H.R. 4444: Student Loan Bankruptcy Improvement Act of 2025

This bill, titled the Student Loan Bankruptcy Improvement Act of 2025, aims to change the rules governing the discharge of student loan debt in bankruptcy. The key points of the bill are as follows:

Purpose of the Bill

The main purpose of the bill is to create a more equitable standard for discharging student loan debt in bankruptcy. It seeks to provide a fairer opportunity for borrowers to get relief from their student loans, which many find difficult to discharge under the current rules.

Current Challenges with Student Loan Discharge

- The existing standard for discharging student loans, known as "undue hardship," is seen as overly strict and requires significant documentation and legal burdens.

- Research indicates that very few borrowers meet this standard—only about 0.01% successfully discharge their loans through bankruptcy.

- The Brunner test, often used to evaluate undue hardship, is considered outdated and excessively challenging for debtors.

- As many borrowers struggle, the bill acknowledges the rising number of individuals who are falling behind on their student loans, suggesting that reforms are needed to assist these individuals.

Proposed Changes

The bill intends to revise the language of Section 523(a)(8) of the U.S. Bankruptcy Code by removing the term "undue." This adjustment would allow bankruptcy courts to apply a new standard when evaluating whether student loan debt can be discharged. Key aspects include:

- This change aims to simplify the process for borrowers, making it easier for them to qualify for debt discharge without the stringent requirements of the current law.

- It will provide bankruptcy courts with more flexibility in determining what constitutes a hardship for student loan borrowers.

- The bill emphasizes that this modification does not eliminate essential bankruptcy procedures such as means testing and other disclosure requirements that maintain the integrity of the bankruptcy system.

Impact on Borrowers

The bill comes in response to a notable crisis among student loan borrowers, with millions currently overdue on payments. It seeks to address issues such as:

- The high percentage of borrowers who are unable to secure better employment despite holding degrees.

- The risks of widespread defaults on student loans, which could lead to serious financial consequences for individuals, including declining credit scores and difficulties in acquiring necessary loans and insurance.

- The acknowledgment that many borrowers may enter bankruptcy without having received the expected financial benefit from their educational investments.

Long-term Considerations

By revising the hardship standard for student loans, the bill aims to facilitate a more reasonable pathway for borrowers seeking relief. It also recognizes that the situation could potentially worsen with the resumption of student loan collections post-pandemic, urging the need for a more effective mechanism to manage student loan debts.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

24 bill sponsors

-

TrackJ. Luis Correa

Sponsor

-

TrackAlma S. Adams

Co-Sponsor

-

TrackBecca Balint

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

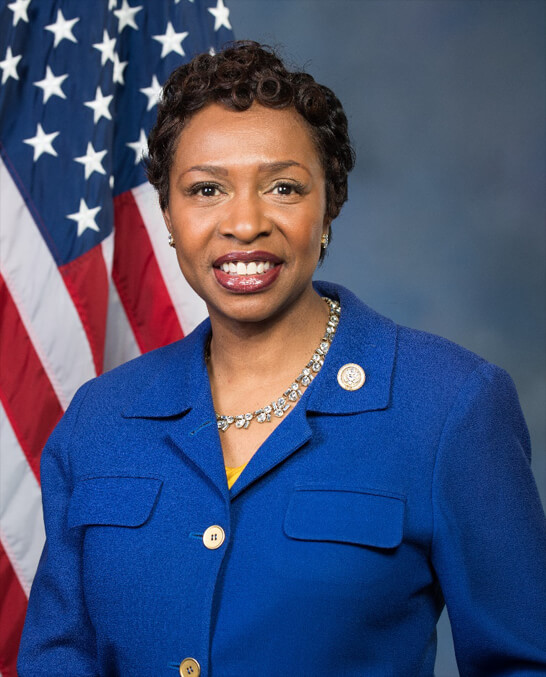

TrackYvette D. Clarke

Co-Sponsor

-

TrackJoe Courtney

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackZoe Lofgren

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackDeborah K. Ross

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackBennie G. Thompson

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

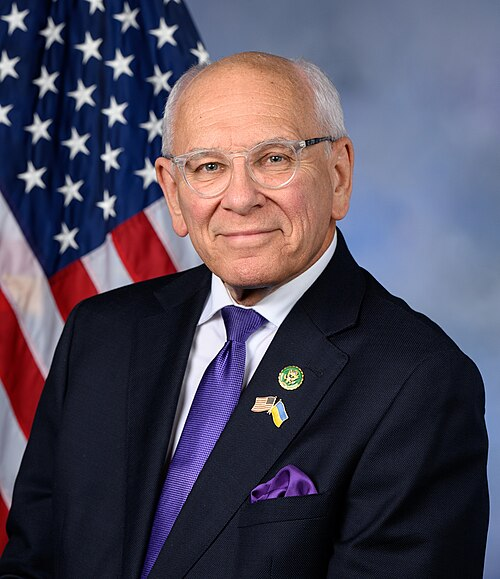

TrackPaul Tonko

Co-Sponsor

-

TrackNydia M. Velázquez

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 16, 2025 | Introduced in House |

| Jul. 16, 2025 | Referred to the House Committee on the Judiciary. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.