H.R. 409: Supporting Transit Commutes Act

The bill, known as the Supporting Transit Commutes Act, proposes changes to the Internal Revenue Code, specifically targeting transportation fringe benefits provided by employers. Here’s a breakdown of what the bill entails:

Purpose of the Bill

The main goal of the bill is to allow employers to deduct certain transportation-related benefits they provide to employees from their taxable income. This aims to encourage and support the use of public transportation and other means of commute that can help reduce traffic congestion and promote environmentally friendly travel options.

Key Provisions

- Tax Deduction Expansion: The bill amends Section 274 of the Internal Revenue Code to allow for deductions related to qualified transportation fringe benefits. These benefits can include the use of public transit, parking, and could potentially cover bike commuting.

- Increased Limits: The deductions will apply up to the limits set in Section 132(f)(2)(A) of the code, which pertains to fringe benefits for mass transit and parking.

- Salary Reduction Agreement Adjustment: For transportation benefits offered under salary reduction agreements, employers can deduct 50 percent of the benefits instead of the total amount.

- Bicycle Commuting Reimbursement: The bill includes amendments to recognize and accommodate qualified bicycle commuting reimbursements under the same section for tax deductions.

Effective Date

The amendments proposed by this bill would take effect for expenses incurred after the bill is enacted, affecting taxable years ending after its enactment date.

Implications

By providing these tax deductions, the bill aims to incentivize employers to support different commuting options, potentially encouraging employees to utilize public transit or bicycles instead of personal vehicles. This could contribute to reducing carbon emissions and alleviating urban traffic challenges.

Relevant Companies

- LYFT: Lyft could see an increase in use if more employees are incentivized to use rideshare options as part of their commuting benefits.

- UAL: United Airlines may benefit indirectly if employees traveling longer distances opt for air travel due to better transportation fringe benefits.

- GOOG: Google, known for its investments in transportation services and commuting benefits, could further enhance its commuting programs alongside the implementation of this bill.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

9 bill sponsors

-

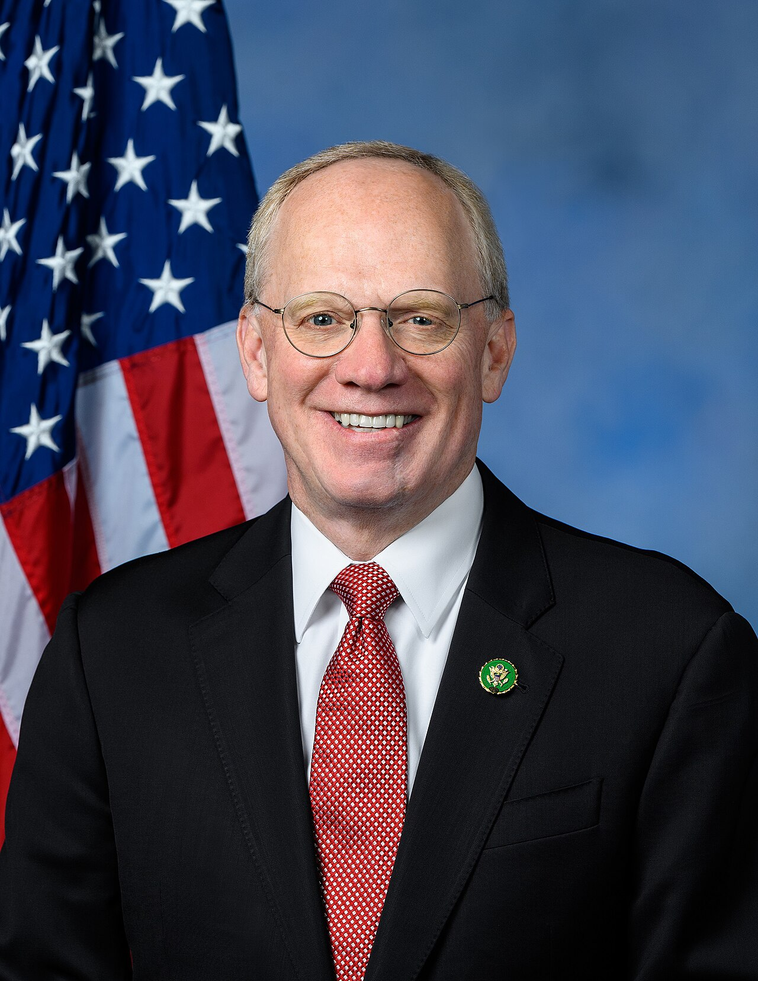

TrackJake Auchincloss

Sponsor

-

TrackAndré Carson

Co-Sponsor

-

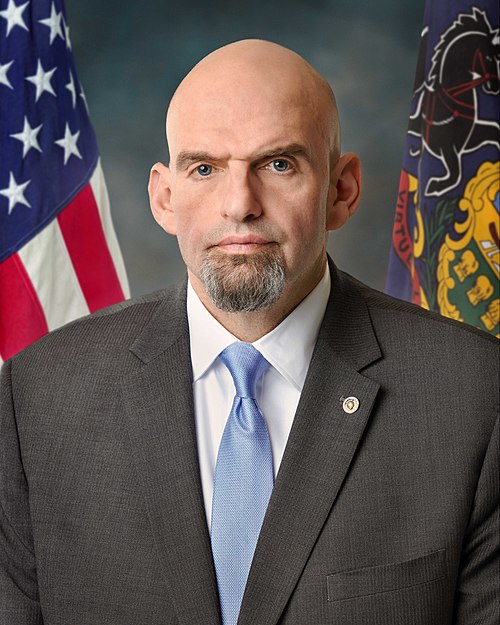

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackGeorge Latimer

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

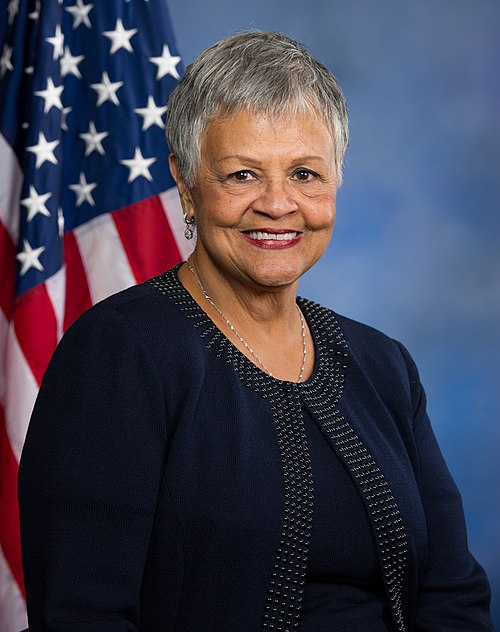

TrackBonnie Watson Coleman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 15, 2025 | Introduced in House |

| Jan. 15, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.