H.R. 4430: To lower the aggregate market value of voting and non-voting common equity necessary for an issuer to qualify as a well-known seasoned issuer.

This bill aims to amend the criteria for identifying a "well-known seasoned issuer" (WKSI) under federal securities laws. Currently, to qualify as a WKSI, an issuer must have an aggregate market value of $75 million or more in voting and non-voting common equity held by non-affiliated individuals. The bill proposes to lower this threshold, thereby enabling more companies to be classified as well-known seasoned issuers.

Key Changes Proposed

- The definition of a well-known seasoned issuer would be modified to include issuers that meet the new threshold for market value.

- The bill specifies that the aggregate market value should be determined under the existing Form S-3 general instructions, ensuring continuity in how this valuation is assessed.

- Other existing requirements for qualification would remain unchanged, except for those concerning minimum worldwide market value of the equity held by non-affiliates.

Implications of the Bill

The main intention behind this bill is to simplify the process for smaller companies to access the capital markets. By lowering the market value requirement, more issuers would be able to qualify as well-known seasoned issuers, which offers several advantages, including:

- Increased access to funding: Companies classified as WKSIs have streamlined access to raise funds by issuing securities.

- Reduced regulatory burdens: WKSIs benefit from fewer restrictions and more straightforward reporting requirements compared to other issuers.

- Enhanced market visibility: Being classified as a WKSI may elevate a company's profile among investors, potentially improving investor confidence and market performance.

Overall Purpose

The overarching goal of the bill is to foster greater participation in public markets by a broader range of companies. This could lead to increased market liquidity and more diverse investment opportunities for investors.

Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

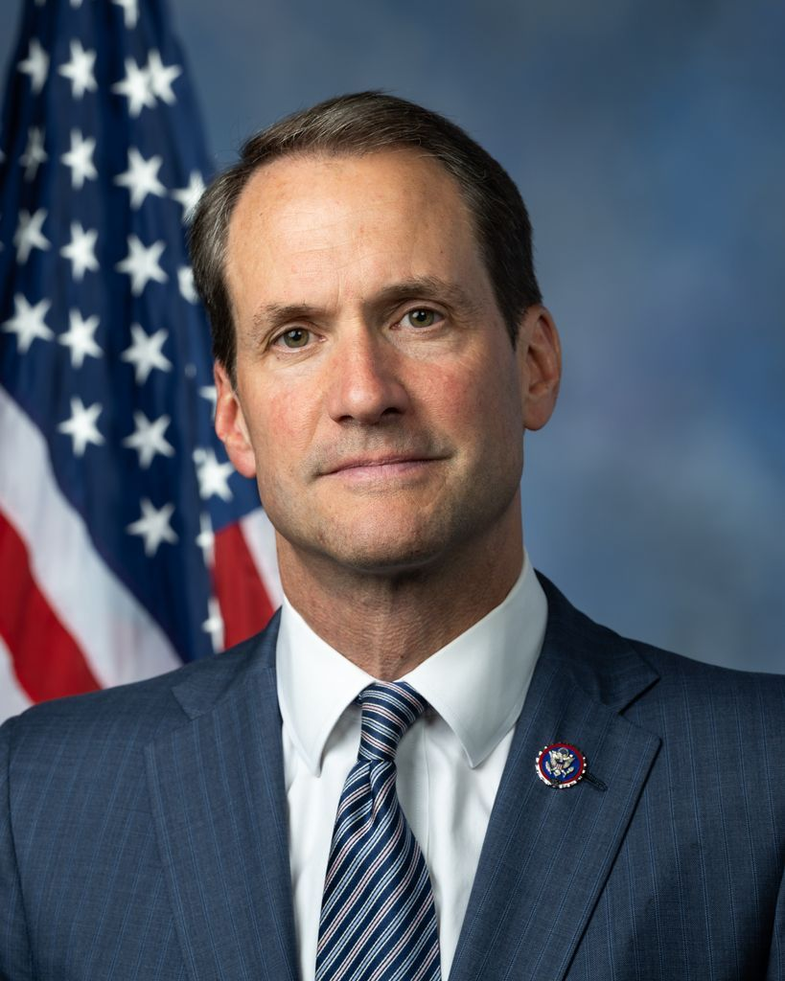

Sponsors

4 bill sponsors

Actions

13 actions

| Date | Action |

|---|---|

| Dec. 02, 2025 | Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

| Dec. 01, 2025 | Considered under suspension of the rules. (consideration: CR H4952-4953) |

| Dec. 01, 2025 | DEBATE - The House proceeded with forty minutes of debate on H.R. 4430. |

| Dec. 01, 2025 | Motion to reconsider laid on the table Agreed to without objection. |

| Dec. 01, 2025 | Mr. Davidson moved to suspend the rules and pass the bill, as amended. |

| Dec. 01, 2025 | On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. (text: CR H4952) |

| Dec. 01, 2025 | Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. (text: CR H4952) |

| Sep. 08, 2025 | Placed on the Union Calendar, Calendar No. 204. |

| Sep. 08, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-247. |

| Jul. 22, 2025 | Committee Consideration and Mark-up Session Held |

| Jul. 22, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 51 - 2. |

| Jul. 16, 2025 | Introduced in House |

| Jul. 16, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.