H.R. 3526: Uplifting First-Time Homebuyers Act of 2025

This bill, known as the Uplifting First-Time Homebuyers Act of 2025, proposes changes to the Internal Revenue Code of 1986 that primarily focus on increasing the amount of money first-time homebuyers can access from their retirement accounts without facing penalties.

Key Provisions

- The bill seeks to amend the existing law, which currently allows first-time homebuyers to withdraw up to $10,000 from their retirement accounts without incurring a penalty.

- Under this new proposal, that limit would increase significantly to $50,000.

Eligibility

The amendment specifically targets first-time homebuyers, though the bill does not provide additional details on the precise qualifications or definitions related to being a "first-time homebuyer." Generally, this term refers to individuals who are purchasing their first home or have not owned a home in the past several years.

Effective Date

The changes proposed in the bill would take effect for taxable years beginning after December 31, 2024. This means that individuals looking to benefit from the increased withdrawal limit would be able to do so starting January 1, 2025, for eligible uses related to home buying.

Impact

This legislation aims to provide financial assistance to first-time homebuyers by allowing them greater access to their retirement savings during the often costly process of purchasing a home. The increase in withdrawal limits could help more individuals afford down payments and related expenses that come with buying a home.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

36 bill sponsors

-

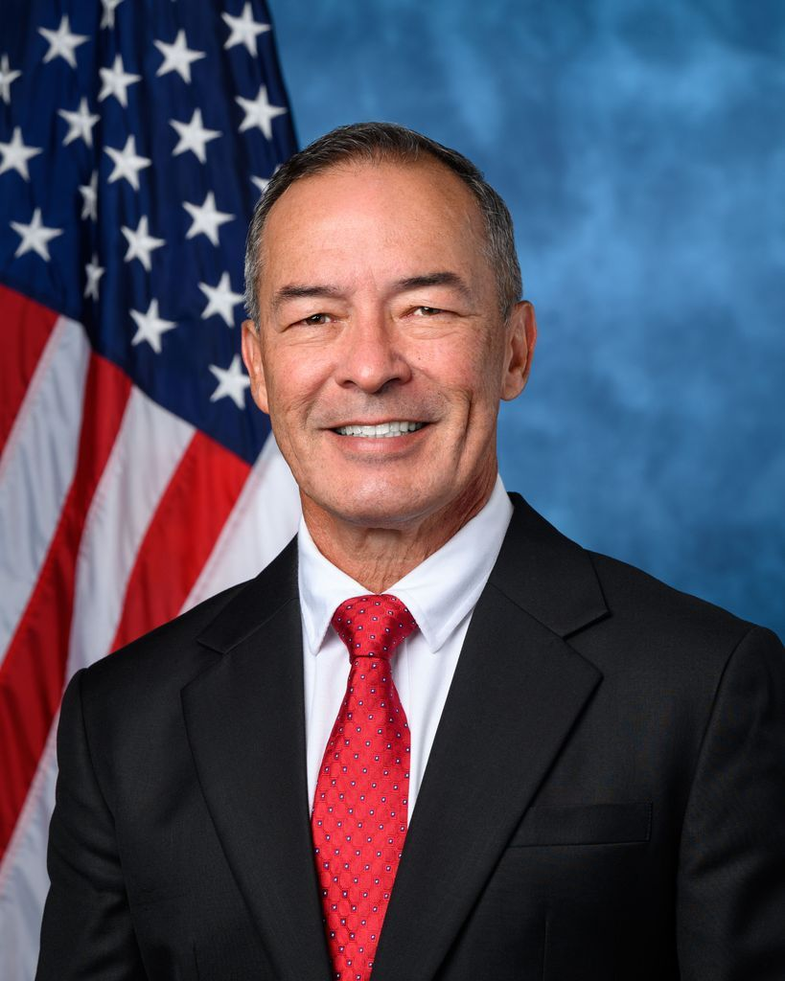

TrackBeth Van Duyne

Sponsor

-

TrackNicholas Begich

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackSanford D. Bishop, Jr.

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackKen Calvert

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackGilbert Ray Cisneros, Jr.

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackHenry Cuellar

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackBill Foster

Co-Sponsor

-

TrackRobert Garcia

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

TrackLaura Gillen

Co-Sponsor

-

TrackLance Gooden

Co-Sponsor

-

TrackAl Green

Co-Sponsor

-

TrackAshley Hinson

Co-Sponsor

-

TrackWesley Hunt

Co-Sponsor

-

TrackGeorge Latimer

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackJames C. Moylan

Co-Sponsor

-

TrackJoe Neguse

Co-Sponsor

-

TrackJay Obernolte

Co-Sponsor

-

TrackJohnny Olszewski

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

TrackChristopher H. Smith

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackJefferson Van Drew

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

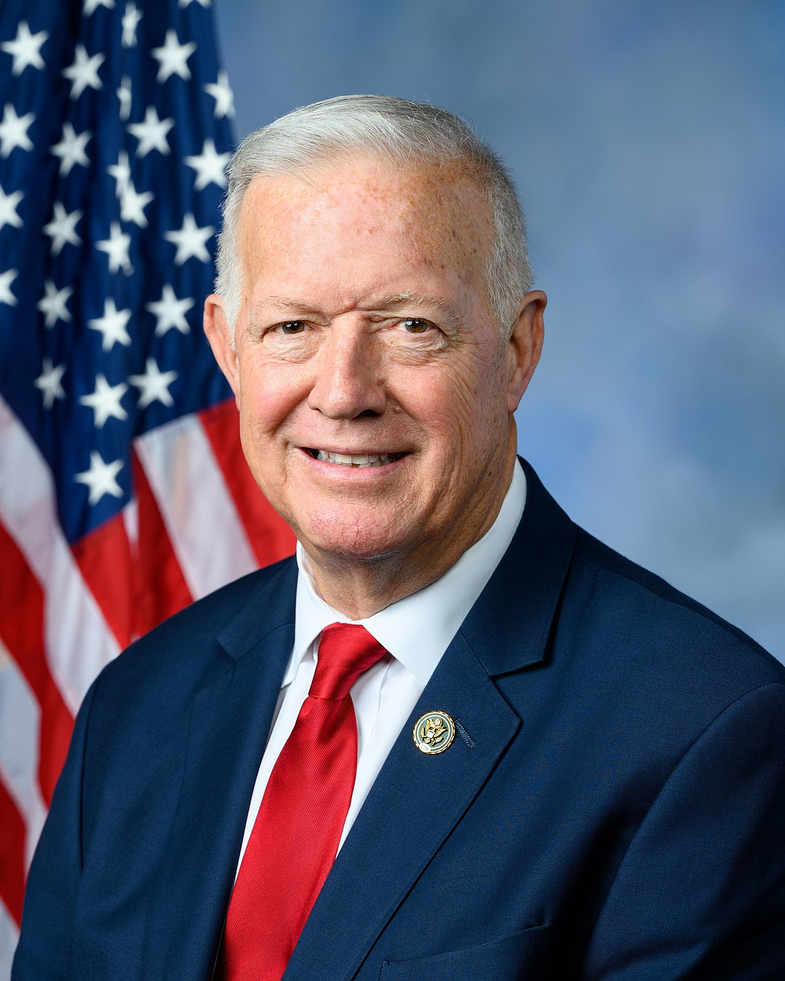

TrackRandy K. Weber, Sr.

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 20, 2025 | Introduced in House |

| May. 20, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.