

-

TrackLloyd Smucker

Co-Sponsor

-

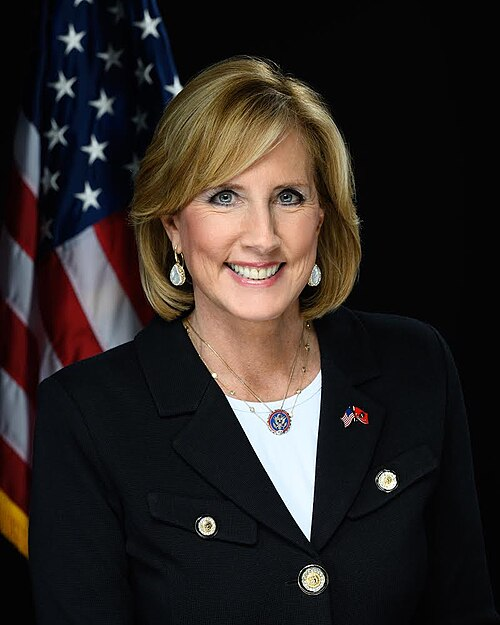

TrackClaudia Tenney

Co-Sponsor

-

TrackBeth Van Duyne

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 16, 2025 | Introduced in House |

| Jan. 16, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.