H.R. 4666: Baby Clothing Tax Relief Act

This bill, titled the Baby Clothing Tax Relief Act, proposes to prohibit the President from imposing or continuing any duties on specific baby clothing items under the International Emergency Economic Powers Act. The main points of the bill are outlined below:

Prohibition of Duties

- The President cannot impose duties on the defined baby clothing items as specified in the bill.

- Any existing duties on these items currently in effect must be terminated upon the enactment of this bill.

- The bill states that duties on these items imposed under other authorities, if similar to those imposed under the International Emergency Economic Powers Act, shall also be void.

Definitions of Items Covered

The bill specifically mentions that the duties pertain to a range of baby clothing items, including but not limited to:

- Baby garments and clothing accessories

- Baby socks and booties

- Baby shoes

- Baby shirts and blouses

- Baby pants and trousers

- Baby swimsuits

- Baby sweaters

- Baby dresses

- Baby onesies and bodysuits

- Baby hats

Scope of Changes

The changes would eliminate any possible duties that could increase the cost of these essential baby items, making them more affordable for consumers. The bill reflects a focus on ensuring that baby clothing remains duty-free, thereby aiming to assist families with young children by potentially lowering the retail prices of these goods.

Relevant Companies

- BRK.A (Berkshire Hathaway) - This company has several subsidiaries in the apparel industry, and any reduction in duties on baby clothing could affect pricing and demand for its clothing lines.

- NKE (Nike, Inc.) - As a major player in apparel, including baby clothing and accessories, changes to import duties might influence product pricing and sales strategies.

- CMCSA (Comcast Corporation) - Although primarily a media company, its interests in e-commerce could see sales volume increase if baby clothing becomes more affordable.

This is an AI-generated summary of the bill text. There may be mistakes.

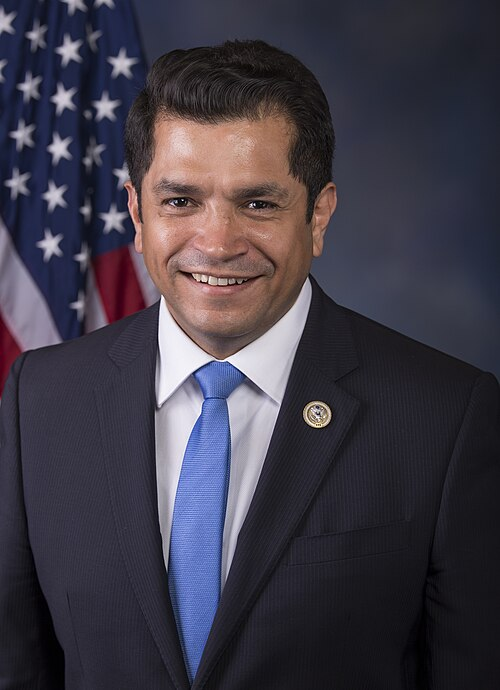

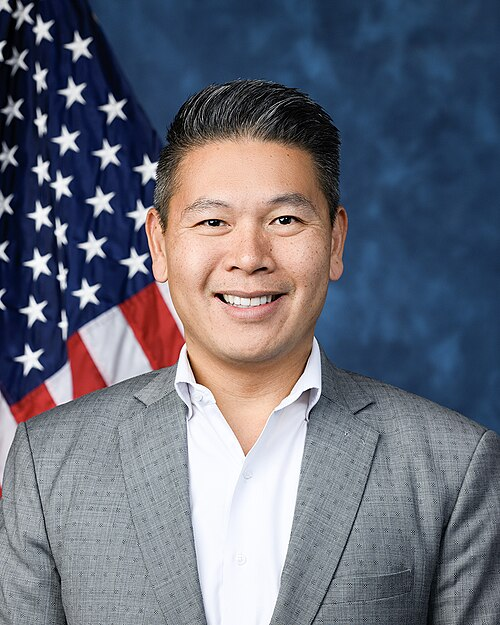

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in House |

| Jul. 23, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Foreign Affairs, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.