H.R. 3879: Broadcast Varied Ownership Incentives for Community Expanded Service Act

The Broadcast Varied Ownership Incentives for Community Expanded Service Act, or Broadcast VOICES Act, aims to promote diversity in the ownership of broadcast stations in the United States. The key elements of the bill are outlined below:

Purpose of the Act

The primary goal of this Act is to ensure that there is a greater diversity of ownership and viewpoints within the broadcasting industry, specifically aiming to increase the number of broadcast stations owned by socially disadvantaged individuals.

Key Findings

The Act highlights several important points regarding the current state of ownership in the broadcasting sector:

- Less than 6% of full-power commercial broadcast television stations are owned by women, and less than 4% are minority-owned.

- Among full-power commercial radio stations, only about 9% are owned by women and less than 3% by minorities.

- The bill refers to the past success of a minority tax certificate program that facilitated ownership transfers, resulting in 287 radio station and 40 television station ownership changes between 1978 and 1995.

Federal Communications Commission (FCC) Reports

The FCC is tasked with submitting reports to Congress on a regular basis:

- Reports every two years on recommendations for increasing the ownership and value of broadcast stations held by socially disadvantaged individuals.

- Reports that detail the total number of broadcast stations owned by socially disadvantaged individuals.

Tax Certificate Program

A significant provision of this Act is the establishment of a tax certificate program aimed at facilitating transactions in broadcast stations that contribute to ownership by socially disadvantaged individuals. Key aspects include:

- To qualify for a tax certificate, a sale must result in or preserve the ownership and control of the station by socially disadvantaged individuals.

- The definition of socially disadvantaged individuals includes women and those subjected to racial or ethnic prejudice.

- The FCC will issue certificates to individuals engaging in qualifying sales.

Rules and Regulations

The FCC is responsible for developing rules related to the issuance of tax certificates, which will include:

- Limits on the value of qualifying sales (not to exceed $50 million).

- A minimum holding period during which the station must remain under the control of socially disadvantaged individuals (between 2 to 3 years).

- Annual reporting requirements to Congress about the issued certificates and sales statistics.

Nonrecognition of Gain or Loss

The Act amends tax laws to provide for nonrecognition of gain or loss for taxpayers selling interests in qualifying broadcast stations, contingent upon FCC certification. Key points include:

- Sales certified under the new program may avoid recognition of capital gains for tax purposes, effectively treating it as an involuntary property conversion.

- Should the buyer fail to meet FCC requirements post-sale, the tax benefits may be revoked.

Credit for Contributions

The Act includes provisions for tax credits related to contributions made to entities focused on training socially disadvantaged individuals in the management of broadcast stations:

- Qualified contributions can be valued as tax credits, encouraging donations to support diversity in station management.

Timeline for Implementation

The FCC must adopt rules to implement the various provisions of this Act within a year of enactment, with a plan for further examination and reporting on its impact within six years.

Impact on the Broadcasting Sector

By focusing on increasing ownership opportunities for socially disadvantaged individuals, this Act aims to create a more diverse broadcasting landscape, potentially leading to a broader range of perspectives and content in media communication.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

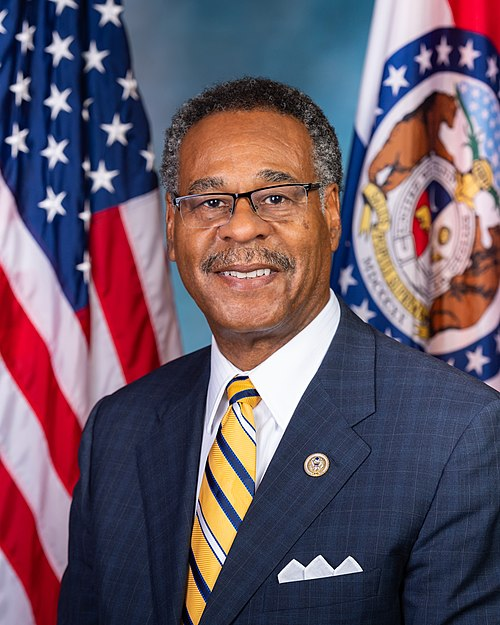

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 10, 2025 | Introduced in House |

| Jun. 10, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Energy and Commerce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.