H.R. 3975: Tax Fairness for Disaster Victims Act

This bill, titled the Tax Fairness for Disaster Victims Act

, proposes amendments to the Internal Revenue Code to provide a “lookback” rule for certain federally declared disasters. The aim is to determine tax credits for individuals living in disaster areas based on their earned income. Here’s a breakdown of what the bill entails:

Lookback Rule for Tax Credits

The main feature of the bill is the introduction of a lookback rule, which will allow certain qualified individuals to use their earned income from the previous year if it is greater than their earned income for the current year, especially when they reside in areas affected by federally declared disasters.

Key Provisions

- Qualified Individual: The term refers to any individual whose primary residence was in a disaster area on the date designated by the Federal Emergency Management Agency (FEMA).

- Applicable Date: This is defined as the first day of the period specified by FEMA as the time during which the disaster occurred.

- Tax Credit Adjustments:

- If a person's earned income for the taxable year including the disaster is less than for the preceding year, they can substitute their previous year's earned income when calculating certain tax credits.

- If the social security taxes paid in the current year are less than in the preceding year, a similar adjustment applies specifically for the child tax credit.

- Joint Returns: For couples filing jointly, the rules apply if either spouse qualifies as a qualified individual. The calculation of earned income and social security taxes will take into account both spouses’ amounts from the previous year.

Treatment of Errors

The bill also proposes that any incorrect application of earned income or social security taxes under the new lookback rule will be treated as a mathematical or clerical error. This means that such errors can be corrected by the IRS without penalties that typically apply to more substantial discrepancies.

Effective Date

The changes outlined in the bill will apply to determinations of earned income and social security taxes for taxable years that begin after the bill becomes law.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

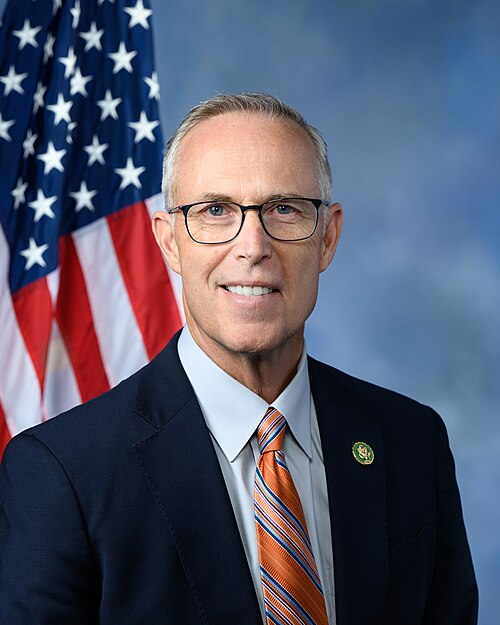

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 12, 2025 | Introduced in House |

| Jun. 12, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.