H.R. 4654: Baby Sleep Tax Relief Act

This bill, known as the Baby Sleep Tax Relief Act, seeks to eliminate tariffs on certain baby sleep-related items in the United States. The primary objectives of the bill are as follows:

Prohibition on Duties

The bill states that the President cannot impose any duties or tariffs on specific baby sleep items under the International Emergency Economic Powers Act. This act currently allows the President to impose such duties in response to international emergencies. The bill specifically requires the President to remove any existing duties on these items as of the date the bill becomes law.

Items Covered

The items that would be exempt from duties under this bill include:

- Cribs

- Toddler beds

- Mattresses and bedding

- Bassinets

- Cradles

- Baby monitors

Impact on Existing Duties

If there are any duties on these baby sleep items imposed by the President under other legal authorities that are similar to those imposed under the International Emergency Economic Powers Act, those duties would also be rendered ineffective.

Reason for the Legislation

The purpose of this bill is to ensure that families have access to necessary baby sleep products without facing added costs from tariffs, which can increase retail prices. By lifting these duties, the legislation aims to alleviate financial burdens on parents and caregivers.

Legislative Process

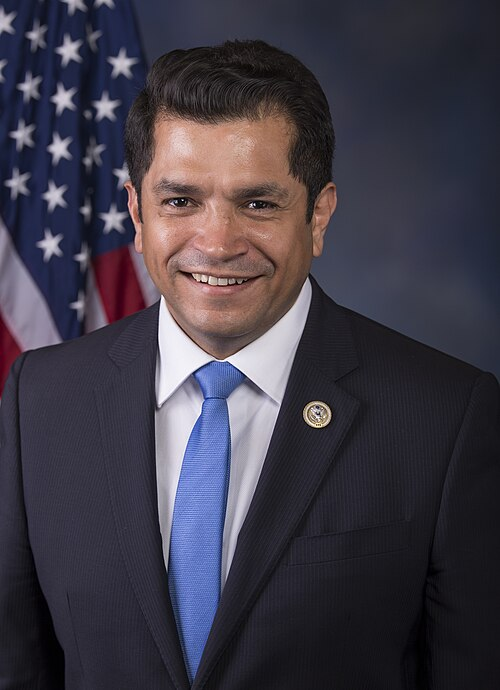

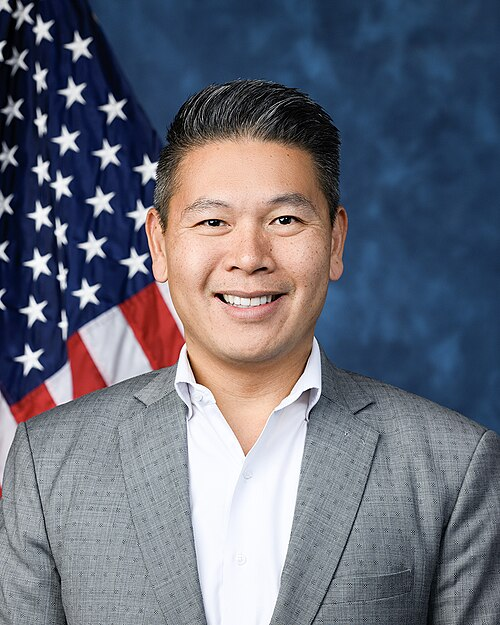

The bill was introduced by Mr. Figures and co-sponsored by several other members of Congress. It has been referred to the Committee on Ways and Means, as well as the Committee on Foreign Affairs for further consideration.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in House |

| Jul. 23, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Foreign Affairs, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.