H.R. 3383: Increasing Investor Opportunities Act

This bill, titled the Increasing Investor Opportunities Act, aims to amend existing regulations regarding closed-end companies and their ability to invest in private funds under the Investment Company Act of 1940. Here’s a breakdown of its key components:

Closed-End Company Investments in Private Funds

The bill allows closed-end companies to invest their assets in private funds without being restricted by certain regulations that currently govern these investments. Specifically:

- The Securities and Exchange Commission (SEC) cannot prohibit closed-end companies from investing in private funds, except where specifically mentioned in the bill.

- There cannot be limitations placed on the offer or sale of securities by closed-end companies merely because they include investments in private funds.

- The SEC's ability to impose conditions or restrictions on these investments is limited, especially if such conditions do not relate to the nature of the private funds themselves.

Definition of Private Fund

The bill clarifies that a "private fund" is defined according to the Investment Advisers Act of 1940. This standardizes the understanding of what constitutes a private fund within these regulations.

Treatment by National Securities Exchanges

National securities exchanges are not permitted to impose restrictions on the listing or trading of securities for closed-end companies that invest in private funds, provided that such restrictions align with existing laws. This change is intended to facilitate easier access to trading for such securities.

Investment Limitations

The bill amends the existing investment limitations for closed-end companies. It allows for broader investment opportunities by removing certain restrictions related to the types of private funds in which these companies may invest.

Fiduciary Duties and Obligations

The bill includes provisions that clarify that its amendments do not alter any fiduciary duties owed by closed-end companies or investment advisers. It also maintains current requirements related to valuation, liquidity, and redemption obligations for these companies, ensuring that investor protections remain in place.

Summary

Overall, the Increasing Investor Opportunities Act seeks to enhance the ability of closed-end companies to diversify their investment portfolios by allowing them to invest in private funds more freely, thus potentially providing new opportunities for investors. The bill ensures that existing investor protections and fiduciary responsibilities are preserved while aiming to increase market accessibility for closed-end company securities.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

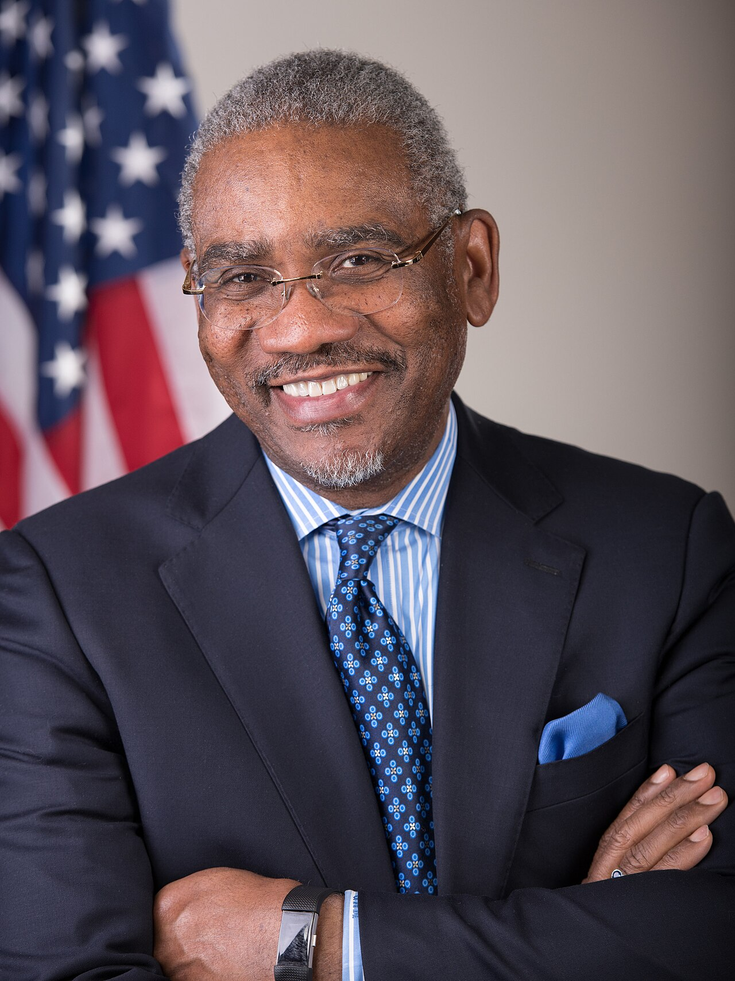

Sponsors

5 bill sponsors

Actions

32 actions

| Date | Action |

|---|---|

| Dec. 15, 2025 | Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

| Dec. 11, 2025 | Considered as unfinished business. (consideration: CR H5790-5793) |

| Dec. 11, 2025 | Motion to reconsider laid on the table Agreed to without objection. |

| Dec. 11, 2025 | On passage Passed by recorded vote: 302 - 123 (Roll no. 328). |

| Dec. 11, 2025 | Passed/agreed to in House: On passage Passed by recorded vote: 302 - 123 (Roll no. 328). |

| Dec. 11, 2025 | The House adopted the amendments en gros as agreed to by the Committee of the Whole House on the state of the Union. |

| Dec. 11, 2025 | The House resolved into Committee of the Whole House on the state of the Union for further consideration. |

| Dec. 11, 2025 | The House rose from the Committee of the Whole House on the state of the Union to report H.R. 3383. |

| Dec. 11, 2025 | The previous question was ordered pursuant to the rule. |

| Dec. 10, 2025 | Committee of the Whole House on the state of the Union rises leaving H.R. 3383 as unfinished business. |

| Dec. 10, 2025 | Considered under the provisions of rule H. Res. 936. (consideration: CR H5534-5555; text: CR H5540-5546) |

| Dec. 10, 2025 | DEBATE - Pursuant to the provisions of H.Res. 936, the Committee of the Whole proceeded with 10 minutes of debate on the Self amendment No. 1. |

| Dec. 10, 2025 | DEBATE - Pursuant to the provisions of H.Res. 936, the Committee of the Whole proceeded with 10 minutes of debate on the Self amendment No. 2. |

| Dec. 10, 2025 | DEBATE - Pursuant to the provisions of H.Res. 936, the Committee of the Whole proceeded with 10 minutes of debate on the Waters amendment No. 3. |

| Dec. 10, 2025 | DEBATE - Pursuant to the provisions of H.Res. 936, the Committee of the Whole proceeded with 10 minutes of debate on the Waters amendment No. 4. |

| Dec. 10, 2025 | DEBATE - Pursuant to the provisions of H.Res. 936, the Committee of the Whole proceeded with 10 minutes of debate on the Waters amendment No. 5. |

| Dec. 10, 2025 | GENERAL DEBATE - The Committee of the Whole proceeded with one hour of general debate on H.R. 3383. |

| Dec. 10, 2025 | House resolved itself into the Committee of the Whole House on the state of the Union pursuant to H. Res. 936 and Rule XVIII. |

| Dec. 10, 2025 | Mrs. Wagner moved that the committee rise. |

| Dec. 10, 2025 | On motion that the committee rise Agreed to by voice vote. |

| Dec. 10, 2025 | POSTPONED PROCEEDINGS - At the conclusion of debate on the Self amendment No. 1, the Chair put the question on agreeing to the amendment and by voice vote, announced the noes had prevailed. Mr. Self demanded a recorded vote, and the Chair postponed further proceedings until a time to be announced. |

| Dec. 10, 2025 | POSTPONED PROCEEDINGS - At the conclusion of debate on the Waters amendment No. 3, the Chair put the question on agreeing to the amendment and by voice vote, announced the noes had prevailed. Ms. Waters demanded a recorded vote, and the Chair postponed further proceedings until a time to be announced. |

| Dec. 10, 2025 | POSTPONED PROCEEDINGS - At the conclusion of debate on the Waters amendment No. 5, the Chair put the question on agreeing to the amendment and by voice vote, announced the noes had prevailed. Ms. Waters demanded a recorded vote, and the Chair postponed further proceedings until a time to be announced. |

| Dec. 10, 2025 | Rule provides for consideration of H.R. 3898, H.R. 3383, H.R. 3638, H.R. 3628, H.R. 3668 and S. 1071. The resolution provides for consideration of H.R. 3898, H.R. 3383, H.R. 3638, and H.R. 3628 under a structured rule; and H.R. 3668 and S. 1071 under a closed rule. The resolution provides for one motion to recommit on H.R. 3898, H.R. 3383, H.R. 3638, H.R. 3628, and H.R. 3668; and one motion to commit on S. 1071. |

| Dec. 10, 2025 | The Speaker designated the Honorable James C. Moylan to act as Chairman of the Committee. |

| Dec. 09, 2025 | Rules Committee Resolution H. Res. 936 Reported to House. Rule provides for consideration of H.R. 3898, H.R. 3383, H.R. 3638, H.R. 3628, H.R. 3668 and S. 1071. The resolution provides for consideration of H.R. 3898, H.R. 3383, H.R. 3638, and H.R. 3628 under a structured rule; and H.R. 3668 and S. 1071 under a closed rule. The resolution provides for one motion to recommit on H.R. 3898, H.R. 3383, H.R. 3638, H.R. 3628, and H.R. 3668; and one motion to commit on S. 1071. |

| Jun. 25, 2025 | Placed on the Union Calendar, Calendar No. 135. |

| Jun. 25, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-169. |

| May. 20, 2025 | Committee Consideration and Mark-up Session Held |

| May. 20, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 41 - 10. |

| May. 14, 2025 | Introduced in House |

| May. 14, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

9 companies lobbying