H.R. 4115: Saving Our Mainstreet American Locations for Leisure and Shopping Act of 2025

The bill titled "Saving Our Mainstreet American Locations for Leisure and Shopping Act of 2025", also referred to as the "Saving Our MALLS Act", aims to amend the Internal Revenue Code regarding how certain discharges of debt are treated for tax purposes. The key provisions of the bill are as follows:

Exclusion of Discharged Indebtedness from Income

The bill proposes that certain types of debt discharged—specifically, qualified commercial or retail indebtedness—will not be counted as income for tax purposes. This means that if a business has a debt forgiven, it will not have to pay taxes on that amount under the conditions set forth in the bill.

Definition of Qualified Commercial or Retail Indebtedness

The legislation defines "qualified commercial or retail indebtedness" as debt that:

- Was incurred or assumed by the taxpayer before March 1, 2023;

- Is discharged between December 31, 2023, and January 1, 2028;

- Is secured directly or indirectly by specific real property owned by the taxpayer during the entire time the debt was incurred and until it is discharged.

Specifications of Real Property

Additionally, "specified real property" is defined in the bill as property that:

- Is used in the trade or business of the taxpayer;

- Does not fall under certain specific exclusions outlined in the Internal Revenue Code.

Coordination with Existing Tax Provisions

The bill includes amendments to ensure that the new provisions related to qualified commercial or retail indebtedness are properly integrated with existing tax laws. This includes updating sections that relate to the treatment of discharged indebtedness and ensuring that various exclusions align with one another.

Reduction of Tax Attributes

Jurisdictions that benefit from this bill will have their tax attributes reduced accordingly, as specified in the existing tax laws, to reflect the exclusions granted by this new legislation.

Effective Date

The changes proposed by this bill will be effective for any discharges of indebtedness occurring on or after December 31, 2023.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

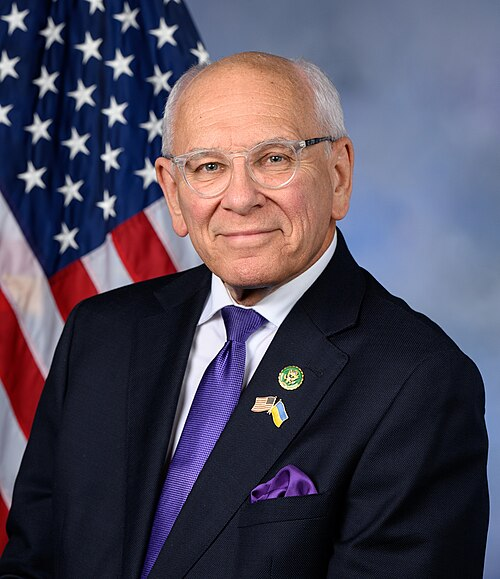

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 24, 2025 | Introduced in House |

| Jun. 24, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.