H.R. 3249: Mom and Pop Tax Relief Act

This bill, titled the "Mom and Pop Tax Relief Act," proposes changes to the Internal Revenue Code concerning the deduction for qualified business income. It aims to benefit small businesses by modifying the existing rules under Section 199A of the tax code. Here’s what the bill includes:

1. Increased Deduction Limits

The bill introduces a new deduction structure that allows small business owners to deduct up to $25,000 of their qualified business income. This amount will be the lesser of:

- The sum of the taxpayer’s qualified business income from all their businesses, or

- $25,000.

2. Adjusted Gross Income Limitation

To qualify for this deduction, a taxpayer's adjusted gross income will be limited. The deductible amount will decrease if the taxpayer's income exceeds:

- $200,000 for single filers, and

- $400,000 for joint filers.

3. Simplification of Loss Carryover Rules

The bill simplifies the rules around carrying over business losses by removing certain complex provisions that currently exist under Section 199 of the tax code.

4. Redefining Qualified Business Activities

Additionally, the bill defines what constitutes a "qualified trade or business" for the purpose of this deduction. It specifies that this generally excludes businesses offering services as an employee.

5. Effectivity of the Amendments

The proposed changes will be effective for tax years beginning after December 31, 2025.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

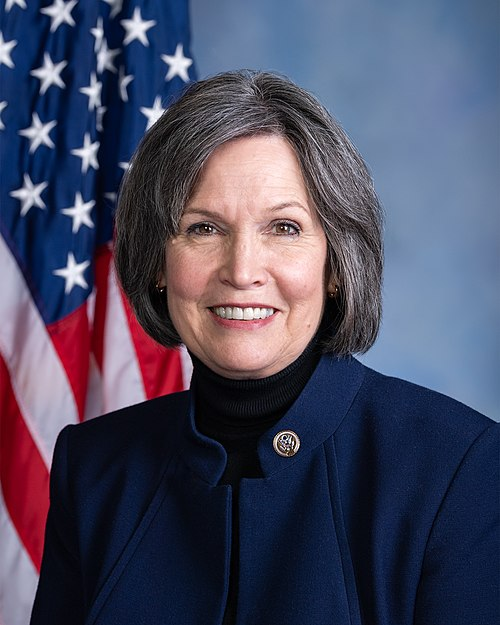

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 07, 2025 | Introduced in House |

| May. 07, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.