H.R. 3964: Affordable Housing Equity Act of 2025

This bill, known as the Affordable Housing Equity Act of 2025, aims to amend the Internal Revenue Code to increase the low-income housing tax credit specifically for projects that are intended to serve extremely low-income households. Here’s a breakdown of what the bill proposes:

Increased Tax Credits

The bill introduces provisions to increase the tax credit for building projects that designate at least 20% of their residential units for extremely low-income households. These households are defined as those with incomes that do not exceed either:

- 30% of the area median gross income, or

- 100% of the federal poverty line.

For a building to qualify for this increased tax credit, it must be designated by a housing credit agency as requiring the increase to be financially feasible as part of a qualified low-income housing project.

Financial Feasibility

If a project is eligible, the portion of the building dedicated to extremely low-income units will have an eligible basis set at 150% of what it would be without this amendment. This means developers can claim more in tax credits, potentially making it easier to construct and maintain affordable housing.

Effective Date

The changes made by this bill would apply to buildings that receive allocations of housing credits after the bill is enacted. For certain specified buildings, the rules would apply to obligations issued after December 31, 2025.

Summary

Overall, the Affordable Housing Equity Act of 2025 intends to enhance financial incentives for property developers to include affordable units for extremely low-income households by increasing the available tax credits for such projects.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

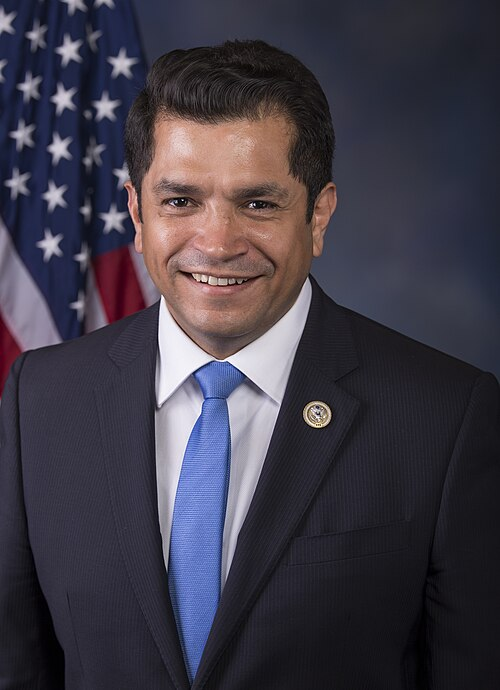

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 12, 2025 | Introduced in House |

| Jun. 12, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.