H.R. 4746: Baby Food Tax Relief Act

The Baby Food Tax Relief Act proposes to prohibit the imposition of duties on certain baby food items under the International Emergency Economic Powers Act. Here’s how the bill is structured:

1. Overview of the Bill

This bill focuses on exempting specific baby-related items from any duties that the President might impose. This is aimed at alleviating financial burdens associated with buying these essential products.

2. Prohibition on Duties

The key components include:

- General Prohibition: The President is not allowed to impose duties on certain baby food items as specified in this bill.

- Termination of Current Duties: Any existing duties on the items described in the bill, which are currently in effect when the bill is enacted, must be terminated.

- Other Authorities: Any duties imposed through other means that are similar in nature to those covered by the International Emergency Economic Powers Act will also have no effect.

3. Items Affected

The bill specifies the following items that will be exempt from duties:

- Baby bottles

- Breast pumps

- Highchairs and booster seats

- Nursing nipples

- Baby formula

In summary, this legislation aims to protect families from additional costs associated with essential baby products by prohibiting any new duties on these items and eliminating any that are currently in place.

Relevant Companies

- CLX - The Clorox Company: Manufacturers baby-related products like wipes which could be influenced by changes in regulatory costs.

- KMB - Kimberly-Clark Corporation: Produces products such as baby wipes and diapers, potentially benefiting from duty-free requirements.

- PG - Procter & Gamble Co.: Known for baby care products, including diapers and formula, which might see cost implications affected by this legislation.

This is an AI-generated summary of the bill text. There may be mistakes.

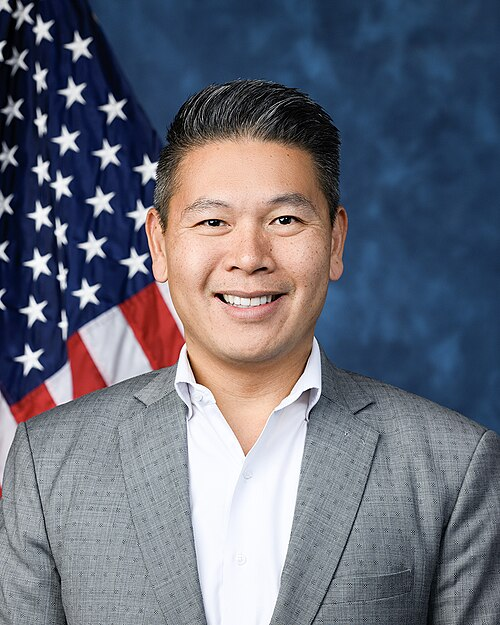

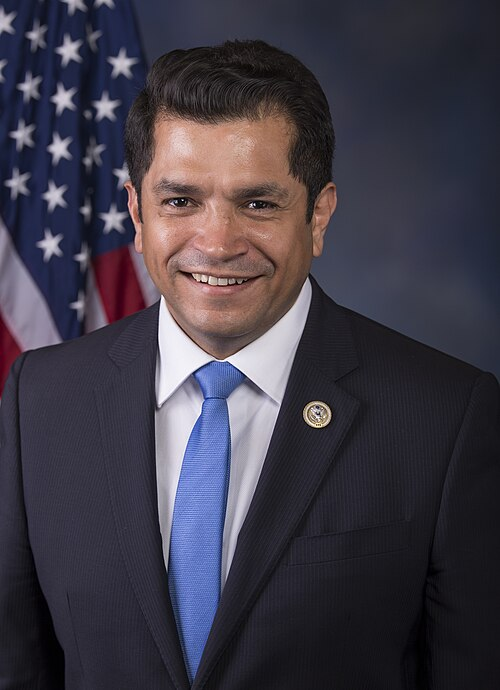

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in House |

| Jul. 23, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Foreign Affairs, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.