H.R. 5146: Federal Receivership Fairness Act

This bill, known as the Federal Receivership Fairness Act, seeks to amend the Internal Revenue Code to clarify how tax liabilities are determined when a receiver is appointed in a receivership case. Here’s a summary of its main provisions:

Key Provisions

1. **Tax Liability Determination**: The bill allows the court that appoints a receiver to determine the amount and legality of any Federal taxes, fines, or penalties related to those taxes for the receivership estate. This applies whether the tax has been assessed or paid, or if it has been contested in court.

2. **Exceptions**: There are specific exceptions where the court cannot determine tax liabilities: - If the tax legality was already contested and adjudicated before the receivership began. - Any claims for a Federal tax refund need to wait until a request is properly submitted by the receiver. - The court cannot determine matters related to property taxes if the deadline to contest those taxes has passed.

3. **Requests for Determination**: Receivers can submit requests for determining unpaid tax liabilities. If they file the appropriate paperwork and the tax authority does not respond within set time frames, they can potentially discharge their tax liabilities by paying the assessed taxes.

Procedures and Responsibilities

- Receivers must maintain records and follow designated procedures to make requests for tax determinations.- The bill outlines the responsibilities of the court and the tax authorities in processing these requests.- After determining a tax liability, the governmental unit can assess said tax against the estate or related entities.

Sovereign Immunity Waiver

The bill includes provisions waiving sovereign immunity, allowing the court to hear matters involving tax determinations without being restricted by the protections that typically prevent claims from being brought against the government. This includes allowing the court to issue judgments against government units regarding these tax matters, with limitations on punitive damages.

Jurisdiction and Transfers

If there are objections to state court jurisdiction by the governmental unit, these matters can be transferred to a federal district court, ensuring flexibility in how cases are adjudicated.

Effective Date

The provisions of this bill would apply to tax returns for which the assessment period is open as of the enactment date, and any returns filed afterward.

Definitions

The bill defines key terms, including the role of the receiver, which is distinct from bankruptcy trustees and executors of decedent estates.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

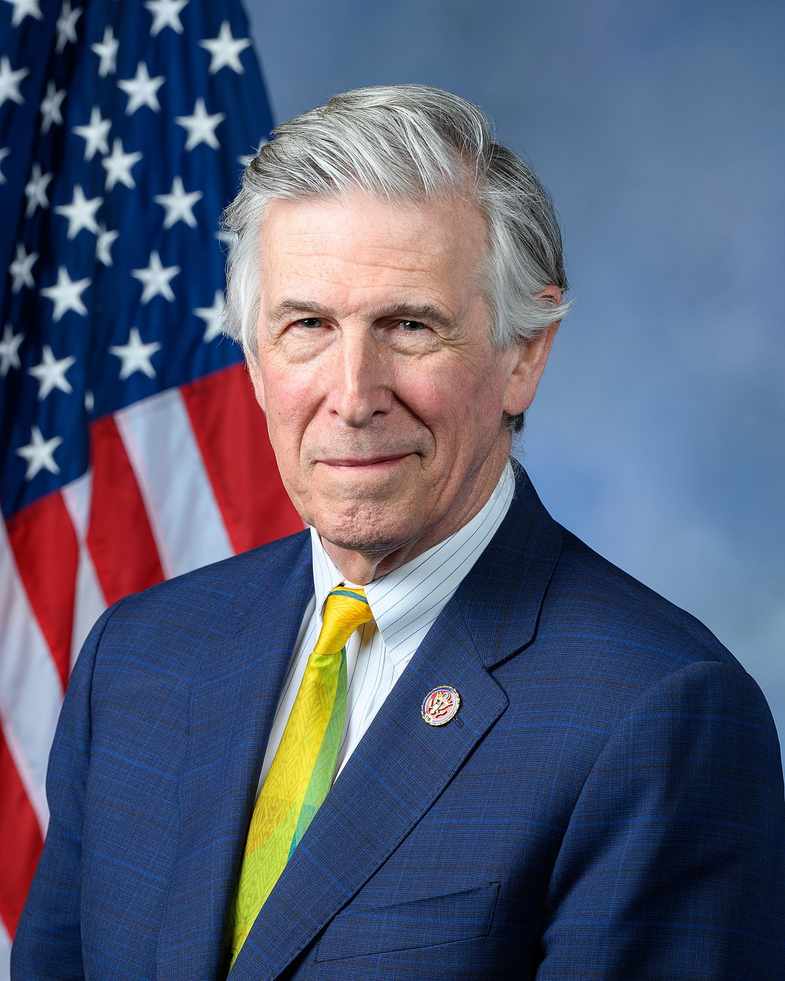

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 04, 2025 | Introduced in House |

| Sep. 04, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on the Judiciary, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.