H.R. 3140: Stop Subsidizing Multimillion Dollar Corporate Bonuses Act

This bill, named the Stop Subsidizing Multimillion Dollar Corporate Bonuses Act, aims to make changes to the Internal Revenue Code related to the deductibility of excessive employee compensation. Here are the key components it addresses:

Changes to Deduction Limits

- The bill expands the limitations on tax deductions that corporations can claim for high executive pay.

- Specifically, it amends existing laws to replace terms like “applicable employee remuneration” with “applicable remuneration” and changes “covered employee” to “covered individual” to include a broader range of individuals who may qualify for these compensation deductions.

Definition of Covered Individuals

- The bill modifies the definition of “covered individual” to include anyone performing services for the taxpayer or any employee in executive positions within a specified timeframe.

- This includes individuals who were the principal executive or financial officer at any time from 2016 to 2021, as well as those whose compensation was among the top three reported to shareholders.

Publicly Held Corporations

- The definition of publicly held corporations is refined to clarify which organizations are subject to these compensation rules.

- The amendment indicates that such corporations are those that were required to file specific reports under U.S. securities law during three consecutive taxable years.

Regulatory Authority

- The bill grants the Secretary of the Treasury the power to implement regulations to ensure the bill’s objectives are met.

- This includes establishing guidelines for reporting and preventing strategies aimed at circumventing the new restrictions by using other business structures to provide compensation.

Effective Date

- The changes proposed by the bill would take effect for taxable years starting after December 31, 2024.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

22 bill sponsors

-

TrackLloyd Doggett

Sponsor

-

TrackGreg Casar

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackRosa L. DeLauro

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackAdriano Espaillat

Co-Sponsor

-

TrackJohn Garamendi

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackGwen Moore

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackJamie Raskin

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackMark Takano

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

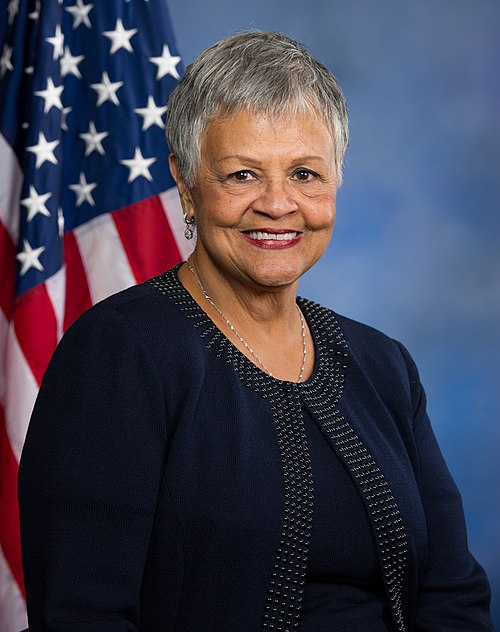

TrackBonnie Watson Coleman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 01, 2025 | Introduced in House |

| May. 01, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.