H.R. 5145: Bipartisan Premium Tax Credit Extension Act

This bill, known as the Bipartisan Premium Tax Credit Extension Act, aims to extend certain provisions related to premium tax credits for health insurance. It primarily focuses on enhancing financial assistance for individuals and families purchasing health insurance through the marketplace, particularly those with incomes above 400% of the federal poverty line. Here are the key points of the bill:

Extension of Enhanced Premium Tax Credits

The bill proposes to extend the current enhanced premium tax credits that help lower the cost of health insurance premiums for eligible individuals and families. Specifically:

- The current provision that allows increased premium assistance amounts for taxpayers will be extended through the end of 2026, rather than ending in 2025.

- Additionally, the extension includes the provision that permits individuals and families with household incomes exceeding 400% of the poverty line to receive these credits. This allowance will also continue through 2026.

Effective Date

The amendments introduced by this bill would take effect for taxable years that begin after December 31, 2025. This means that the extended benefits would be available starting in the 2026 tax year.

Overall Impact

By prolonging access to enhanced premium tax credits, the bill seeks to assist more individuals in affording health insurance, particularly those on the higher end of the income scale who may struggle with costs despite earning above the poverty threshold.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

29 bill sponsors

-

TrackJennifer Kiggans

Sponsor

-

TrackRobert Bresnahan

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackJuan Ciscomani

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackMonica De La Cruz

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

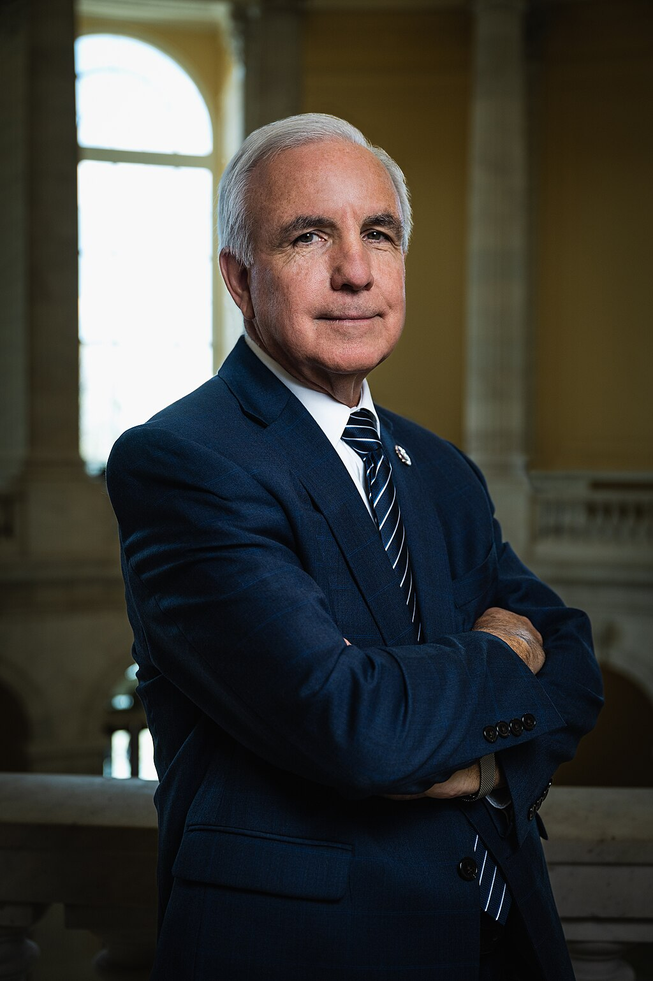

TrackCarlos A. Gimenez

Co-Sponsor

-

TrackJared F. Golden

Co-Sponsor

-

TrackVicente Gonzalez

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackJosh Harder

Co-Sponsor

-

TrackJeff Hurd

Co-Sponsor

-

TrackMarcy Kaptur

Co-Sponsor

-

TrackThomas H. Kean, Jr.

Co-Sponsor

-

TrackYoung Kim

Co-Sponsor

-

TrackNick LaLota

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackSusie Lee

Co-Sponsor

-

TrackCory Mills

Co-Sponsor

-

TrackChris Pappas

Co-Sponsor

-

TrackMarie Gluesenkamp Perez

Co-Sponsor

-

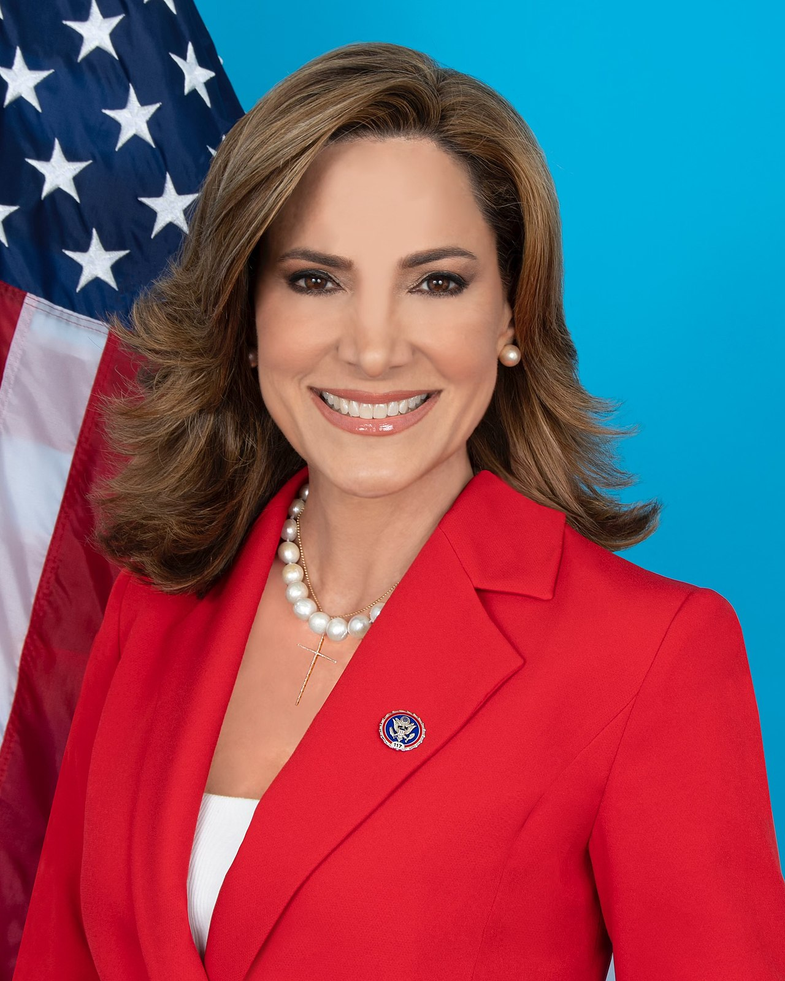

TrackMaria Elvira Salazar

Co-Sponsor

-

TrackHillary J. Scholten

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackDavid G. Valadao

Co-Sponsor

-

TrackJefferson Van Drew

Co-Sponsor

-

TrackGabe Vasquez

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 04, 2025 | Introduced in House |

| Sep. 04, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

1 company lobbying