H.R. 5225: Protect Innocent Victims of Taxation After Fire Extension Act

This bill, known as the Protect Innocent Victims of Taxation After Fire Extension Act, aims to amend the Internal Revenue Code to provide specific tax relief for individuals affected by wildfires. It proposes to exclude certain payments received as compensation for losses or damages related to wildfires from being counted as taxable income. Below are the key components of the bill:

Key Provisions

- Exclusion of Compensation from Gross Income: The bill states that amounts received by individuals as qualified wildfire relief payments will not be included in their gross income for tax purposes.

- Definition of Qualified Wildfire Relief Payment: A "qualified wildfire relief payment" refers to any compensation received for losses or damages incurred due to a wildfire disaster. This can include payments for:

- Additional living expenses

- Lost wages (but not if these wages would have been paid by an employer)

- Personal injury

- Death

- Emotional distress

- Definition of Qualified Wildfire Disaster: A "qualified wildfire disaster" is defined as any wildfire event that has been federally declared as a disaster, occurring after December 31, 2014.

- Denial of Double Benefit: The bill ensures that taxpayers cannot receive a double benefit. This includes prohibiting:

- Deductions or credits for any expenditures related to the amount excluded from gross income due to the relief payments.

- Adjustments to property basis for amounts excluded, preventing taxpayers from inflating their property value due to these payments.

- Termination Date: The provisions of this bill will not apply to any amounts received after December 31, 2032.

Effective Date

The changes outlined in this bill will take effect for amounts received after December 31, 2025.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

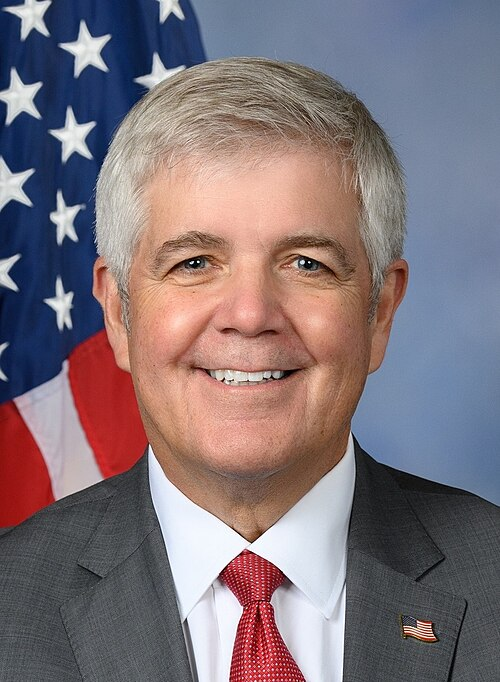

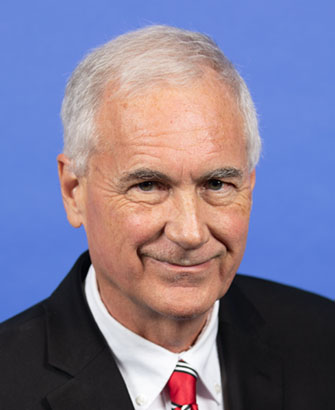

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 09, 2025 | Introduced in House |

| Sep. 09, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.