H.R. 486: Young Americans Financial Literacy Act

The Young Americans Financial Literacy Act aims to enhance financial literacy among young people and families aged 8 to 24 by establishing a grant program managed by the Bureau of Consumer Financial Protection (CFPB). The following outlines the key objectives and provisions of the bill:

Goals of the Bill

The bill addresses the pressing need for improved financial literacy education by:

- Providing support for the development and implementation of effective financial literacy programs.

- Ensuring that educational content is accessible and relevant to various demographics, particularly at-risk populations.

- Reducing rates of student loan default through educational initiatives on managing educational debt.

- Promoting better financial decision-making among young people as they transition into adulthood.

Funding and Grants

The CFPB is authorized to make competitive grants to eligible institutions to set up "centers of excellence." These centers will focus on:

- Researching and developing comprehensive financial literacy curricula tailored for young people.

- Creating outreach programs that target unique life situations and financial challenges, such as credit misuse or bankruptcy.

- Offering professional development for educators in financial literacy to ensure consistent and effective instruction.

- Conducting evaluation and research to assess the impact and effectiveness of these educational programs.

The total amount available for grants each fiscal year will be at least $27.5 million but may not exceed $55 million, with funding set to terminate at the end of fiscal year 2029.

Eligibility for Grants

To qualify for grants, institutions must be partnerships between various entities, which could include:

- Institutions of higher education

- State or local government agencies focused on financial education

- Nonprofit organizations

- Financial institutions

Priority Areas for Grant Applications

The CFPB will prioritize grant applications that:

- Clearly define financial literacy and financially literate outcomes.

- Identify effective programs tailored to the needs of young people in challenging financial situations.

- Develop age-appropriate content and educational materials.

- Encourage asset building through savings and investments.

Reporting and Assessment

The Director of the CFPB is required to report annually to Congress on the progress of grant recipients, detailing:

- The amount of funding awarded

- The populations served through these financial literacy programs

Delivery of Program Content

Funds granted under this bill must be used to deliver financial literacy content in accessible formats, utilizing both traditional educational methods and digital platforms, including social media, to reach a broader audience.

Long-Term Implications

The legislation recognizes that financial literacy is crucial not only for individual well-being but also for broader economic stability. By focusing on younger generations, the bill seeks to cultivate informed individuals who can make more sound financial decisions and reduce the risk of future financial crises.

Relevant Companies

- PSFC - A financial education platform that may benefit from enhanced market demand for their services as schools and institutions may incorporate more financial literacy programs.

- SQUID - A nonprofit organization focused on financial education that may attract more grants and funding through this bill's initiatives.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

49 bill sponsors

-

TrackAndré Carson

Sponsor

-

TrackGabe Amo

Co-Sponsor

-

TrackNanette Diaz Barragán

Co-Sponsor

-

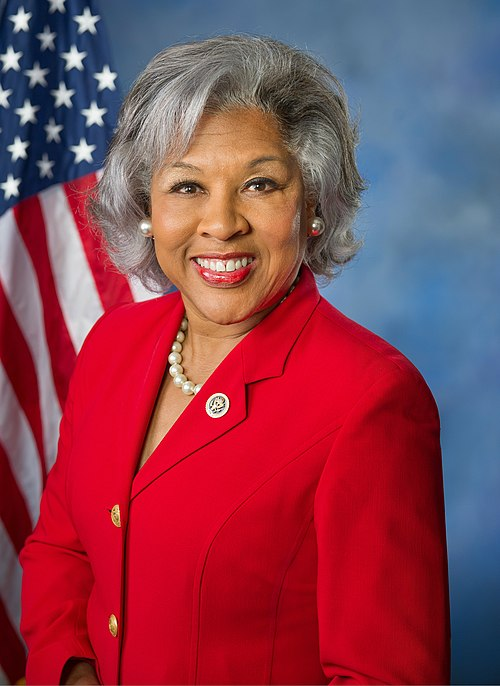

TrackJoyce Beatty

Co-Sponsor

-

TrackShontel M. Brown

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

TrackSean Casten

Co-Sponsor

-

TrackSheila Cherfilus-McCormick

Co-Sponsor

-

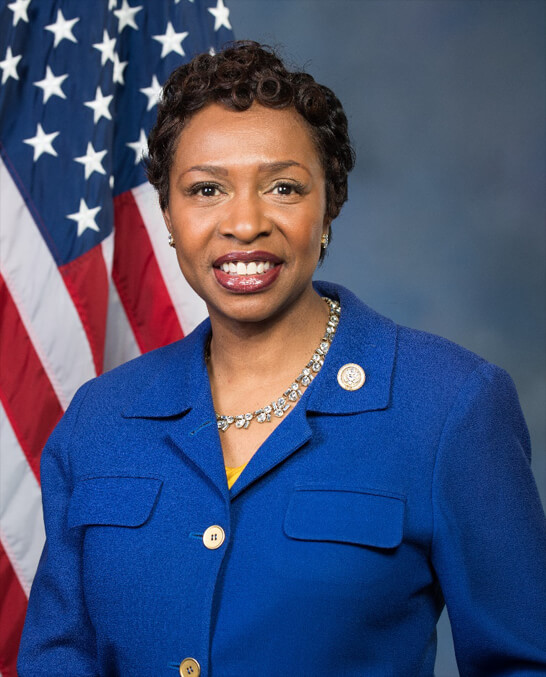

TrackYvette D. Clarke

Co-Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackMadeleine Dean

Co-Sponsor

-

TrackVeronica Escobar

Co-Sponsor

-

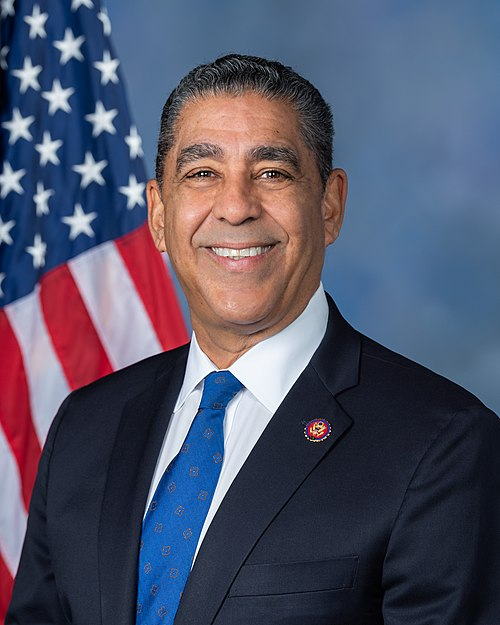

TrackAdriano Espaillat

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackShomari Figures

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackJahana Hayes

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackJulie Johnson

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackWilliam R. Keating

Co-Sponsor

-

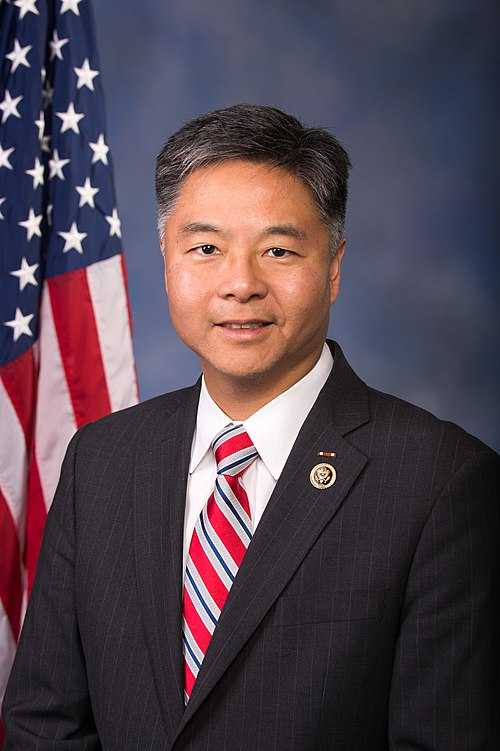

TrackTed Lieu

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackKweisi Mfume

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackJohnny Olszewski

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackHillary J. Scholten

Co-Sponsor

-

TrackAdam Smith

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackBennie G. Thompson

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackMarc A. Veasey

Co-Sponsor

-

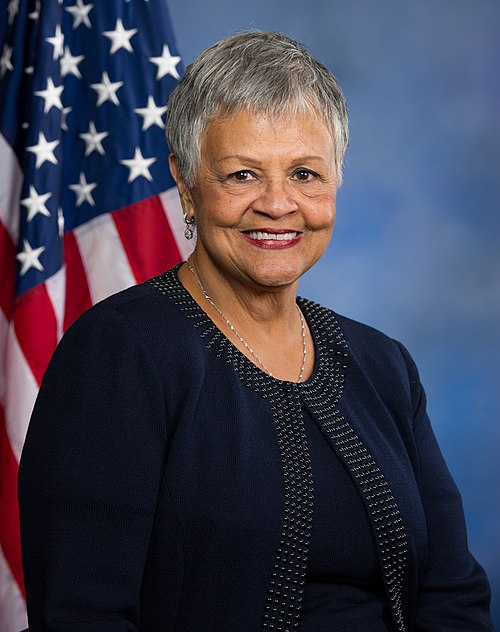

TrackBonnie Watson Coleman

Co-Sponsor

-

TrackFrederica S. Wilson

Co-Sponsor

Actions

3 actions

| Date | Action |

|---|---|

| Jan. 16, 2025 | Introduced in House |

| Jan. 16, 2025 | Referred to the Committee on Financial Services, and in addition to the Committee on Education and Workforce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

| Jan. 16, 2025 | Sponsor introductory remarks on measure. (CR E40) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.