H.R. 4968: Protecting and Preserving Social Security Act

This bill, titled the Protecting and Preserving Social Security Act, aims to amend regulations related to Social Security benefits, focusing on two main areas: cost-of-living increases and the fairness of contributions and benefits.

Cost-of-Living Increases

The bill establishes a new index called the Consumer Price Index for Elderly Consumers, which will measure changes in expenses for individuals aged 62 and older. This index will help ensure that cost-of-living adjustments for Social Security benefits more accurately reflect the economic realities faced by older Americans.

Furthermore, the bill modifies how cost-of-living increases are computed under the Social Security Act to incorporate this new index. This means that from a specified date onward, increases in Social Security benefits will be tied directly to the Consumer Price Index for Elderly Consumers, providing potentially higher adjustments than current guidelines allow.

Also, it is noted that any increase in monthly benefits due to these changes will not be counted as income or resources when determining eligibility for other assistance programs like Supplemental Security Income (SSI) or Medicaid.

Contribution and Benefit Fairness

The legislation introduces changes to the rules determining how wages and self-employment income are treated under Social Security. Specifically:

- It establishes a methodology for assessing wages above the contribution and benefit base, starting from 2026. This will involve a percentage system that varies by year, with specific percentages outlined for 2026 to 2031.

- It allows the inclusion of surplus earnings in calculating Social Security benefits, ensuring that additional income does not negatively affect the amount received by beneficiaries.

The bill specifies that the additional income from surplus earnings will be factored into how benefits are calculated for individuals newly eligible for Social Security after 2025. The formula for determining benefits will include consideration of these surplus earnings, which can enhance the overall benefit amount for eligible individuals.

Implementation Timelines

The provisions within the bill are set to take effect based on specific timelines. For example, the new consumer price index for elderly consumers and changes to cost-of-living computations will begin to apply to specified periods as of July 31 of the year following the bill's enactment. The future adjustments on wages and self-employment income are structured to take effect from the start of 2026, with ongoing adjustments planned through 2031 and beyond.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackJill N. Tokuda

Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackVeronica Escobar

Co-Sponsor

-

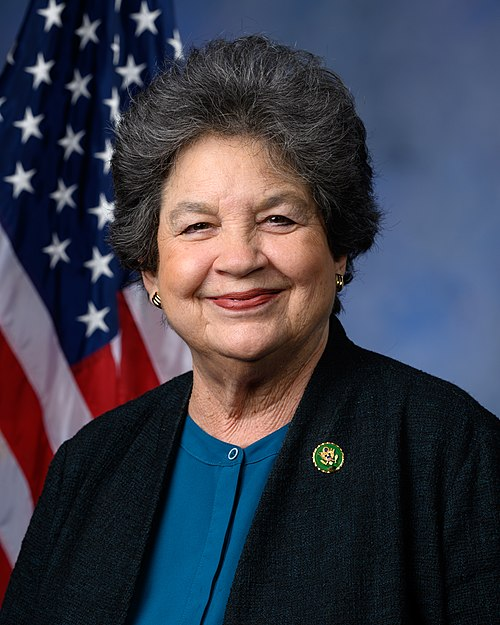

TrackLois Frankel

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackBrittany Pettersen

Co-Sponsor

-

TrackChellie Pingree

Co-Sponsor

-

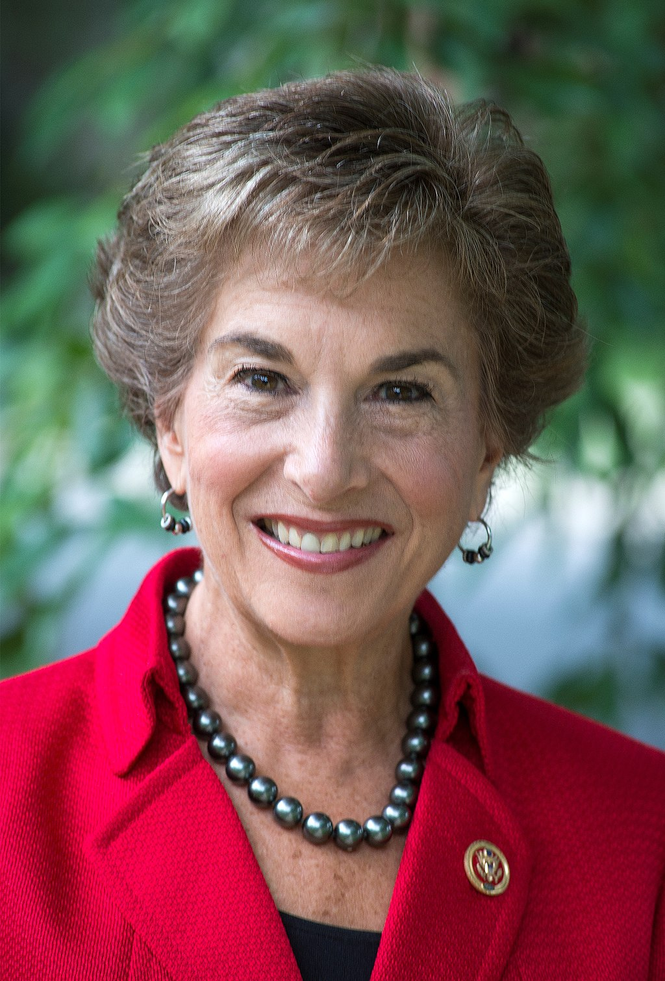

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

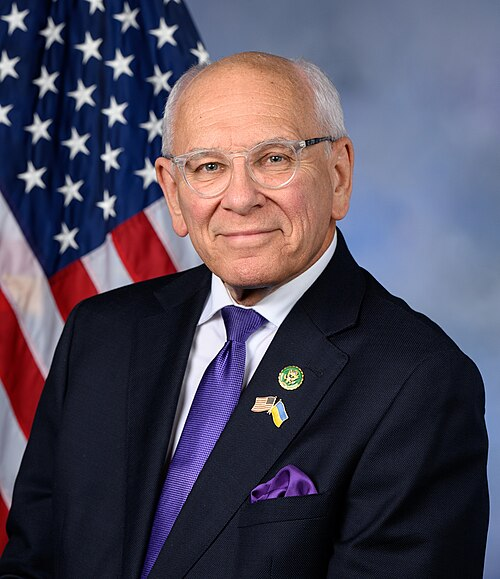

TrackPaul Tonko

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Aug. 12, 2025 | Introduced in House |

| Aug. 12, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committees on Energy and Commerce, and Education and Workforce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.