H.R. 4738: Baby Safety Tax Relief Act

This bill, titled the **Baby Safety Tax Relief Act**, primarily aims to eliminate certain import duties on specific baby safety products. It focuses on the following key provisions:

1. Prohibition of Duties

The bill proposes that the President of the United States cannot impose import duties on specific baby safety items under the International Emergency Economic Powers Act. Additionally, any existing duties on these items must be terminated as soon as the bill is enacted. This means that if there are any tariffs currently applied to these products, they will be removed.

2. Items Covered

The items specified in the bill that are protected from these duties include:

- Baby carriages

- Strollers

- Baby carriers

- Baby car seats

These items are classified as crucial for the safety of infants and young children, and the bill seeks to make them more affordable by removing additional costs associated with import duties.

3. Duties Under Other Authorities

The bill also states that if any other duties have been imposed outside the scope of the International Emergency Economic Powers Act and are similar to those previously eliminated, those duties will not have any effect. This aims to ensure that the elimination of duties is comprehensive and not circumvented by other legal means.

4. Legislative Process

After its introduction, the bill has been referred to the Committee on Ways and Means and the Committee on Foreign Affairs for further consideration. These committees will examine the provisions of the bill and determine the impact and necessity of its enactment.

5. Objective

The overall goal of the Baby Safety Tax Relief Act is to reduce the financial burden on families purchasing essential baby safety items by removing tariffs, thereby enhancing safety and accessibility for parents and guardians.

Relevant Companies

- BRK.A - Berkshire Hathaway: A major holding company with interests in various industries, including consumer goods and child safety products, which may see changes in import costs.

- THO - Thor Industries: Manufacturer of recreational vehicles that may produce baby-related transportation products and could see a reduction in costs.

This is an AI-generated summary of the bill text. There may be mistakes.

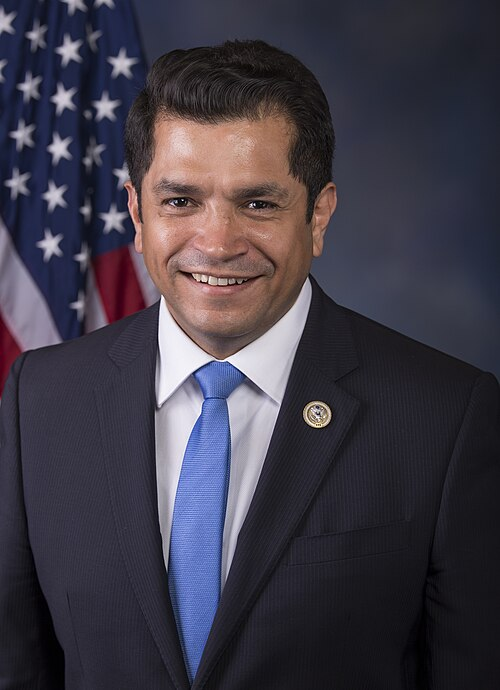

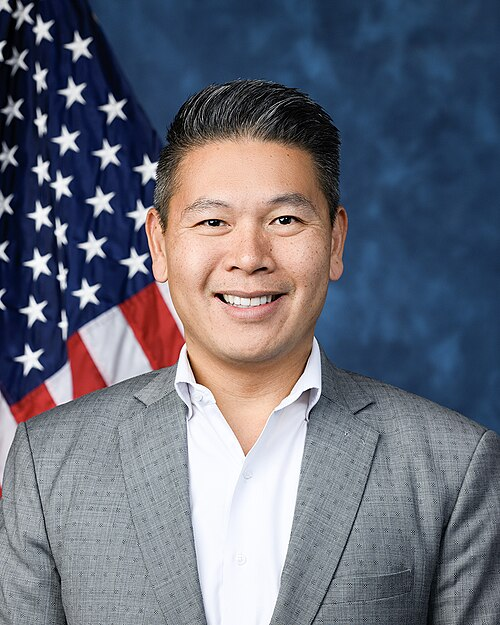

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in House |

| Jul. 23, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Foreign Affairs, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.