H.R. 4726: Educational Toy Tax Relief Act

This bill, known as the Educational Toy Tax Relief Act, aims to prevent the U.S. President from imposing import duties on specific baby and educational toy items under the International Emergency Economic Powers Act (IEEPA). Here are the key points of the bill:

Prohibition on Duties

The bill states that:

- The President cannot impose duties on items specified in the bill under the IEEPA.

- Any existing duties on these items that the President may have imposed under the IEEPA would have to be terminated when this bill becomes law.

- Additionally, should any duties that are similar be imposed under any other legal authority, those would also be nullified.

Items Covered

The items described in the bill include:

- Products designed for children under the age of three.

- Tricycles, scooters, and pedal cars intended for babies and children.

- Playpens, play yards, and enclosures for children's play.

- Baby swings.

- Educational toys aimed at babies and children.

Context and Purpose

The purpose of this bill is to ensure that these specific products, crucial for the development and safety of infants and young children, remain accessible without additional financial burdens from import duties. By preventing such duties, the bill seeks to reduce costs for manufacturers and consumers related to these essential items.

Legislative Process

After being introduced, the bill has been referred to the Committee on Ways and Means, as well as the Committee on Foreign Affairs, for further consideration.

Relevant Companies

- HAS - Hasbro manufactures toys for children, including educational toys, which may benefit from the elimination of duties.

- MAT - Mattel produces various children’s products, including educational toys, which could see reduced costs due to the bill.

- LEG - LEGO Group sells building sets that are educational for young children; they may benefit from tax relief on imports.

This is an AI-generated summary of the bill text. There may be mistakes.

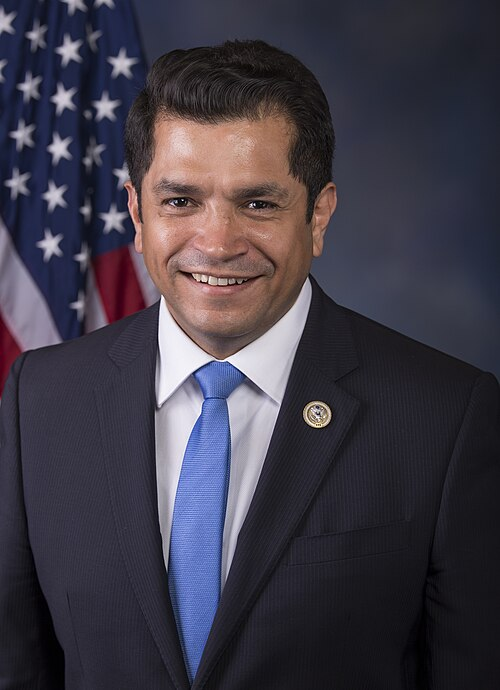

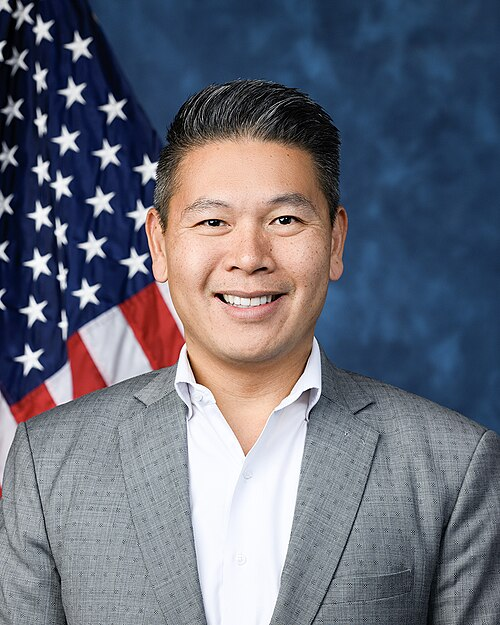

Sponsors

7 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in House |

| Jul. 23, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Foreign Affairs, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.