H.R. 3283: Federal Agriculture Risk Management Enhancement and Resilience Act

This bill, titled the Federal Agriculture Risk Management Enhancement and Resilience Act (or FARMER Act), aims to amend the Federal Crop Insurance Act to provide enhanced premium support for certain crop insurance plans. The changes proposed in the bill include the following key points:

1. Premium Support for Individual Plans

The bill amends the Federal Crop Insurance Act to introduce premium support for individual farm-based revenue protection or yield protection plans. Specifically, when farmers choose plans based on enterprise units or whole farm units, the bill stipulates that the government will pay a portion of the insurance premium, with specific percentages based on coverage levels:

- 77% premium support for one coverage level.

- 68% premium support for another coverage level.

2. Coverage Level Adjustments

Changes are proposed regarding the coverage levels and premium subsidies available under supplemental coverage options. Notably:

- The maximum coverage level mentioned in the bill is reduced from 14 to 10.

- The minimum gauged coverage is increased from 86% to 90%.

3. Increased Premium Subsidy

The bill seeks to increase the premium subsidy rate from 65% to 80% for specific insurance plans under the supplemental coverage. This change is intended to enhance the affordability of insurance for farmers.

4. Study on Coverage Modifications

The bill mandates a study on the feasibility of modifying the supplemental coverage option to cover regions larger than 1,400 square miles, allowing for more tailored insurance coverage at levels smaller than county-wide. The results of this study must be reported within one year after the bill's enactment and should include any recommendations based on the findings.

5. Purpose and Intent

The overall goal of the FARMER Act is to improve support for farmers by enhancing risk management strategies and making crop insurance more accessible and affordable through federal subsidies and adjustments to coverage qualifications.

Relevant Companies

- CORN - Teucrium Corn Fund: This fund is likely to see changes in premium affordability directly related to farming and may impact investor behavior regarding agricultural investments.

- AIVSF - Agricultural Investment Companies: Companies involved in agricultural investments may experience fluctuations based on crop insurance availability and farmer engagement.

This is an AI-generated summary of the bill text. There may be mistakes.

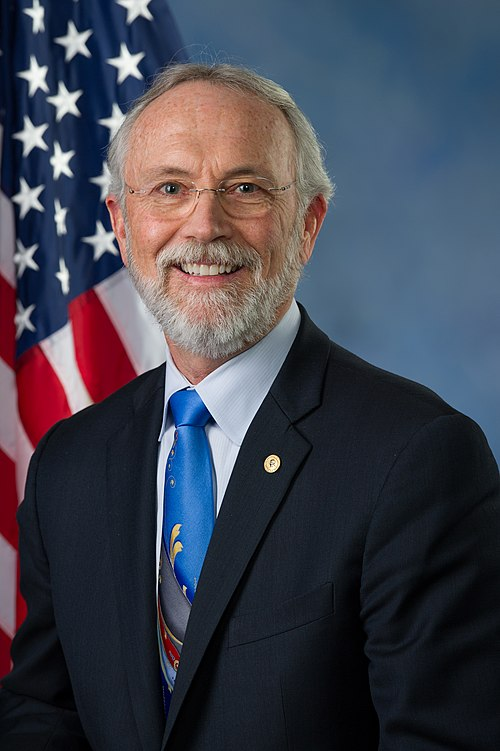

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 08, 2025 | Introduced in House |

| May. 08, 2025 | Referred to the House Committee on Agriculture. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.