H.R. 3357: Enhancing Multi-Class Share Disclosures Act

This bill, known as the Enhancing Multi-Class Share Disclosures Act, aims to amend the Securities Exchange Act of 1934 by introducing new disclosure requirements for companies that have a multi-class share structure. A multi-class share structure is defined as having two or more types of shares that offer different voting rights in the election of a company's directors.

Key Provisions

- The bill mandates that any company with a multi-class share structure must provide specific information in proxy or consent solicitation materials. These materials are used by shareholders to vote on important corporate matters, such as the election of directors.

- In the disclosures, companies need to include information about directors and director nominees, as well as any executives who own 5 percent or more of the voting power of the organization's shares.

- The required disclosure must state:

- The number of shares owned by these individuals across all classes and the percentage of total voting shares that represents.

- The amount of voting power they hold, expressed as a percentage of the total combined voting power of all classes of shares entitled to vote.

Intended Purpose

The intent behind this bill is to enhance transparency regarding who holds voting power within companies that utilize different classes of shares. This provision seeks to improve shareholder awareness about the distribution of voting rights, which can have significant implications for corporate governance.

Implementation

Once enacted, the Securities and Exchange Commission (SEC) would be responsible for establishing rules to enforce these new disclosure requirements. The bill does not specify when the disclosures would take effect, allowing the SEC to determine a timeframe for compliance.

Impact on Shareholders

By requiring detailed disclosures, the bill aims to provide shareholders with better information about the control dynamics of companies with multi-class share structures. This is particularly relevant for investors who wish to understand how voting power is distributed among executives and board members compared to regular shareholders.

Relevant Companies

- GOOGL (Alphabet Inc.): Alphabet has a multi-class share structure which means some shares have more voting power than others. This bill would require them to disclose more information regarding who holds the voting power.

- FB (Meta Platforms, Inc.): Meta also has various classes of shares with differing voting rights. This would increase transparency about the voting power among its executives and significant shareholders.

- BRK.B (Berkshire Hathaway Inc.): Berkshire is known for its dual-class stock structure. The disclosure requirements could impact how shareholders view executive influence within the company.

This is an AI-generated summary of the bill text. There may be mistakes.

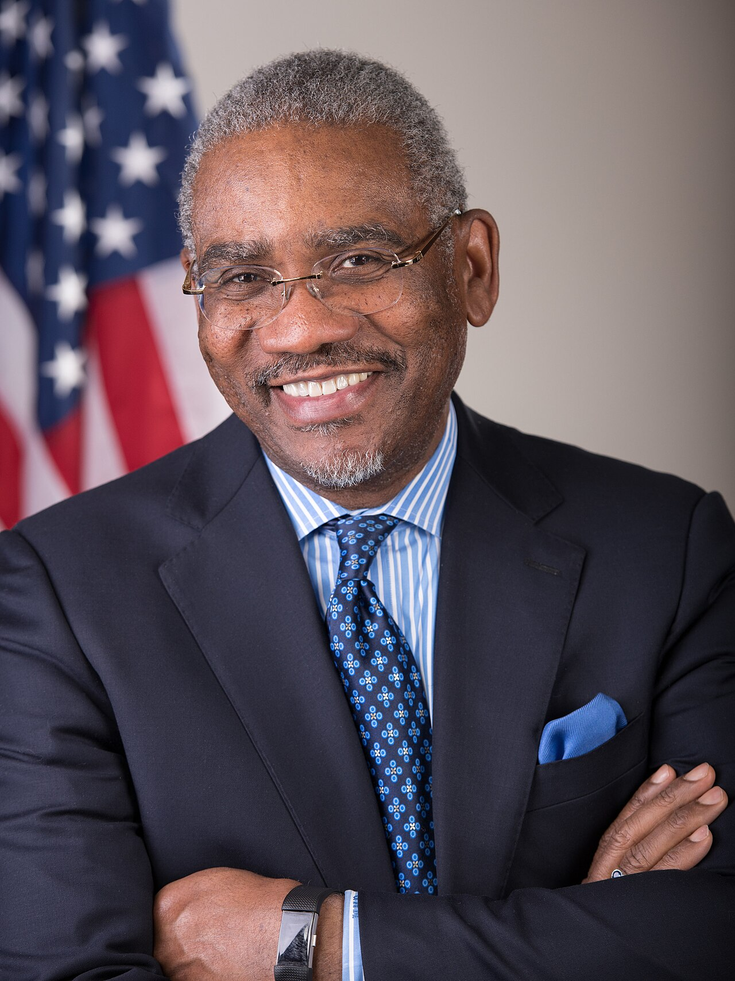

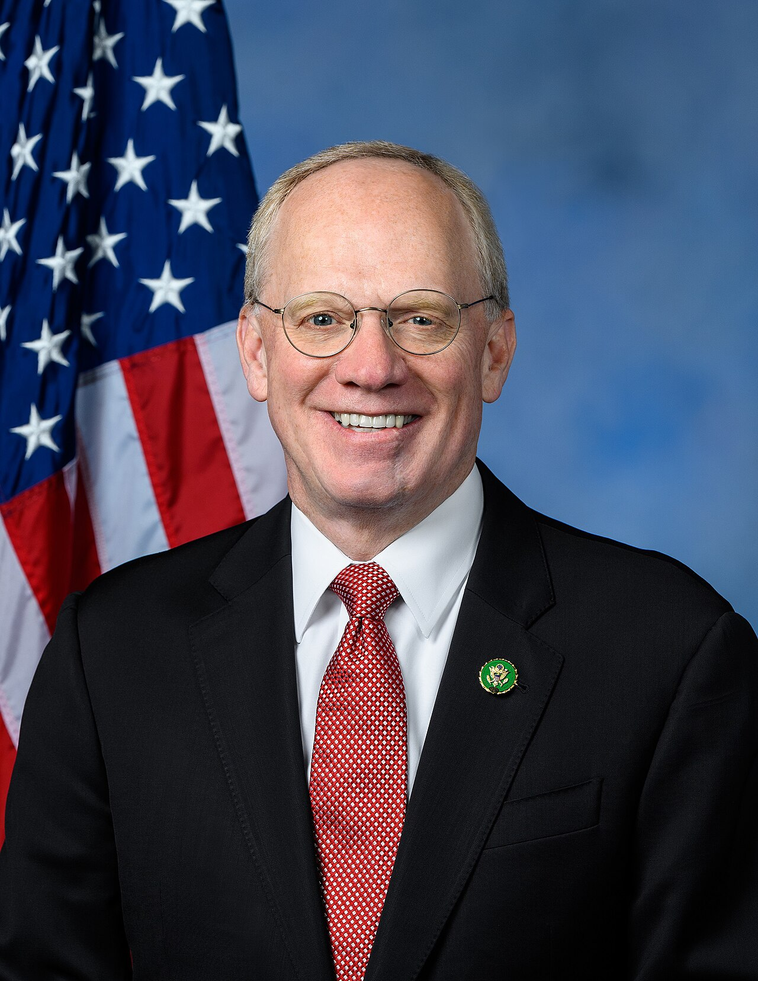

Sponsors

1 sponsor

Actions

15 actions

| Date | Action |

|---|---|

| Jul. 24, 2025 | Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

| Jul. 23, 2025 | Considered as unfinished business. (consideration: CR H3621-3622: 4) |

| Jul. 23, 2025 | Motion to reconsider laid on the table Agreed to without objection. |

| Jul. 23, 2025 | On motion to suspend the rules and pass the bill, as amended Agreed to by the Yeas and Nays: (2/3 required): 381 - 31 (Roll no. 217). (text: 07/21/2025 CR H3508) |

| Jul. 23, 2025 | Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by the Yeas and Nays: (2/3 required): 381 - 31 (Roll no. 217). (text: 07/21/2025 CR H3508) |

| Jul. 21, 2025 | At the conclusion of debate, the Yeas and Nays were demanded and ordered. Pursuant to the provisions of clause 8, rule XX, the Chair announced that further proceedings on the motion would be postponed. |

| Jul. 21, 2025 | Considered under suspension of the rules. (consideration: CR H3508: 1) |

| Jul. 21, 2025 | DEBATE - The House proceeded with forty minutes of debate on H.R. 3357. |

| Jul. 21, 2025 | Mr. Hill (AR) moved to suspend the rules and pass the bill, as amended. |

| Jun. 03, 2025 | Placed on the Union Calendar, Calendar No. 90. |

| Jun. 03, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-120. |

| May. 20, 2025 | Committee Consideration and Mark-up Session Held |

| May. 20, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 51 - 0. |

| May. 13, 2025 | Introduced in House |

| May. 13, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.