H.R. 3381: Encouraging Public Offerings Act of 2025

This bill, titled the Encouraging Public Offerings Act of 2025, aims to amend existing securities regulations to facilitate and encourage public offerings by companies. The proposed changes primarily affect the processes surrounding initial public offerings (IPOs) and the submission of registration statements to the Securities and Exchange Commission (SEC).

Key Provisions of the Bill

1. Expanding 'Testing the Waters'

The bill amends the ability for companies to engage in “testing the waters” communications. This means that companies looking to go public will have broader permission to communicate with potential investors about their plans and solicit interest before the formal registration of securities. Specifically:

- It enables any issuer (not just emerging growth companies) to engage in these communications.

- The SEC can establish regulations regarding the conditions under which these communications can occur, ensuring proper oversight and compliance.

- Before the SEC can implement any new rules related to this, they must first submit a report to Congress justifying the need for such rules.

2. Confidential Review of Draft Registration Statements

The bill modifies the process for companies wanting to confidentially submit draft registration statements to the SEC. The changes are as follows:

- Companies will be allowed to confidentially submit drafts of their registration statements for a nonpublic review before any official filing.

- Drafts must be publicly filed with the SEC a set period before the expected effective date of the registration.

- For an IPO: 10 days before the effective date.

- For initial security registration: 10 days before listing.

- For follow-on offerings: 48 hours before the effective date.

- Similar to testing the waters, the SEC will have the authority to set additional terms and conditions for these submissions, which will also require a justification report to Congress before implementation.

Overall Goals

The primary goal of this bill is to simplify and enhance the process for companies seeking to go public, thereby fostering an environment that encourages more businesses to offer shares to the public. By expanding options for communications and providing a route for confidential submissions, the bill seeks to reduce barriers for companies in raising capital through public markets.

Relevant Companies

- LYFT (Lyft, Inc.): As a company that may consider public offerings for future expansions or capital raises, the ability to confidentially submit registration statements could streamline its public fundraising efforts.

- POST (Post Holdings, Inc.): This company might benefit from the expanded testing the waters provision to gauge investor interest before official offerings.

This is an AI-generated summary of the bill text. There may be mistakes.

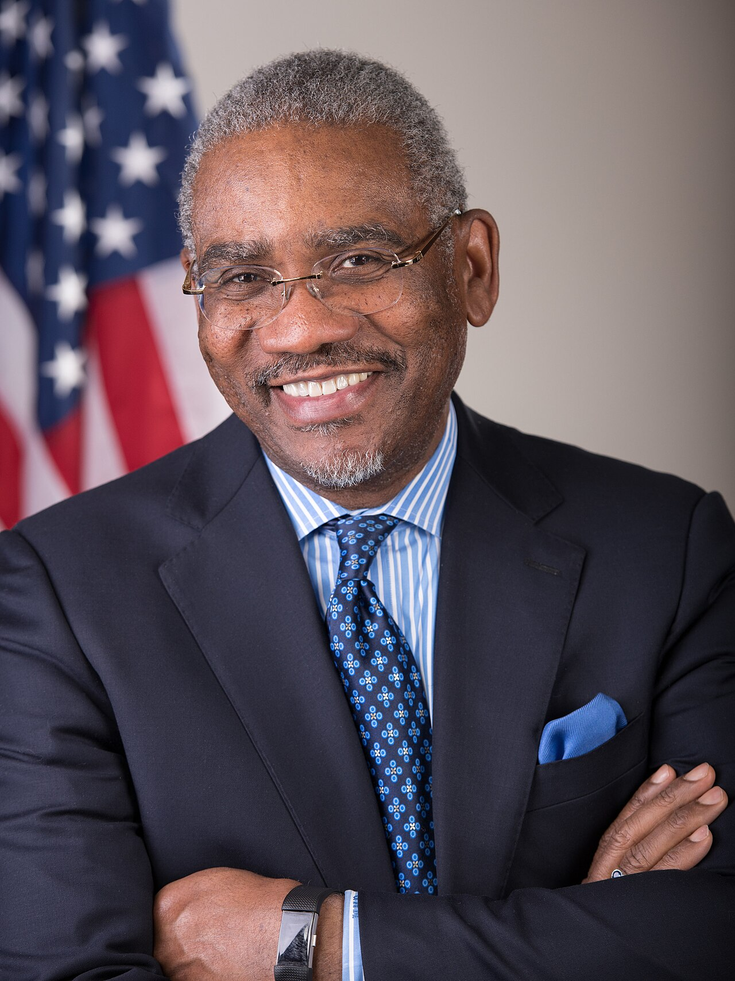

Sponsors

3 bill sponsors

Actions

13 actions

| Date | Action |

|---|---|

| Jun. 24, 2025 | Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

| Jun. 23, 2025 | Considered under suspension of the rules. (consideration: CR H2872-2873) |

| Jun. 23, 2025 | DEBATE - The House proceeded with forty minutes of debate on H.R. 3381. |

| Jun. 23, 2025 | Motion to reconsider laid on the table Agreed to without objection. |

| Jun. 23, 2025 | Mrs. Wagner moved to suspend the rules and pass the bill, as amended. |

| Jun. 23, 2025 | On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. (text: CR H2872-2873) |

| Jun. 23, 2025 | Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. (text: CR H2872-2873) |

| Jun. 03, 2025 | Placed on the Union Calendar, Calendar No. 86. |

| Jun. 03, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-116. |

| May. 20, 2025 | Committee Consideration and Mark-up Session Held |

| May. 20, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 48 - 2. |

| May. 14, 2025 | Introduced in House |

| May. 14, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.