H.R. 3216: Housing Market Transparency Act

This bill, known as the Housing Market Transparency Act, aims to enhance transparency and data collection related to properties that receive low-income housing tax credits. Here’s a breakdown of what the bill proposes:

Data Collection on Low-Income Housing

The bill requires the Secretary of Housing and Urban Development (HUD) to gather and maintain detailed information about properties that are allocated low-income housing tax credits under Section 42 of the Internal Revenue Code. This information will cover:

- Development Costs: This includes general contractor costs associated with the development of the property.

- Ownership Data: Information on who owns the property.

- Ownership Structure: Details on whether the owner is a pass-through entity, which may have tax implications.

- Habitability Standards: The most recent standards regarding the livability of the property.

- Disposition Reasons: If a covered property is sold, foreclosed, or destroyed, the reason for the action will be recorded.

- Expiration Dates: Dates indicating when affordable use provisions of the property expire.

- Qualified Contracts: Information on whether the owner has waived the right to a qualified contract.

- Inspection Information: The latest results from inspections that assess the property’s habitability.

- Other Relevant Data: Any additional information deemed important by the Secretary.

Reporting Requirements for States

Each state agency responsible for administering these tax credits must report the required data about covered properties to the Secretary. This must occur within 18 months after a property is put into service and annually thereafter.

Standards and Assistance

The Secretary is tasked with establishing consistent standards and definitions for the data being collected. Additionally, the Secretary will provide support to states to help them compile and submit data accordingly. There will also be efforts to coordinate with other federal housing programs to reduce redundant reporting for properties that receive multiple forms of assistance.

Public Reporting

The Secretary will compile this data and make it publicly available at least once a year. Furthermore, the Secretary is responsible for periodically assessing the overall multifamily housing development market and producing a public report on the findings.

Data on Non-Compliant Properties

If a covered property is determined to no longer be eligible for the low-income housing tax credit before the year ends, the Secretary will still collect information on the final owner or purchaser, including whether the buyer is a nonprofit organization.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

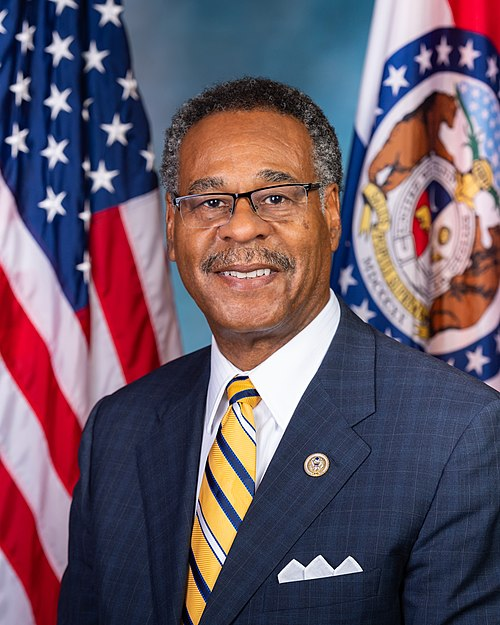

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 06, 2025 | Introduced in House |

| May. 06, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Financial Services, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.