H.R. 4528: Price Gouging Prevention Act of 2025

This bill, known as the Price Gouging Prevention Act of 2025, aims to prohibit and prevent price gouging in the sale of goods and services. Here’s a breakdown of its main points:

1. Definitions

The bill defines several key terms:

- Commission: Refers to the Federal Trade Commission (FTC).

- Critical trading partner: A person or entity that can significantly limit access to essential inputs or services, impacting competition.

- Exceptional market shock: Refers to abrupt market changes due to disasters, emergencies, or similar events.

- Good or service: Any item or service sold in commerce.

2. Price Gouging Prevention

Under this legislation:

- It is illegal to sell goods or services at excessively high prices, defined as "grossly excessive prices," regardless of where a seller is in the supply chain.

- Exceptions exist for businesses that earn less than $100 million in gross revenue over the previous year and can prove that price increases are due to uncontrollable cost increases.

- The FTC will evaluate price increases during "exceptional market shocks" to identify presumptive violations. This includes situations where sellers exploit emergencies to raise prices.

- A rebuttal is allowed where sellers can demonstrate costs that led to price increases were beyond their control.

3. Enforcement Mechanisms

The bill expands the enforcement authority of the FTC:

- Violations will be treated similarly to unfair or deceptive acts under the Federal Trade Commission Act.

- The FTC can take legal actions against violators in any U.S. district court, seeking injunctions and damages for affected consumers.

- State attorneys general can also enforce this law, bringing actions in federal or state courts against violators.

4. Transparency in Securities Filings

Companies that fall under the definition of "covered issuers" (those that report and have experienced an exceptional market shock) must:

- Include disclosures in their quarterly and annual reports about pricing strategies, changes in sales volume, average prices, gross margins, and reasons for price changes.

- Provide a narrative explaining any increases in gross margins, including factors influencing such changes and pricing strategy decisions.

5. Funding for Implementation

The bill allocates $1 billion for the FTC to implement its provisions, aimed at preventing price gouging, which will be available until September 30, 2033.

Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

-

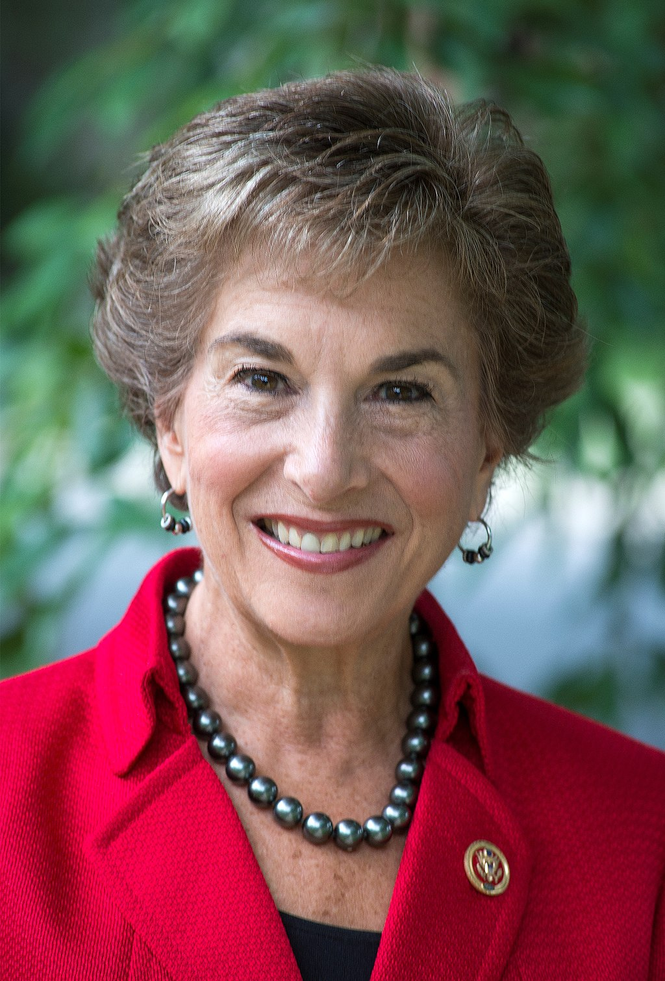

TrackJanice D. Schakowsky

Sponsor

-

TrackAngie Craig

Co-Sponsor

-

TrackRosa L. DeLauro

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackMaggie Goodlander

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

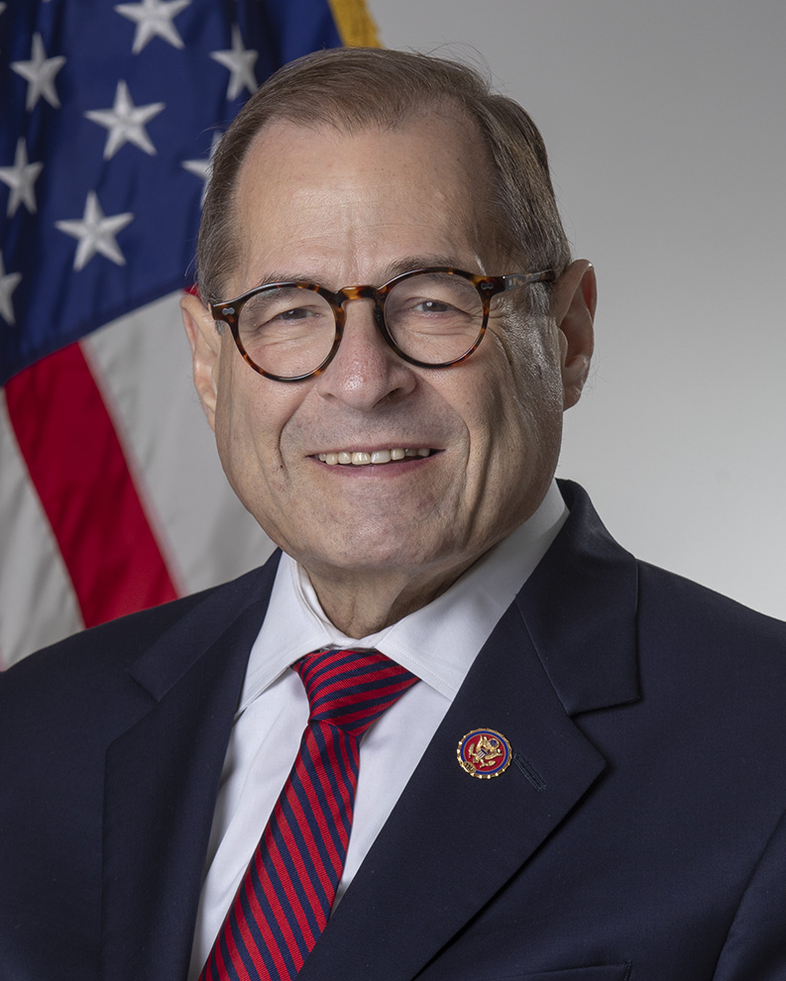

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

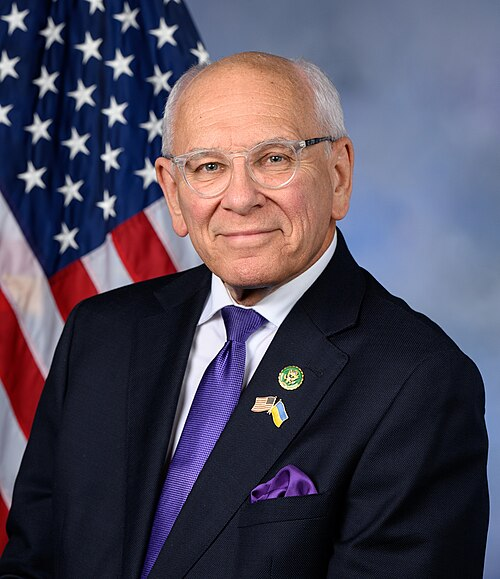

TrackPaul Tonko

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 17, 2025 | Introduced in House |

| Jul. 17, 2025 | Referred to the Committee on Energy and Commerce, and in addition to the Committee on Financial Services, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.