H.R. 3682: Financial Stability Oversight Council Improvement Act of 2025

This bill, titled the Financial Stability Oversight Council Improvement Act of 2025, aims to amend the Financial Stability Act of 2010, specifically relating to how the Financial Stability Oversight Council (FSOC) makes decisions regarding the supervision of nonbank financial companies by the Federal Reserve. The proposed changes focus on the procedures the Council must follow before it can classify a U.S. nonbank financial company as needing this level of supervision.

Key Changes Proposed

- Consultation Requirement: Before the FSOC can make a determination that a nonbank financial company should be supervised by the Federal Reserve, it must first consult with the company in question and its primary financial regulatory agency. This means the company will have a say in discussions about its potential supervision.

- Exploration of Alternatives: The FSOC must consider alternative actions it or the primary regulatory agency could take to manage any threats posed by the company. This includes the possibility of applying new or heightened standards and safeguards instead of moving directly to increased supervision. If these alternatives are deemed impracticable or insufficient, only then can the Council proceed with the proposed determination.

- Voting Requirements: The bill modifies the voting process for the FSOC, indicating that a proposal cannot be voted on unless the requirements related to consultation and consideration of alternative actions are met.

Purpose

The primary purpose of this bill is to ensure a more measured and consultative process for determining whether nonbank financial companies require oversight from the Federal Reserve. This is intended to protect financial stability while also allowing for a wider range of responses to potential risks posed by such companies.

Impact on the Financial Stability Oversight Council

This amendment is designed to enhance the FSOC's processes and decision-making capabilities. By requiring the Council to consult those directly affected and explore alternatives, it aims to create a more transparent and potentially less disruptive supervisory environment for nonbank financial institutions.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

21 bill sponsors

-

TrackBill Foster

Sponsor

-

TrackJanelle Bynum

Co-Sponsor

-

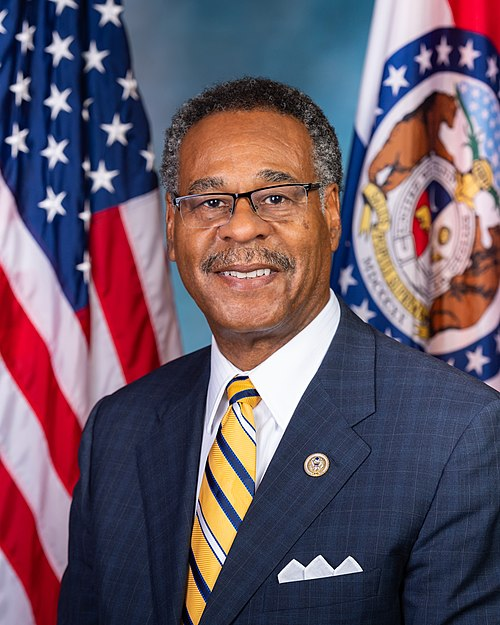

TrackEmanuel Cleaver

Co-Sponsor

-

TrackMonica De La Cruz

Co-Sponsor

-

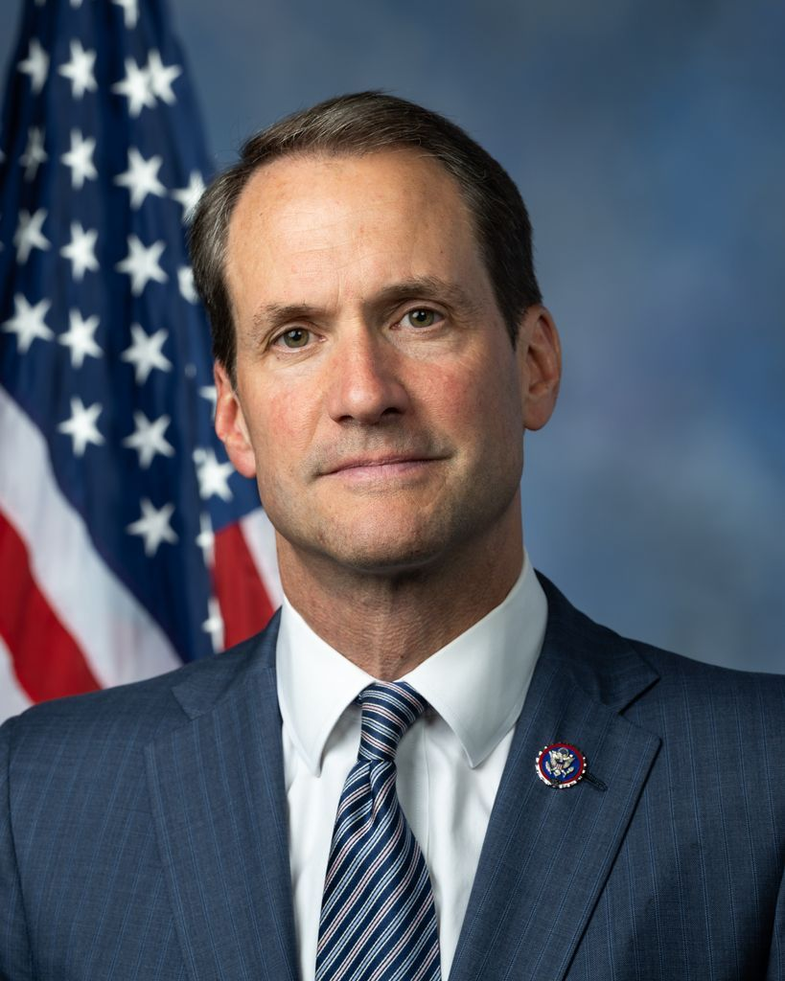

TrackTroy Downing

Co-Sponsor

-

TrackVicente Gonzalez

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackJames A. Himes

Co-Sponsor

-

TrackChrissy Houlahan

Co-Sponsor

-

TrackBill Huizenga

Co-Sponsor

-

TrackYoung Kim

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackFrank D. Lucas

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackBrittany Pettersen

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackDavid Scott

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackAnn Wagner

Co-Sponsor

Actions

6 actions

| Date | Action |

|---|---|

| Nov. 04, 2025 | Placed on the Union Calendar, Calendar No. 316. |

| Nov. 04, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-364. |

| Sep. 16, 2025 | Committee Consideration and Mark-up Session Held |

| Sep. 16, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 47 - 4. |

| Jun. 03, 2025 | Introduced in House |

| Jun. 03, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.