H.R. 3665: Medicare Economic Security Solutions Act

This bill, titled the Medicare Economic Security Solutions Act, proposes amendments to the Medicare system, specifically addressing penalties related to late enrollment in Medicare Part B. Here are the key points of the bill:

Late Enrollment Penalty Changes

The bill seeks to change how the penalty for late enrollment in Medicare Part B is calculated. Currently, if an individual enrolls late, they face a penalty of 10% for each full 12 months they were not enrolled. The proposed amendment would increase this penalty to 15% and would apply it for a period equal to twice the number of months the individual was not enrolled. This means that the penalty would still be based on a duration of non-enrollment, but the percentage would be higher than before.

Exclusion of Certain Coverage Periods

This legislation would exclude specific periods of coverage from being counted against an individual when determining late enrollment penalties. The exclusions would apply to:

- COBRA coverage, which is a continuation of health insurance that can be purchased after leaving a job.

- Retiree coverage provided by an employer.

- VA (Veterans Affairs) healthcare coverage.

These exclusions aim to ensure that individuals who have maintained certain types of health coverage would not face penalties for late enrollment in Medicare Part B.

Special Enrollment Periods

The bill establishes a special enrollment period for individuals whose COBRA or retiree coverage ends. Under the current rules, individuals may face restrictions based on their employment status when trying to enroll in Medicare. The proposed changes would remove the requirement that individuals be employed to qualify for enrollment during this special period.

Implementation Timeline

The amendments outlined in the bill would take effect for premiums paid for months beginning after a 90-day period following the enactment of the Act.

Additional Provisions

The bill also outlines various conforming amendments to ensure that the changes align with existing sections of the Social Security Act related to Medicare.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

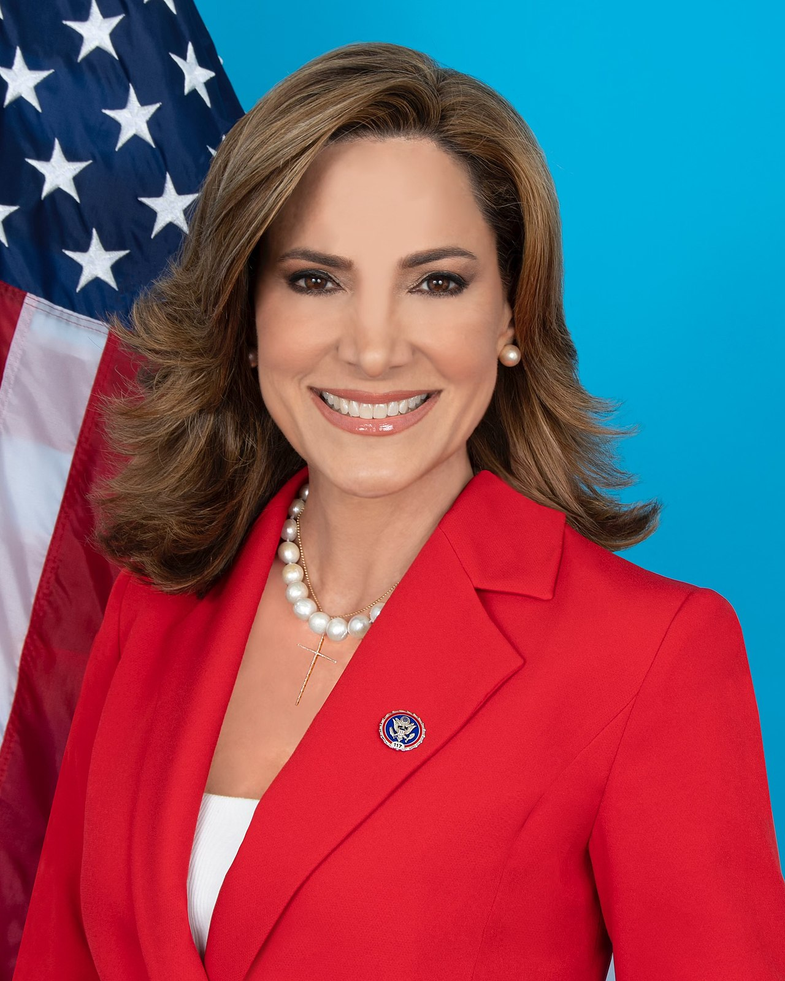

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 29, 2025 | Introduced in House |

| May. 29, 2025 | Referred to the Committee on Energy and Commerce, and in addition to the Committee on Ways and Means, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.